Digital Payment Market Industry Report | Key Players, Innovations, and Forecast 2025 - 2032

Executive Summary Digital Payment Market :

Executive Summary Digital Payment Market :

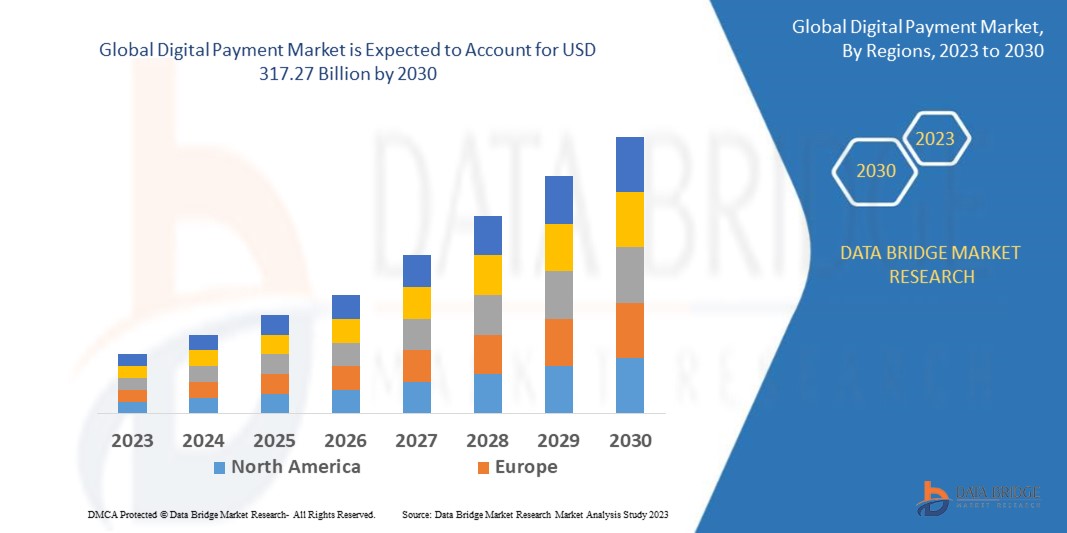

Data Bridge Market Research analyses that the digital payment market, which was USD 94.34 billion in 2022, is expected to reach USD 317.27 billion by 2030, at a CAGR of 20.60% during the forecast period 2023 to 2030.

Digital Payment Market report is offered to the business with a complete overview of the market, covering various aspects such as product definition, market segmentation based on various parameters, and the customary vendor landscape. All statistical and numerical information given in the report is symbolized with the help of graphs and charts which facilitates the understanding of facts and figures. All the data and information collected for research and analysis is denoted in the form of graphs, charts or tables for the sensible understanding of users. The Digital Payment Market report defines fluctuation during the forecast period of 2019 - 2025 for the market.

This Digital Payment Market report is composed of myriad of factors that have an influence on the market and include industry insight and critical success factors (CSFs), market segmentation and value chain analysis, industry dynamics, market drivers, market restraints, key opportunities, technology and application outlook, country-level and regional analysis, competitive landscape, company market share analysis and key company profiles. This global Digital Payment Market business report is very reliable as all the data and the information regarding the industry is collected via genuine sources such as websites, journals, annual reports of the companies, and magazines.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Digital Payment Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-digital-payment-market

Digital Payment Market Overview

**Segments**

- On the basis of payment mode, the global digital payment market can be segmented into Mobile Wallets, Digital Wallets, Credit/Debit Cards, Net Banking, and others. Mobile wallets are gaining significant traction due to their convenience and ease of use, especially in emerging markets where smartphone penetration is increasing. Digital wallets are also witnessing rapid adoption, thanks to the increasing integration of e-commerce platforms with these wallets. Credit/debit cards continue to be a popular choice for online transactions due to their widespread acceptance globally. Net banking is another segment that is seeing growth, particularly among older demographics who prefer traditional banking methods.

- Based on the end-user, the market can be classified into BFSI, retail, healthcare, telecom & IT, education, and others. The BFSI sector is a major contributor to the digital payment market, with banks and financial institutions increasingly offering online payment options to their customers. The retail sector is also witnessing a surge in digital payments, driven by the growing popularity of e-commerce platforms. Healthcare is another sector where digital payments are gaining traction, as patients opt for online payment methods for medical bills. The telecom & IT industry, along with education, are also key end-users driving the growth of the digital payment market.

- Geographically, the global digital payment market is segmented into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America leads the market, driven by technological advancements, a high level of digital literacy, and the presence of major players in the region. Europe is also a significant market for digital payments, with countries like the UK and Germany at the forefront of digital payment adoption. Asia-Pacific is witnessing rapid growth in digital payments, fueled by the increasing smartphone penetration and expanding e-commerce ecosystem in countries like China and India.

**Market Players**

- Some of the key players in the global digital payment market include PayPal Holdings, Inc., Visa Inc., MasterCard, Alipay, Apple Inc., Google Pay, Amazon Pay, Paytm, Samsung Pay, and Square, Inc. These players are focusing on innovations such as biometric authentication, tokenization, and artificial intelligence to enhance the security and convenience of digital payments. Partnerships and collaborations are also common strategies adopted by market players to expand their presence and offer a seamless payment experience to consumers.

In the ever-evolving landscape of digital payments, there are several emerging trends and factors shaping the market that are worth exploring. One of the key trends making waves in the digital payment industry is the rising adoption of contactless payments. With the ongoing COVID-19 pandemic emphasizing the importance of hygiene and touch-free interactions, contactless payments have gained immense popularity among consumers and businesses alike. This trend is expected to drive further innovation in payment technologies, such as Near Field Communication (NFC) and Quick Response (QR) codes, to facilitate seamless and secure contactless transactions.

Another significant factor influencing the digital payment market is the increasing focus on financial inclusion. As digital payment solutions become more widespread and accessible, they have the potential to bridge the financial inclusion gap by providing unbanked and underbanked populations with convenient and affordable ways to participate in the formal economy. This push towards financial inclusion is not only a social imperative but also represents a vast market opportunity for digital payment providers to tap into new customer segments and drive financial empowerment.

Furthermore, the convergence of technologies such as blockchain, Internet of Things (IoT), and artificial intelligence is poised to revolutionize the digital payment landscape. Blockchain technology, in particular, holds the promise of enhancing the security, transparency, and efficiency of digital transactions by providing a decentralized and tamper-proof ledger for recording payment data. IoT devices are also playing a crucial role in enabling seamless and interconnected payment experiences, such as in-store contactless payments through smart wearables or automated online transactions.

Moreover, the regulatory environment surrounding digital payments is undergoing significant changes globally, with regulators focusing on enhancing consumer protection, data privacy, and anti-money laundering measures. Compliance with evolving regulatory requirements poses both challenges and opportunities for digital payment providers, as they strive to navigate complex regulatory landscapes while maintaining innovation and competitiveness.

In conclusion, the global digital payment market is experiencing a period of unprecedented transformation driven by technological advancements, shifting consumer preferences, and regulatory developments. As market players continue to innovate and collaborate to meet the evolving needs of consumers and businesses, the digital payment ecosystem is poised for continued growth and expansion across industries and geographies. The key to success in this dynamic market lies in anticipating and adapting to these emerging trends and leveraging them to drive value creation and differentiation in the fiercely competitive digital payment landscape.The digital payment market continues to evolve rapidly, driven by various factors that are reshaping the industry landscape. One emerging trend that is significantly impacting the market is the convergence of technologies such as blockchain, IoT, and AI. Blockchain technology, with its decentralized and secure nature, is revolutionizing digital transactions by enhancing security and transparency. IoT devices are enabling seamless and interconnected payment experiences, facilitating in-store contactless payments through smart wearables and simplifying online transactions. AI is being utilized by market players to enhance security through biometric authentication and to improve customer experiences through personalized recommendations and fraud detection mechanisms.

Another key factor influencing the digital payment market is the increasing emphasis on financial inclusion. As digital payment solutions become more accessible, they are playing a crucial role in bridging the financial inclusion gap by providing unbanked populations with convenient and affordable ways to participate in the formal economy. This push for financial inclusion not only addresses a social imperative but also represents a significant market opportunity for digital payment providers to tap into new customer segments and drive financial empowerment.

Moreover, the regulatory environment surrounding digital payments is undergoing substantial changes globally, with a focus on enhancing consumer protection, data privacy, and anti-money laundering measures. Compliance with evolving regulatory requirements poses both challenges and opportunities for market players as they seek to navigate complex regulatory landscapes while maintaining innovation and competitiveness. Adhering to these regulations is crucial for building trust with consumers and ensuring the long-term sustainability of digital payment solutions.

In conclusion, the digital payment market is experiencing a period of rapid transformation driven by technological advancements, changing consumer preferences, and regulatory developments. Market players need to adapt to these emerging trends by investing in innovative technologies, focusing on financial inclusion initiatives, and staying abreast of regulatory changes. By embracing these changes and leveraging them to drive value creation and differentiation, companies can capitalize on the vast opportunities presented by the dynamic digital payment landscape and secure their positions in the competitive market.

The Digital Payment Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-digital-payment-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Key Pointers Covered in the Digital Payment Market Industry Trends and Forecast

- Digital Payment Market Size

- Digital Payment Market New Sales Volumes

- Digital Payment Market Replacement Sales Volumes

- Digital Payment Market By Brands

- Digital Payment Market Procedure Volumes

- Digital Payment Market Product Price Analysis

- Digital Payment Market Regulatory Framework and Changes

- Digital Payment Market Shares in Different Regions

- Recent Developments for Market Competitors

- Digital Payment Market Upcoming Applications

- Digital Payment Market Innovators Study

Browse More Reports:

Global Data Centre Rack Server Market

Europe Automated Material Handling Market

Global Sustainable Plastic Market

Asia-Pacific Underactive Bladder Market

Global Remote Monitoring and Control System Market

Global Blood Collection Market

Global Swine Feed Additives Market

Global Fabry Disease Drug Market

Middle East and Africa Medical Device Testing Market

Europe Insulin Delivery Devices Market

Europe Nucleic Acid Therapeutics, Sport Food Additives and Skin Care Market

Global Sexually Transmitted Diseases (STDs) Antimicrobial Medication Market

Europe Electrosurgery Equipment Market

Middle East and Africa Commercial Seaweed Market

Global Antiphospholipid Antibody Syndrome Market

Global Haemophilus Influenzae Infection Market

Global Face Transplants Market

Asia-Pacific Video Measuring System Market

Global Specialty Paper Market

Global Sleeve Labels Market

Global Sputum Test Market

Global Liposome Drug Delivery Market

Asia-Pacific Digital Payment Market

Asia-Pacific Health Screening Market

North America Nucleic Acid Therapeutics, Sport Food Additives and Skin Care Market

Global Ribbed Phenolic Cap Market

Asia-Pacific Craniomaxillofacial Implants Market

Global Instant Meals Market

Global Small Kitchen Appliances Market

Global Cytokine Release Syndrome Drug Market

North America Pharmaceutical Isolator Market

Global Medical Coatings Market

Global Natural Refrigerants Market

Global Private Network Services Market

Global Liquid Packaging Carton Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness