Contactless Payment Market Size, Share, Trends, Key Drivers, Demand and Opportunities

"Executive Summary Contactless Payment Market :

"Executive Summary Contactless Payment Market :

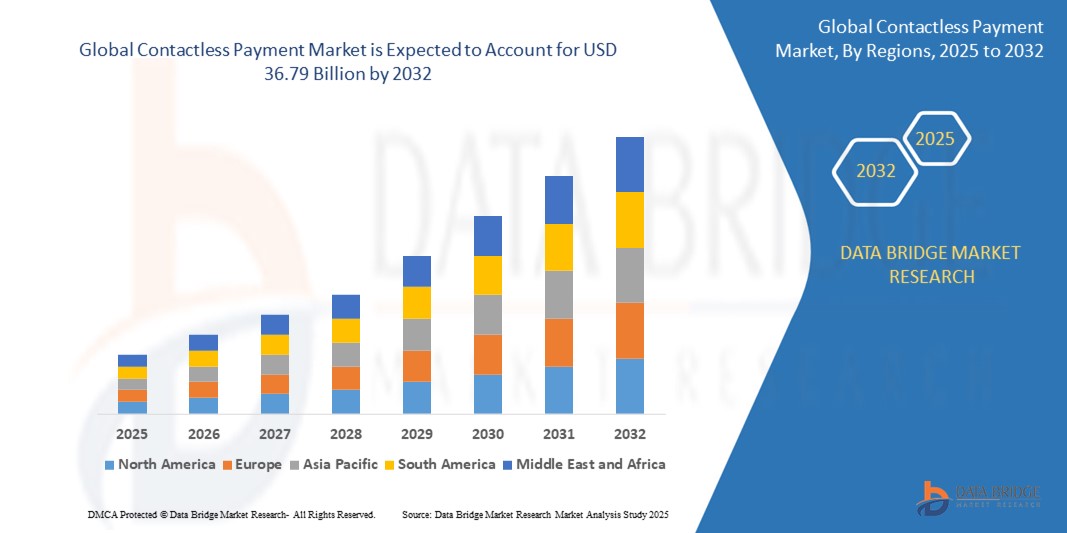

The global contactless payment market was valued at USD 15.74 billion in 2024 and is expected to reach USD 36.79 billion by 2032

A market research analysis and estimations carried out in this Contactless Payment Market Market report aids businesses in gaining knowledge about what is already there in the market, what market looks forward to, the competitive background and steps to be followed for outdoing the rivals. With the comprehensive analysis of the market, it puts forth overview of the market regarding type and applications, featuring the key business resources and key players. Further, manufacturer can adjust production according to the conditions of demand which are analysed here. The Contactless Payment Market Market underlines the global key manufacturers, to define, describe and analyze the market competition landscape with the help of SWOT analysis.

Graphs, TOC, and tables included in the report help understand the market size, share, trends, growth drivers and market opportunities and challenges. This report presents with the key statistics on the market status of global and regional manufacturers and also acts as a valuable source of leadership and direction. The company profiles of all the key players and brands that are dominating the market have been given in this report. The statistical and numerical data are represented in graphical format for a clear understanding of facts and figures. With this report not only an unskilled individual but also a professional can easily extrapolate the entire market within a few seconds.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Contactless Payment Market Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-contactless-payment-market

Contactless Payment Market Market Overview

**Segments**

- By Technology: Radio Frequency Identification (RFID), Near Field Communication (NFC)

- By Payment Mode: Smartphones, Smart Cards, Others

- By End-User: Retail, Healthcare, Hospitality, Transportation, Others

The global contactless payment market is segmented based on technology, payment mode, and end-user. In terms of technology, the market is divided into Radio Frequency Identification (RFID) and Near Field Communication (NFC). RFID technology is widely used in contactless payment systems as it allows for quick and efficient transactions. NFC technology is also gaining popularity, especially with the increasing usage of smartphones for contactless payments. When it comes to payment mode, the market can be categorized into smartphones, smart cards, and others. Smartphones are becoming the preferred choice for many consumers due to their convenience and versatility. The end-user segment includes retail, healthcare, hospitality, transportation, and others. Each of these sectors is adopting contactless payment solutions to streamline transactions and enhance customer experience.

**Market Players**

- Apple Inc.

- Google LLC

- Samsung Electronics Co., Ltd.

- Visa Inc.

- Mastercard

- American Express

- PayPal Holdings, Inc.

- Verifone

- Square, Inc.

- Gemalto (Thales Group)

Key players in the global contactless payment market include Apple Inc., Google LLC, Samsung Electronics Co., Ltd., Visa Inc., Mastercard, American Express, PayPal Holdings, Inc., Verifone, Square, Inc., and Gemalto (Thales Group). These companies are at the forefront of driving innovation in contactless payment technologies and are constantly coming up with new solutions to cater to the evolving needs of consumers and businesses. With their strong market presence and extensive resources, these players are expected to continue shaping the future of the contactless payment industry.

https://www.databridgemarketresearch.com/reports/global-contactless-payment-market The global contactless payment market is witnessing significant growth and evolution driven by various technological advancements and changing consumer behavior. One key trend that is shaping the market is the increasing adoption of contactless payment methods across various industries such as retail, healthcare, hospitality, and transportation. As consumers seek more convenient and secure payment options, businesses are investing in contactless payment solutions to meet these demands. This trend is expected to continue driving the growth of the market, as more companies and institutions embrace the benefits of contactless transactions.

Another important factor influencing the contactless payment market is the rise of smartphone-based payment modes. With the widespread use of smartphones and the growing popularity of mobile payment apps, consumers are increasingly opting for contactless payments using their mobile devices. This shift towards smartphone-based payments is also being supported by the integration of NFC technology in smartphones, making it easier for users to make secure and quick transactions. As a result, smartphone-based contactless payments are expected to become more prevalent across various industries, further fueling the growth of the market.

Furthermore, the presence of key market players such as Apple Inc., Google LLC, Samsung Electronics Co., Ltd., and Visa Inc. is playing a crucial role in driving innovation and competition within the contactless payment market. These companies are continuously developing new technologies and solutions to enhance the efficiency and security of contactless payments, thereby shaping the overall market landscape. Additionally, collaborations and partnerships between these market players and other stakeholders are expected to accelerate the adoption of contactless payment technologies globally.

In terms of challenges, one key issue facing the contactless payment market is the need for enhanced security measures to protect against fraud and cyber threats. As contactless transactions become more widespread, the risk of security breaches also increases, necessitating the implementation of robust security protocols and solutions. Companies operating in the contactless payment space will need to prioritize security measures to build trust among consumers and ensure the long-term sustainability of contactless payment technologies.

Overall, the global contactless payment market is poised for continued growth and innovation, driven by technological advancements, changing consumer preferences, and the efforts of key market players to drive adoption and acceptance of contactless payment solutions. With the increasing penetration of smartphones, the expansion of NFC technology, and the development of secure payment ecosystems, the future of contactless payments looks promising with ample opportunities for further expansion and development.The global contactless payment market is experiencing significant growth and transformation propelled by advancements in technology and shifts in consumer behavior. One of the key trends influencing the market is the widespread adoption of contactless payment methods across various sectors, including retail, healthcare, hospitality, and transportation. This adoption is being primarily driven by the quest for more convenient and secure payment options by consumers, and businesses are actively investing in contactless payment solutions to meet these changing preferences. This trend of increasing adoption across industries is expected to continue bolstering market expansion as more enterprises recognize the benefits of offering contactless transaction options to their customers.

Moreover, the surge in smartphone-based payment modes is playing a pivotal role in shaping the contactless payment landscape. With the widespread usage of smartphones and the escalating popularity of mobile payment applications, consumers are progressively gravitating towards contactless payments through their mobile devices. The integration of NFC technology in smartphones is further facilitating secure and efficient transactions, contributing to the rising prevalence of smartphone-based contactless payments across diverse sectors. This shift towards smartphone-enabled payments is anticipated to gain further momentum, fostering market growth and innovation.

The presence of key market players such as Apple Inc., Google LLC, Samsung Electronics Co., Ltd., and Visa Inc. is significantly influencing market dynamics by driving innovation and fostering competition within the contactless payment industry. These industry giants consistently introduce novel technologies and solutions aimed at enhancing the security and efficiency of contactless transactions, thereby shaping the overall market landscape. Collaborations and partnerships among these key players and other industry stakeholders are also expected to expedite the global adoption of contactless payment technologies, paving the way for widespread acceptance and integration of contactless payment solutions on a broader scale.

Despite the positive growth trajectory, the contactless payment market faces challenges, particularly concerning the need for enhanced security measures to mitigate fraud and cybersecurity risks. As contactless transactions become more prevalent, the potential for security breaches escalates, underscoring the importance of robust security protocols and solutions to safeguard against threats. Companies operating in the contactless payment sector must prioritize security measures to establish trust among consumers and ensure the sustained viability of contactless payment technologies in the long run.

In conclusion, the global contactless payment market is poised for continuous expansion and innovation driven by technological advancements, evolving consumer preferences, and the proactive initiatives of key market players to foster the adoption and integration of contactless payment solutions. With the growing penetration of smartphones, the proliferation of NFC technology, and the establishment of secure payment ecosystems, the future outlook for contactless payments appears promising with abundant opportunities for further development and advancement in the market landscape.

The Contactless Payment Market Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-contactless-payment-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

The investment made in the study would provide you access to information such as:

- Contactless Payment Market Market [Global Contactless Payment Market Market – Broken-down into regions]

- Regional level split [North America, Europe, Asia Pacific, South America, Middle East & Africa]

- Country wise Market Size Split [of important countries with major Contactless Payment Market Market share]

- Market Share and Revenue/Sales by leading players

- Market Trends – Emerging Technologies/products/start-ups, PESTEL Analysis, SWOT Analysis, Porter's Five Forces, etc.

- Market Size)

- Market Size by application/industry verticals

- Market Projections/Forecast

Browse More Reports:

Global Interactive Whiteboard Market

Global Gibberellins Market

Global Geotechnical Instrumentation - Monitoring Market

Global Espresso Coffee Market

Global Epoxy Primer Market

Global Emphysema Market

Global Conveyor System Market

Global Contraceptives Market

Global Coffee and Tea Shop Market

Global Cat Eye Syndrome Market

Global Cardiac Computed Tomography (CCT) Market

Global Car Dashboard Market

Global Bruton Tyrosine Kinase (BTK) Inhibitors Market

Global Biometric System Market

Global Battery Packaging Material Market

Global Bar Code Sticker Labeling Machine Market

Global Baby Feeding Bottle Market

Global Automotive Parts Die Casting Market

Global Automotive Grade Inductors Market

Global Artificial Organ Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

Tag

Contactless Payment Market Market Size, Contactless Payment Market Market Share, Contactless Payment Market Market Trend, Contactless Payment Market Market Analysis, Contactless Payment Market Market Report, Contactless Payment Market Market Growth, Latest Developments in Contactless Payment Market Market, Contactless Payment Market Market Industry Analysis, Contactless Payment Market Market Key Player, Contactless Payment Market Market Demand Analysis"

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness