2025 Italian Wine Trend Tracker via Scraping: Comeback

![]()

Introduction

Italian wines—especially heritage reds and whites—are staging a strong resurgence in 2025. From Tuscany’s Chianti to Piedmont’s Barbera, Old World varietals are enjoying renewed global attention driven by nostalgia, regional identity, and sustainability. But for importers, sommeliers, and wine e-retailers, capturing these fast-evolving trends in real time is nearly impossible without automation.

That’s where the 2025 Italian Wine Trend Tracker via Scraping proves essential. By tapping into structured, real-time datasets sourced directly from Italian wine retailers, restaurants, and e-commerce platforms, businesses can track varietal popularity, price movements, inventory volatility, and export trends across SKUs.

Manual market monitoring is no longer viable. Instead, web scraping wine listings from Italian retailers offers unparalleled speed and granularity. In fact, between 2020 and 2025, Italian wine data mentions surged by 38% across eCommerce platforms—making automated tracking more urgent than ever.

Let’s break down how structured web scraping solutions can decode 2025’s Italian wine boom.

Monitoring Revival in Old World Reds

Italy’s red wines—especially Chianti, Barolo, and Montepulciano—have seen a revival in both domestic and export markets. Between 2020 and 2025, average demand for Barolo rose by 22% globally, while Chianti saw a 17% price increase on export platforms.

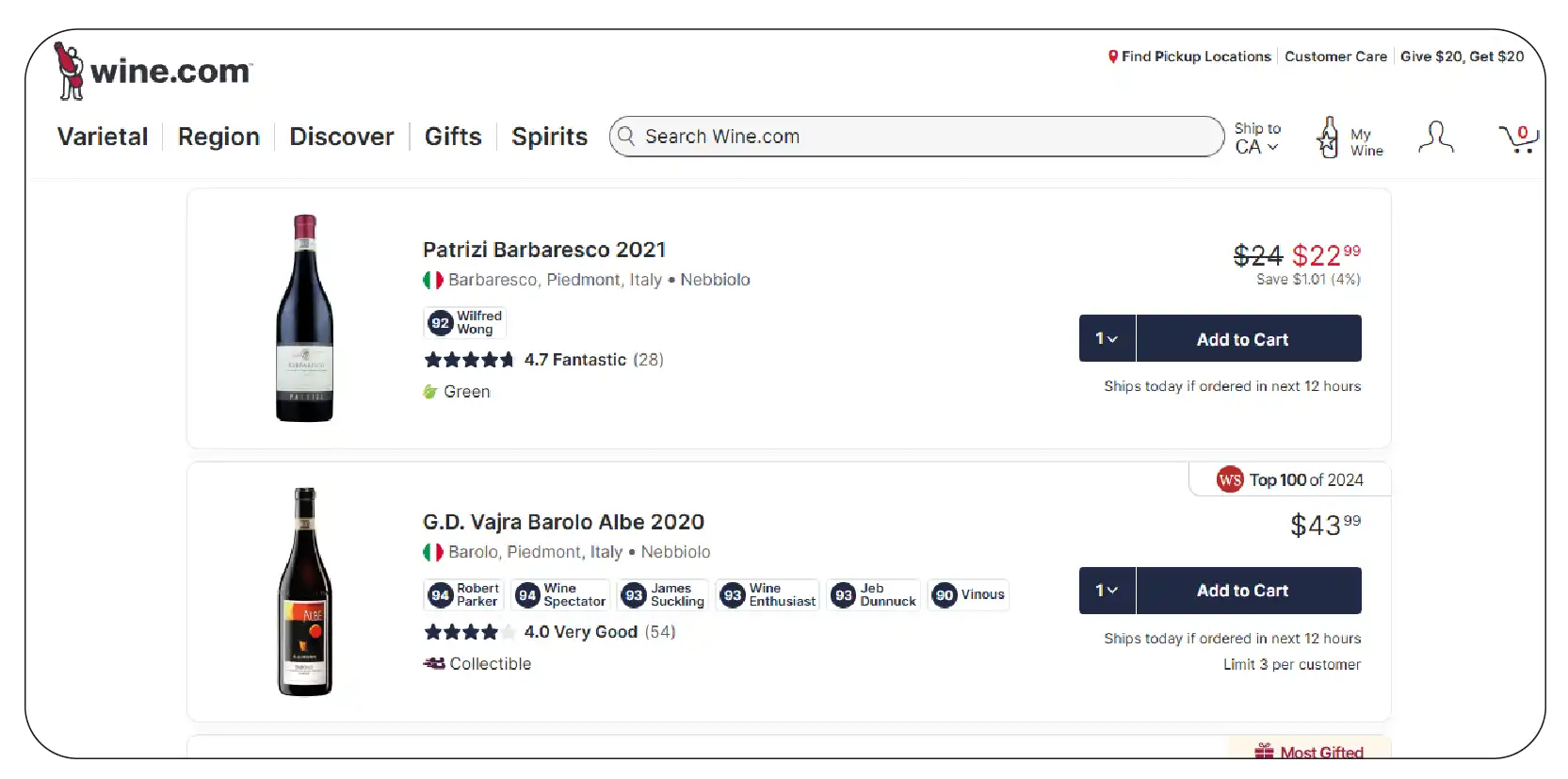

Using Scrape Italian Wine Listings for Market Analysis, analysts can now map SKU-level changes by region (e.g., Piedmont vs Veneto), varietal (e.g., Nebbiolo vs Sangiovese), and retail price tiers.

Table 1: Chianti Pricing Trend 2020–2025 (EUR)

| Year | Avg. Price (750ml) | % YoY Growth |

|---|---|---|

| 2020 | €11.50 | – |

| 2021 | €12.20 | +6.1% |

| 2022 | €13.00 | +6.5% |

| 2023 | €13.40 | +3.1% |

| 2024 | €14.50 | +8.2% |

| 2025 | €15.10 | +4.1% |

The Italian Wine Revival Dataset for Retail Insights captures retail volumes, shipping availability, and shelf placement for heritage red labels, helping importers position their inventory competitively.

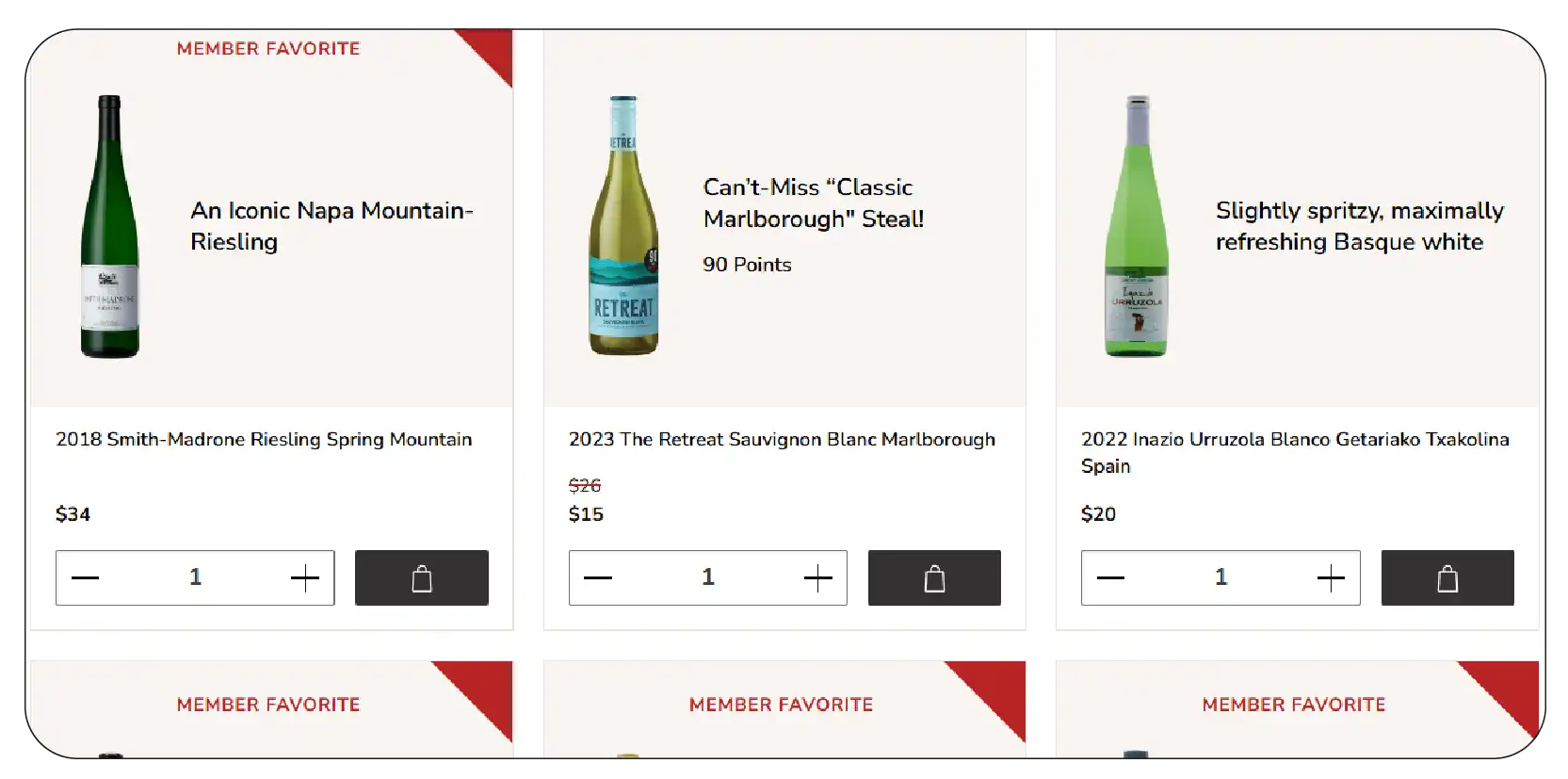

Tracking White Wine Popularity for Summer 2025

The summer of 2025 witnessed an upsurge in Italian white wine consumption—especially Vermentino, Soave, and Pinot Grigio. This trend is driven by lighter, food-friendly wines in health-conscious markets.

By integrating the Italian Red & White Wine Popularity Tracker, businesses can monitor which whites are trending in beach towns, Michelin-star restaurants, and e-commerce channels.

Table 2: Top 5 Italian Whites by Sales Volume (Q2 2025)

| Rank | Wine Type | % Share | Avg. Price (EUR) |

|---|---|---|---|

| 1 | Pinot Grigio | 32% | €9.80 |

| 2 | Soave | 21% | €8.60 |

| 3 | Vermentino | 18% | €10.20 |

| 4 | Trebbiano | 14% | €8.00 |

| 5 | Fiano | 9% | €11.30 |

With Web Scraping Alcohol & Liquor Data , wine brands can adapt seasonal promotions, allocate summer-focused inventory, and optimize digital shelf listings based on consumer behavior.

Stay ahead of seasonal demand—track trending white wines for Summer 2025 with real-time data insights and competitor pricing intelligence.

Regional Performance Analytics with Granular Mapping

Different Italian regions perform differently year over year. Tuscany’s exports grew 12.6% in 2024, while Sicily and Sardinia began rising in 2025 with artisanal and biodynamic labels gaining traction.

Using Italian Wine Market Trends 2025 Datasets, wine professionals can access regional insights, compare vintages, and evaluate DOP (Denominazione di Origine Protetta) label popularity.

Table 3: Regional Export Growth (2020–2025)

| Region | 2020 | 2025 | CAGR (%) |

|---|---|---|---|

| Tuscany | €1.8B | €2.6B | 7.6% |

| Veneto | €1.3B | €1.9B | 7.2% |

| Sicily | €0.6B | €1.1B | 12.7% |

Scraping helps capture localized SKU trends and supports segmentation across price, vintage, alcohol content, and flavor profile.

Real-Time Liquor Inventory Analytics for Retail

Retailers constantly battle inventory volatility. With Real-Time Liquor Inventory Data Scraping Services, businesses can track stock levels across vendors and set replenishment schedules using predictive inventory intelligence.

This is essential for wine importers managing seasonal demands. For instance, during Christmas 2024, over 19% of Italian red wines on WineSearcher went out of stock for 7–10 days—impacting bulk orders.

Extract Wine Searcher Alcohol and Liquor Price Data to monitor availability, dynamic pricing, and backorder patterns. Automating these signals avoids lost revenue and builds supply resilience.

Competitive Benchmarking with Pricing Datasets

Scraping price data reveals which platforms offer discounts, surge pricing, or premium markups. Between 2020–2025, major price variations on Amazon vs VinItaly vs niche boutique platforms were recorded—up to 18% delta for premium bottles.

Using Liquor and Alcohol Price Datasets , distributors can optimize their pricing strategies.

Table 4: 2025 Price Comparison – Barolo DOCG (750ml)

| Platform | Price (EUR) |

|---|---|

| Amazon | €22.50 |

| VinItaly.com | €24.90 |

| BoutiqueWine | €27.00 |

These insights allow you to position your product between competitors or offer strategic promotions to undercut leading players.

Gain a market edge—use pricing datasets for competitive benchmarking and optimize your wine listings across Italian and global eCommerce platforms.

Web Scraping for Marketing Imagery & SKU Mapping

High-quality bottle images, tasting notes, and label metadata are key to listing Italian wines effectively across digital channels. With image scraper tools and web scraping e-commerce websites, brands can build SKU libraries with structured visuals and descriptors.

For Italian wine campaigns, brands scrape data from website to excel to extract complete product listings—including vintage, region, price, and tasting notes. This structured dataset helps marketers adapt their promotions for multilingual audiences, tailoring messaging for international markets while maintaining the authenticity of Italian wine heritage.

Why Choose Product Data Scrape?

Product Data Scrape offers a full-service suite for wine data aggregation—ranging from the 2025 Italian Wine Trend Tracker via Scraping to real-time alcohol inventory monitoring. With deep expertise in structured data, visual scraping, and competitive intelligence, our platform helps global wine brands, retailers, and logistics companies stay ahead of the market curve.

From scraping thousands of listings across Italy's top wine portals to building enriched, export-ready datasets, we support clients across data compliance, scale, and insights. Our instant data scrapper can deliver daily refreshed datasets in your desired format—CSV, Excel, API, or JSON.

Whether it’s launching a new label in India or benchmarking prices for Bordeaux vs Barolo, we give you data that matters.

Conclusion

As the global wine landscape pivots back toward classic Italian labels, understanding SKU-level shifts is critical. Whether you’re a digital retailer, importer, or D2C winery, the 2025 Italian Wine Trend Tracker via Scraping empowers you with accurate, timely, and visual datasets. Monitor seasonality, region-specific demands, competitor discounts, or shelf visibility in real time.

From web scraping wine listings from Italian retailers to advanced e-commerce data scraping, our tools are designed for smart, scalable business operations. Don’t leave your 2025 wine strategy to guesswork. Turn market signals into actionable insights with Product Data Scrape .

📩 Email Us:

✉️ info@productdatascrape.com

📞 Call or WhatsApp:

📱 +1 (424) 377-7584

Learn More >> https://www.productdatascrape.com/italian-wine-trends-scraping-old-world-returns.php

🌐 Get Expert Support in Web Scraping & Datasets — Fast, Reliable, and Scalable! 🚀📊

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness