Why Real-Time Price Monitoring Matters

Consumers don’t just care about food quality—they care about price transparency. For delivery platforms, pricing is dynamic and influenced by multiple variables:

- Restaurant base pricing

- Platform commission structures

- Service & delivery fees

- Surge pricing

- Location-specific promotions

For restaurant chains and investors, price benchmarking across platforms enables better competitive analysis, menu optimization, and market positioning.

Data Collection Methodology

At Food Data Scrape, we built an automated system to extract, normalize, and store real-time pricing data across platforms. Our system used the following approach:

- Target Platforms: Uber Eats and DoorDash

- Cities Monitored: New York, Los Angeles, Chicago, Houston, Phoenix, Philadelphia, San Antonio, San Diego, Dallas, San Jose

- Frequency: Every 4 hours for 30 days

- Metrics Tracked: Base item price, delivery fee, service fee, surge fee, promo discounts, taxes

Sample Data Extract (Panda Express - Chicken Bowl):

Key Findings Across 10 U.S. Cities

1. Uber Eats is Often More Expensive—But Not Always

Across all cities, Uber Eats had a higher average total cost in 7 out of 10 cities. However, when surge fees or promo codes kicked in, DoorDash could become costlier.

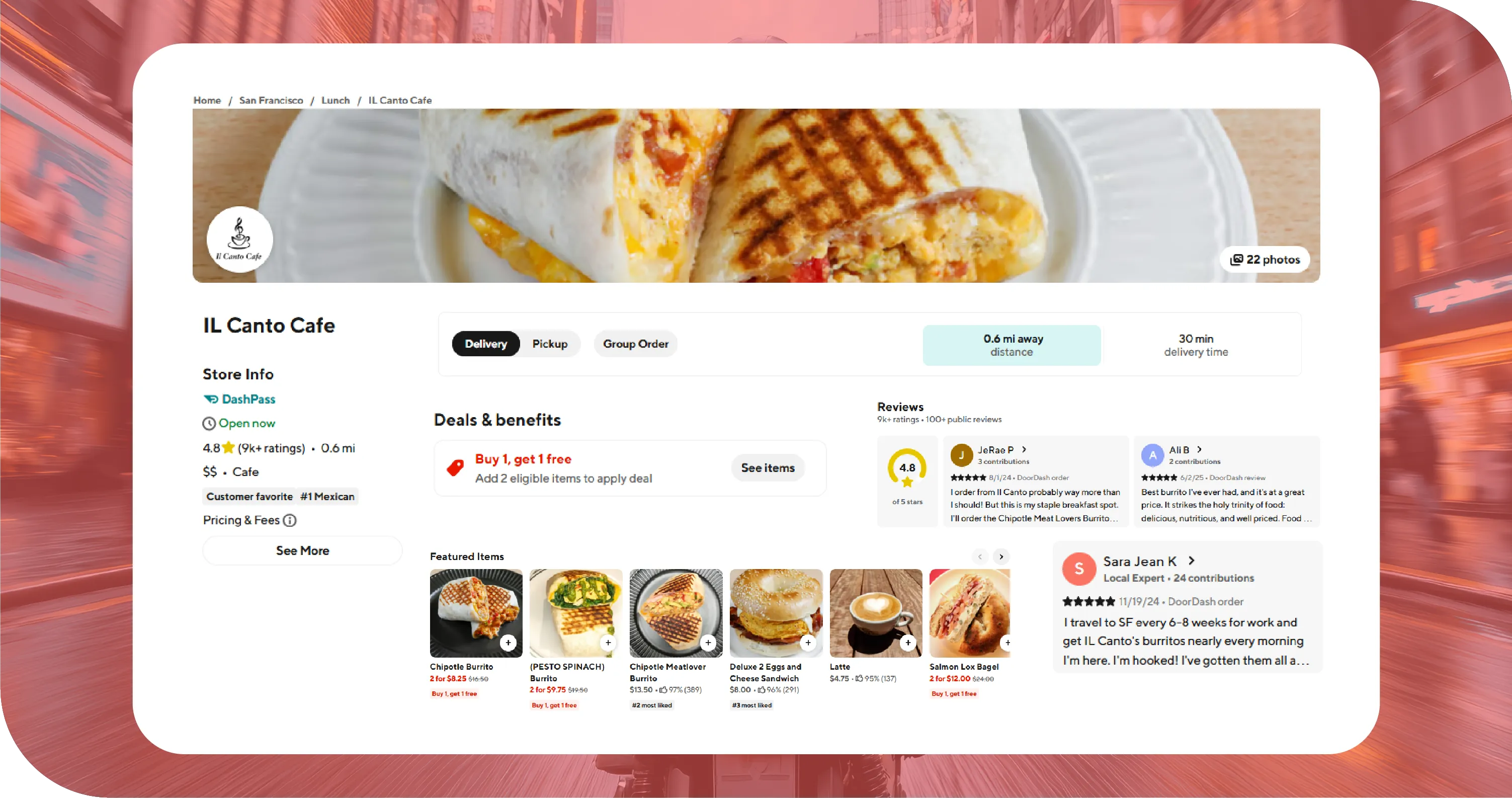

2. DoorDash Leads in Promo Discounts

DoorDash offered more frequent and larger discounts. Over the 30-day scrape, we found that:

- DoorDash provided promo codes in 42% of cases.

- Uber Eats offered promos in only 28% of monitored cases.

3. Delivery Fees Fluctuate Hourly

We observed high volatility in delivery fees, especially during dinner hours (6–9 PM). In cities like Chicago and Houston, DoorDash had lower fees during off-peak, but Uber Eats spiked less aggressively during surges.

Example:

- Houston, 8 PM

- Uber Eats Delivery: $4.29

- DoorDash Delivery: $5.99

4. Regional Pricing Disparities Are Significant

A Chicken Bowl at Panda Express showed a 19% price difference (total cost) between New York and Phoenix on Uber Eats, even though the base price was the same.

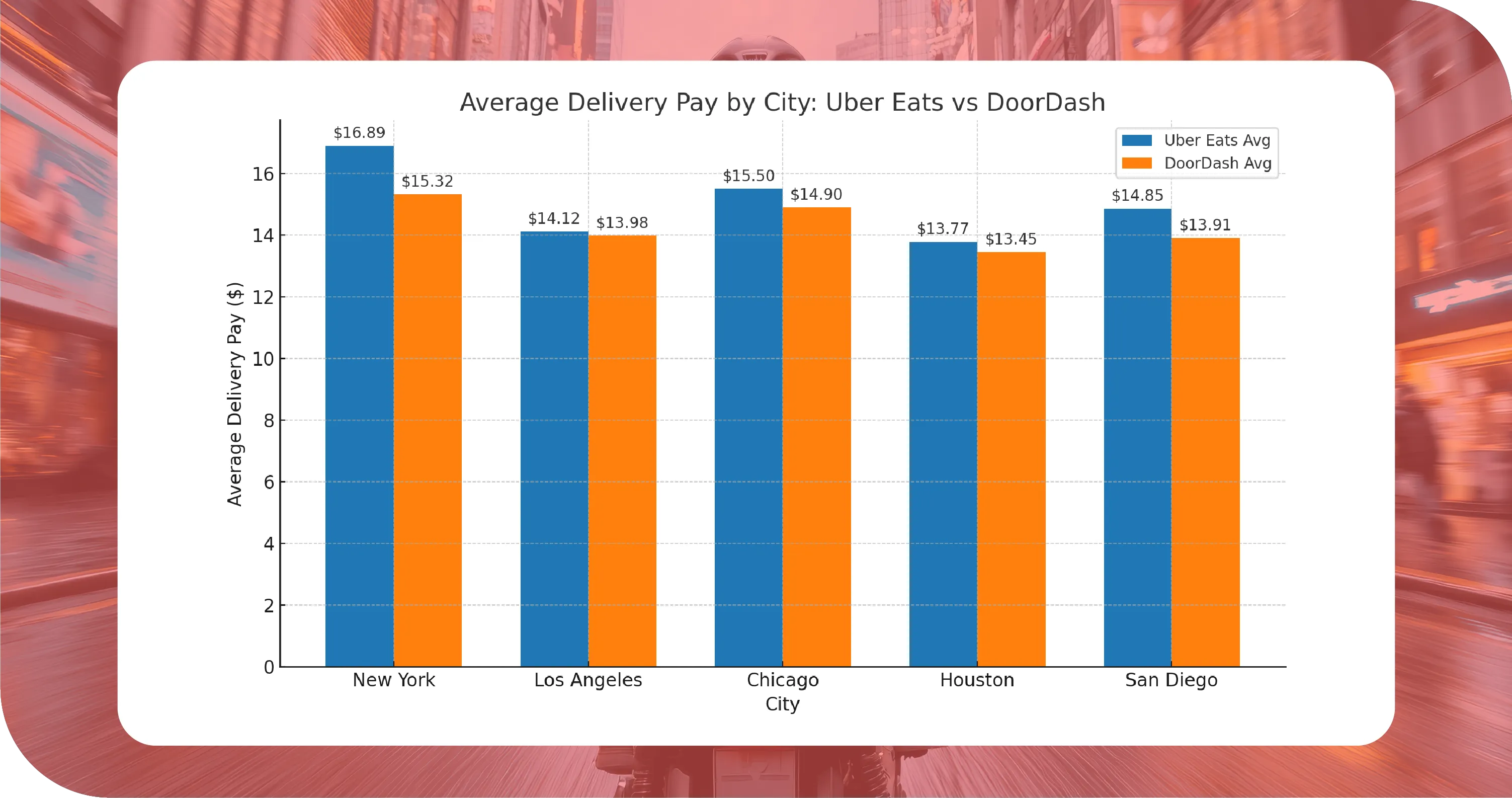

City-by-City Breakdown

New York City

- Uber Eats Total Avg: $16.89

- DoorDash Total Avg: $15.32

- Uber Eats more expensive in 73% of listings.

Los Angeles

- Both platforms priced similarly, but DoorDash offered more coupons.

Chicago

- Uber Eats used surge pricing more frequently on weekends.

Phoenix

- DoorDash consistently undercut Uber Eats by $1–$2 per item.

San Diego

- Uber Eats had lower base prices, but added fees made them costlier.

Visual Snapshot of Price Trends

Insights for Restaurants & Startups

1. Use Dynamic Pricing to Compete

Restaurants partnering with both platforms should optimize pricing and promotions based on real-time trends. Food Data Scrape can notify you when a competitor adjusts prices or fees.

2. Monitor Promotions in Real Time

Our clients use promo alerts to sync in-app offers with high-traffic hours—helping boost margins while staying competitive.

3. Optimize Menu Placement

Understanding item-level price differences can help restaurants adjust menus to be more appealing. A $0.50 difference can significantly shift conversion.

Challenges Faced During Scraping

While collecting live data, Food Data Scrape had to tackle:

- Anti-bot protections: We implemented rotating proxies and captcha-solving systems.

- Geo-targeted results: Delivery availability and fees change by ZIP code.

- Promo code randomness: Some discounts are targeted; we used logged-in sessions to replicate user views.

How Food Data Scrape Solves the Problem

We’ve developed a robust system that offers:

- Real-time data APIs for Uber Eats and DoorDash

- Custom alerts on competitor pricing

- City-level breakdowns for chain and franchise analysis

- Historical price comparison dashboards

Whether you're a food startup, restaurant chain, or investor, our platform empowers you to make data-backed pricing decisions.

Client Success Story: Regional QSR Brand

A regional fast-casual brand with 50+ locations across the Southwest used Food Data Scrape to track Uber Eats and DoorDash fees in Phoenix, Las Vegas, and Albuquerque. After identifying that Uber Eats was charging a higher service fee in Phoenix (average +$1.20), the chain adjusted its DoorDash pricing to appear more competitive—boosting DoorDash orders by 18% in 3 weeks.

Future Roadmap: Beyond Price Monitoring

Our long-term vision includes:

- AI-based price prediction models

- Real-time delivery time tracking

- Sentiment analysis of delivery reviews

- Cross-platform menu listing comparison

Client’s Testimonial

"Partnering with Food Data Scrape has completely transformed how we track delivery pricing. Their real-time insights helped us spot hidden fees, optimize our menu strategy, and stay ahead of competitors across Uber Eats and DoorDash. Within weeks, we saw a measurable boost in orders and customer satisfaction. Their platform is fast, reliable, and essential for any restaurant serious about pricing intelligence."

— VP of Marketing, Southwest QSR Chain

Conclusion

Price transparency in food delivery is no longer optional—it’s a necessity. With two major players like Uber Eats and DoorDash battling for consumer loyalty, the ability to analyze pricing in real-time unlocks a new level of competitive intelligence.

Food Data Scrape is leading the way in transforming how restaurants, consumers, and startups monitor food delivery prices and make smarter, faster decisions.

Source>> https://www.fooddatascrape.com/ubereats-vs-doordash-real-time-price-monitoring-usa.php