Artificial Intelligence (AI) Insurtech Market Outlook 2025–2038: Key Insights on Growth Potential and Competitive Landscape

"Future of Executive Summary Artificial Intelligence (AI) Insurtech Market: Size and Share Dynamics

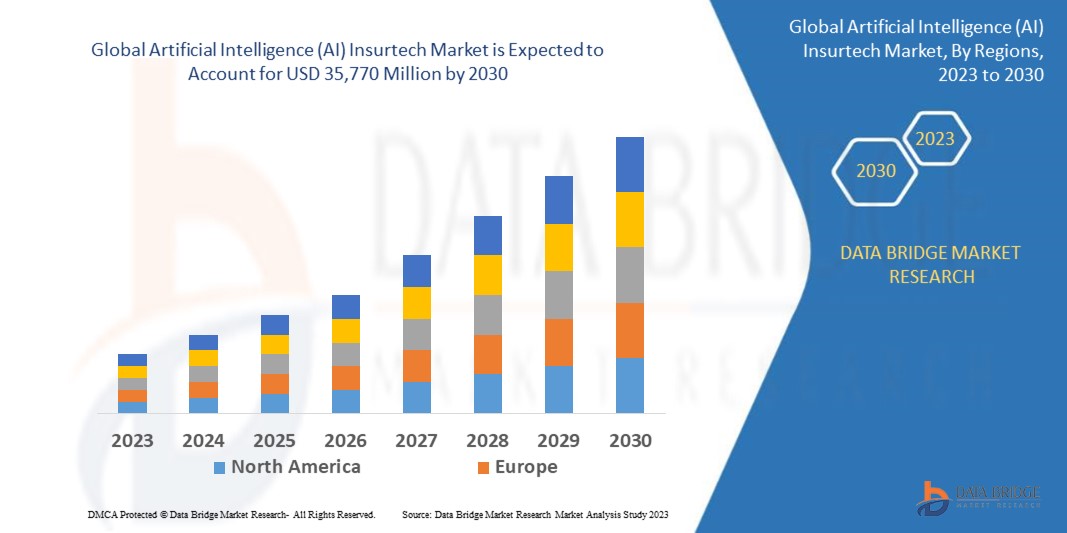

Data Bridge Market Research analyses that the global artificial intelligence (AI) insurtech market which was USD 3,640 million in 2022, is expected to reach USD 35,770 million by 2030, and is expected to undergo a CAGR of 33.06% during the forecast period of 2023 to 2030.

The Artificial Intelligence (AI) Insurtech Market report offers an analytical assessment of the prime challenges faced by the Artificial Intelligence (AI) Insurtech Market industry currently and in the coming years, with which market participants can know the problems they may face while operating in this market over a longer period of time. This Artificial Intelligence (AI) Insurtech Market report has a chapter on the Global Artificial Intelligence (AI) Insurtech Market and all its associated companies with their profiles, which provides valuable data related to their outlook in terms of finances, product portfolios, investment plans, and marketing and business strategies. By providing trustworthy market research information, this Artificial Intelligence (AI) Insurtech Market report helps to extend your reach to the success in your business.

Artificial Intelligence (AI) Insurtech Market research report provides market forecast information, considering the history of industry, the future of the industry with respect to what situation it may face, it will grow or it will fail. Inputs of various industry experts, required for the detailed market analysis, have been used very carefully to structure this finest Artificial Intelligence (AI) Insurtech Market research report. A team of innovative analysts, enthusiastic forecasters, knowledgeable researchers and experienced industry experts work meticulously, 24*7 to structure this most excellent market report. The research study carried out in this Artificial Intelligence (AI) Insurtech Market report covers the local, regional as well as global market.

Tap into future trends and opportunities shaping the Artificial Intelligence (AI) Insurtech Market. Download the complete report:

https://www.databridgemarketresearch.com/reports/global-artificial-intelligence-ai-insurtech-market

Artificial Intelligence (AI) Insurtech Market Environment

Artificial Intelligence (AI) Insurtech Market Environment

Segments

- By Offering: The AI insurtech market can be segmented based on the offering into solution and service. The solution segment is expected to dominate the market due to the increasing adoption of AI technology by insurance companies to streamline operations and improve customer service. AI-powered solutions help insurers in automating processes, detecting fraud, and providing personalized offerings to customers, driving the segment's growth.

- By Deployment: On the basis of deployment, the market can be categorized into cloud and on-premises. The cloud deployment segment is witnessing significant growth as it offers scalability, cost-effectiveness, and flexibility to insurance firms. Cloud-based AI insurtech solutions enable insurers to access real-time data, enhance operational efficiency, and deliver seamless customer experiences, contributing to the segment's expansion.

- By Application: In terms of application, the AI insurtech market is divided into virtual assistance, business process automation, fraud detection, personalized marketing, risk assessment, and others. The fraud detection segment is expected to exhibit substantial growth owing to the rising instances of fraudulent activities in the insurance sector. AI technologies help in identifying suspicious patterns, reducing risks, and improving claim settlement processes, thus propelling the demand for fraud detection solutions.

Market Players

- IBM Corporation: IBM offers AI-powered insurtech solutions for insurers to enhance underwriting processes, claims management, and customer engagement. The company's expertise in artificial intelligence and data analytics positions it as a key player in the market.

- Microsoft Corporation: Microsoft provides advanced AI tools and technologies for insurance companies to optimize operational efficiency, mitigate risks, and deliver personalized services to policyholders. The company's commitment to innovation and digital transformation makes it a prominent player in the AI insurtech landscape.

- Accenture: Accenture offers comprehensive AI insurtech services, including AI strategy development, implementation, and ongoing support. The company's strong industry partnerships and deep expertise in artificial intelligence enable insurers to drive growth and stay competitive in the market.

- Lemonade: Lemonade is a disruptive insurtech company leveraging AI algorithms for quick and hassle-free insurance solutions. With its innovative approach to insurance technology, Lemonade has gained significant traction among tech-savvy consumers, reshaping the traditional insurance landscape.

- NestReady: NestReady provides AI-driven solutions for mortgage and insurance industries, enabling seamless digital experiences and efficient processes. The company's focus on data-driven insights and predictive analytics positions it as a key player in driving digital transformation in the insurance sector.

For more detailed insights, visit: The AI insurtech market presents a dynamic landscape with various segments and key players driving innovation and transformation within the insurance industry. One emerging trend shaping the market is the integration of AI technologies in claims management processes. AI-powered solutions are revolutionizing how insurers handle claims by enabling faster processing, improved accuracy in claims assessment, and enhanced customer experience through automated interactions. As the demand for seamless and efficient claims processing grows, insurance companies are increasingly turning to AI insurtech solutions to streamline operations and reduce costs associated with manual claims handling.

Another significant aspect impacting the market is the increasing focus on personalized insurance offerings. With the help of AI algorithms and machine learning capabilities, insurers can analyze vast amounts of customer data to create personalized insurance products tailored to individual preferences and risk profiles. This customization not only enhances customer satisfaction but also helps insurers optimize pricing strategies and underwriting processes to mitigate risks effectively. As personalization becomes a key differentiator in the competitive insurance landscape, AI insurtech solutions play a vital role in enabling insurers to deliver targeted and relevant insurance products to their customers.

Moreover, the rising importance of predictive analytics in the insurance sector is driving the adoption of AI insurtech solutions for risk assessment and management. By leveraging predictive modeling and data analytics, insurers can proactively identify potential risks, anticipate market trends, and optimize their underwriting decisions. AI technologies enable insurers to extract valuable insights from large datasets, empowering them to make data-driven decisions that enhance risk assessment accuracy and improve overall business performance. As the insurance industry continues to navigate evolving risk landscapes, AI insurtech solutions equipped with advanced analytics capabilities will play a crucial role in helping insurers stay ahead of emerging risks and uncertainties.

In conclusion, the AI insurtech market is poised for significant growth and innovation as insurance companies embrace AI technologies to drive digital transformation, enhance operational efficiency, and deliver enhanced customer experiences. The convergence of AI, machine learning, and data analytics is reshaping the insurance industry, ushering in a new era of intelligent automation and personalized services. As market players continue to invest in AI insurtech solutions and capabilities, we can expect to see continued advancements in claims management, personalized offerings, and risk assessment practices that will redefine the future of insurance.The AI insurtech market is experiencing a dynamic shift driven by innovation and transformation within the insurance industry. One of the pivotal trends shaping the market is the integration of AI technologies in claims management processes. AI-powered solutions are revolutionizing how insurers handle claims by enabling faster processing, improved accuracy in claims assessment, and enhanced customer experience through automated interactions. As insurers strive for seamless and efficient claims processing, the adoption of AI insurtech solutions is becoming increasingly prevalent to streamline operations and reduce manual handling costs.

Personalized insurance offerings are also gaining significance within the market landscape. AI algorithms and machine learning capabilities empower insurers to analyze extensive customer data, enabling the creation of tailored insurance products that align with individual preferences and risk profiles. This customization not only boosts customer satisfaction but also helps insurers optimize pricing strategies and underwriting processes to effectively mitigate risks. As personalization emerges as a crucial competitive differentiator, AI insurtech solutions play a vital role in facilitating the delivery of targeted and relevant insurance products to customers.

Furthermore, the growing emphasis on predictive analytics is fueling the adoption of AI insurtech solutions for risk assessment and management. By harnessing predictive modeling and data analytics, insurers can proactively identify potential risks, foresee market trends, and refine their underwriting decisions. AI technologies empower insurers to extract valuable insights from vast datasets, enabling data-driven decisions that enhance risk assessment accuracy and overall business performance. As the insurance sector navigates through evolving risk landscapes, AI insurtech solutions equipped with advanced analytics capabilities will be instrumental in helping insurers anticipate emerging risks and uncertainties.

In conclusion, the AI insurtech market is undergoing significant expansion and evolution as insurance companies leverage AI technologies to propel digital transformation, improve operational efficiency, and deliver superior customer experiences. The convergence of AI, machine learning, and data analytics is reshaping the insurance domain, ushering in an era of intelligent automation and personalized services. As industry players continue to invest in AI insurtech solutions and capabilities, we anticipate continuous advancements in claims management, personalized offerings, and risk assessment practices that will redefine the future of insurance.

Evaluate the company’s influence on the market

https://www.databridgemarketresearch.com/reports/global-artificial-intelligence-ai-insurtech-market/companies

Forecast, Segmentation & Competitive Analysis Questions for Artificial Intelligence (AI) Insurtech Market

- What’s the estimated market worth of Artificial Intelligence (AI) Insurtech Market globally?

- How is Artificial Intelligence (AI) Insurtech Market growth distributed across regions?

- Which segment generates the highest revenue for Artificial Intelligence (AI) Insurtech Market?

- What companies are discussed in the strategic landscape for Artificial Intelligence (AI) Insurtech Market?

- Which countries are experiencing rapid adoption in Artificial Intelligence (AI) Insurtech Market?

- Who are the globally recognized competitors in Artificial Intelligence (AI) Insurtech Market?

Browse More Reports:

Global Chocolate Biscuit Market

Global Chocolate Ingredients Market

Global Chronic Bacterial Prostatitis Market

Global Clay Desiccant Bag Market

Global Cling Film Market

Global Clinical Nutrition Products Market

Global Clinical Trial Packaging and Labelling Market

Global Closed Circuit Television (CCTV) Camera Market

Global Cloud Seeding System Market

Global Coated Paper Market

Global Coating Resins Market

Global Coconut Milk Powder Market

Global Cold Plasma Processing Market

Global Collapsible Rigid Containers Market

Global Collateral Ligament Stabilizer System Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness