Dubai Abu Dhabi Hotel Pricing Trends

Introduction

The hospitality industry in the UAE continues to thrive, fueled by strategic investments in tourism and events. Dubai Abu Dhabi hotel Pricing Trends underscore a bifurcated market, where high-end accommodations cater to affluent visitors, while economy options attract diverse demographics.

Projections for hotel pricing trends 2025 anticipate moderate ADR increases of 1.4-1.7% in upscale and luxury categories, with economy rates remaining stable amid competitive pressures.

This analysis focuses on 5-star hotel chain rates in Dubai and Abu Dhabi, exemplified by brands like Emirates Palace and Atlantis, which often exceed USD 250 per night.

A detailed UAE hotel cost comparison, luxury vs budget, reveals significant variances, with luxury stays averaging 3-5 times the cost of budget alternatives, influenced by location and amenities.

Dubai's market, with 8.68 million tourists in the first five months of 2025 (a 7% year-over-year increase), drives higher premiums, while Abu Dhabi's cultural focus offers more value-oriented pricing. This report examines these trends to inform stakeholders on investment and operational strategies.

Methodology and Data Sources

This research employs a mixed-methods approach, integrating quantitative data from industry reports and qualitative insights from guest feedback. Primary sources include the Hotel Guest Review Dataset from platforms like TripAdvisor, aggregating over 100,000 reviews for sentiment analysis on pricing value.

Hotel Price Data Scraping from dynamic booking sites provided real-time ADR fluctuations, ensuring accuracy for 2025 trends.

Efforts to Collect Hotel Pricing and Availability Data involved synthesizing reports from STR Global, KPMG, and JLL, covering metrics such as ADR, occupancy, and RevPAR up to Q2 2025.

Additionally, Travel Industry Web Scraping Services facilitated the extraction of seasonal data from Hotels.com and Booking.com, enabling comparative analysis.

Projections are based on CAGR estimates from IMARC and Fortune Business Insights, with cross-validation against UAE-wide statistics. Limitations include potential biases in scraped data due to promotional pricing.

Market Overview

The UAE hospitality sector is projected to grow from USD 53.33 billion in 2025 to USD 69.57 billion by 2030, at a CAGR of 5.46%. Luxury dominates, with Dubai hosting over 150 five-star properties, representing 67% of inventory. Abu Dhabi, with a focus on experiential tourism, sees balanced growth across segments.

Tourist arrivals support this: Dubai welcomed 8.68 million visitors from January to May 2025, up 7%, boosting demand. Key drivers include events like IDEX, which elevated Abu Dhabi's ADR by 40.6% to AED 873 (USD 238) during the period.

Sustainability and technology integration are emerging trends, with luxury chains adopting AI for personalized pricing.

Regional Pricing Analysis

- Dubai Luxury Segment: Dubai's luxury market thrives on opulence, with ADR averaging USD 221 in 2024, projected to rise modestly in 2025. Brands like Burj Al Arab and Armani Hotel command USD 500+, driven by landmarks and events. Price sensitivity is increasing, leading to ADR adjustments during off-peak seasons. RevPAR grew 7.1% year-over-year through April 2025.

- Dubai Budget Segment: Budget brands in Dubai, such as Premier Inn, offer rates from USD 50–100, with averages around USD 71. Oversupply in midscale areas like Deira keeps prices stable, appealing to families and business travelers. High-season spikes reach USD 132, but discounts (up to 40%) maintain occupancy at 78%.

- Abu Dhabi Luxury Segment: Abu Dhabi's luxury ADR stands at approximately USD 186 (AED 683), 30% lower than Dubai, offering value in properties like the Emirates Palace (from USD 545). Events like Formula 1 drive peaks, with RevPAR up 38.7% annually.

- Abu Dhabi Budget Segment: Budget options average USD 77, with medians at USD 64, focusing on areas like Yas Island. Rates are 30% cheaper than Dubai equivalents, supported by government incentives for mid-market growth.

Comparative Analysis

Luxury vs. budget disparities are stark: a week in Dubai luxury costs USD 5,000+, vs. USD 700–1,000 for budget. Abu Dhabi offers better affordability, with luxury 27% cheaper internationally.

Seasonal trends show June 2025 increases of 7.9% UAE-wide, with luxury at USD 249 and budget at USD 77.

Table 1: Average Daily Rates (ADR) by Segment and City, Q1–Q2 2025 (USD)

| Segment | Dubai ADR (USD) | Abu Dhabi ADR (USD) |

|---|---|---|

| Luxury (5-Star) | 280 | 186 |

| Budget | 71 | 77 |

Table 2: Year-Over-Year RevPAR Growth, 2024-2025 (Percentage)

| Segment | UAE-Wide Growth | Dubai-Specific | Abu Dhabi-Specific |

|---|---|---|---|

| Luxury | +7.1% | +6.5% | +38.7% |

| Budget | +0.9% | +1.2% | +2.0% |

Factors Influencing Trends

- Economic policies, such as visa reforms, boost inbound tourism.

- Events contribute to volatility: Abu Dhabi's IDEX saw occupancy at 86.8%.

- Sustainability initiatives in luxury chains justify premiums, while budget brands leverage digital platforms.

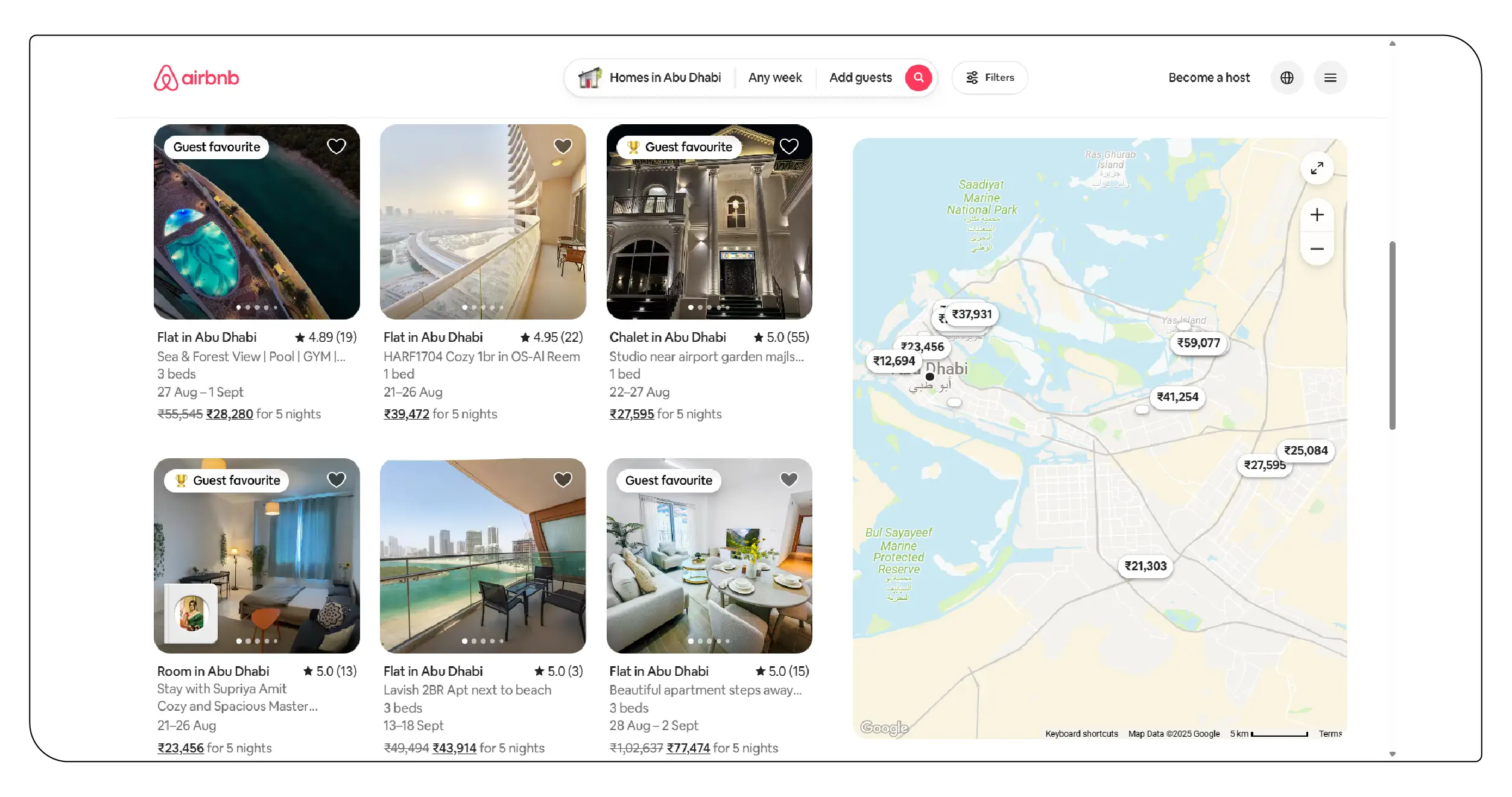

- Competition from short-term rentals pressures budget segments, reducing ADR growth.

Future Projections

- The MENA hospitality market will grow at 6.67% CAGR to USD 487.36 billion by 2032.

- UAE luxury segment anticipates 5.3% CAGR.

- Dubai plans 16 new hotels in 2025.

Table 3: Projected Market Size and Growth, 2025-2030 (USD Billion)

| Year | UAE Hospitality | Luxury Sub-Segment |

|---|---|---|

| 2025 | 53.33 | 23.9 |

| 2030 | 69.57 | 35.2 (est.) |

Table 4: Occupancy Rates by Segment, Q1 2025 (Percentage)

| Segment | Dubai | Abu Dhabi |

|---|---|---|

| Luxury | 78.1 | 71.9 |

| Budget | 75.0 | 80.0 |

Source: Derived from event-driven data and averages.

Challenges and Opportunities

Challenges include oversupply in budget segments and geopolitical risks affecting tourism. Opportunities lie in experiential travel and tech integration, with 54% of UAE travelers planning more trips in 2025.

Conclusion

The UAE hospitality landscape in 2025 reflects resilience and innovation. Dubai luxury hotel market trends emphasize premium growth through iconic developments and record investments.

5-star hotel price trends Abu Dhabi indicate competitive pricing, leveraging cultural assets for sustained demand.

In essence, luxury vs budget hotel price trends illustrate a polarized yet complementary market, where luxury drives revenue and budget ensures accessibility, positioning the UAE as a global leader.

Ready to elevate your travel business with cutting-edge data insights? Get in touch with Travel Scrapetoday to explore how our end-to-end data solutions can uncover new revenue streams, enhance your offerings, and strengthen your competitive edge in the travel market.

Source : https://www.travelscrape.com/dubai-abu-dhabi-hotel-pricing-trends.php

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness