Usage-Based Insurance Market Share 2025 - 2032 | Challenges and Opportunities with Top Countries Data

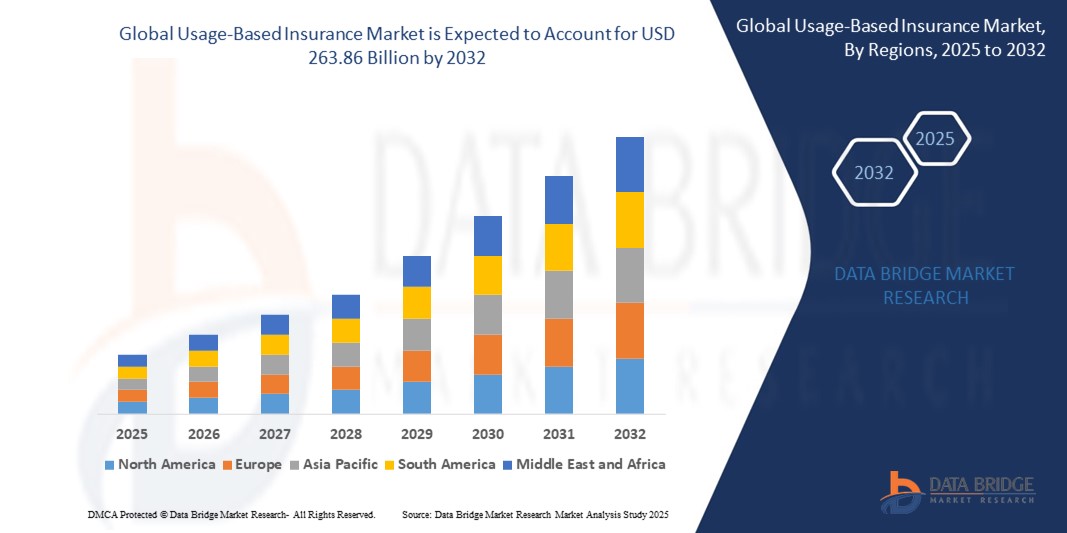

The global usage-based insurance market size was valued at USD 39.83 billion in 2024 and is expected to reach USD 263.86 billion by 2032, at a CAGR of 26.66% during the forecast period

Introduction

Provide an overview of the Usage-Based Insurance Market. Explain how usage-based insurance (UBI) leverages telematics, connected devices, and driving behavior data to offer personalized insurance products. Discuss how technological advancements, changing consumer expectations, and regulatory reforms are driving the adoption of UBI models. Highlight how this approach benefits both insurers, by improving risk assessment and reducing claims, and customers, through fairer premiums and improved safety incentives.

Market Dynamics

Drivers

Explain the factors driving growth in the usage-based insurance market. Rising smartphone penetration, advancements in telematics, and growing demand for personalized insurance solutions are key contributors. Additionally, increasing awareness about safe driving habits and the need to reduce insurance fraud are supporting the adoption of UBI models. Government policies promoting digital insurance platforms and data-driven decision-making are also accelerating market expansion.

Restraints

Highlight challenges such as data privacy concerns, cybersecurity risks, and consumer hesitation to share driving behavior information. The complexity of integrating telematics devices with legacy insurance systems and the need for substantial investment in technology infrastructure may slow market growth. Furthermore, uneven regulatory frameworks across regions can complicate the rollout of UBI products.

Opportunities

Explore opportunities such as partnerships between insurance providers and technology firms, use of artificial intelligence to enhance data analysis, and the expansion of connected vehicle ecosystems. The increasing popularity of electric and autonomous vehicles presents avenues for customized insurance offerings tailored to new mobility solutions. Additionally, targeted services for fleets, ride-sharing, and delivery services create niche market segments.

Challenges

Discuss challenges such as ensuring data accuracy, managing customer expectations, and maintaining transparency in pricing models. Building trust with users who may fear surveillance or misuse of data is essential for market acceptance. The need for scalable platforms and cost-effective devices also presents hurdles for insurers aiming to expand UBI coverage.

Market Segmentation

By Component

Hardware (telematics devices, sensors), software (analytics platforms, apps), and services (monitoring, reporting, customer support). Explain how each component is critical to offering a seamless UBI experience and how technological integration enhances user engagement.

By Application

Personal vehicles, commercial fleets, ride-sharing platforms, and others. Describe how each application has distinct requirements in terms of monitoring, pricing, and user interaction.

By Insurance Type

Pay-as-you-drive (PAYD), pay-how-you-drive (PHYD), and others. Highlight the differences between these models and how they appeal to various customer segments depending on usage patterns and driving habits.

Regional Outlook

Provide insights into regions such as North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Discuss how regulatory environments, digital infrastructure, automotive trends, and consumer behavior influence market adoption. North America and Europe, for example, lead the market due to technological readiness, while Asia-Pacific offers growth opportunities with increasing vehicle ownership and urbanization.

Competitive Landscape

Identify major players operating in the usage-based insurance space. Discuss how they are focusing on developing advanced analytics tools, expanding into new markets, collaborating with automotive OEMs, and offering customer-friendly pricing models. Highlight innovations such as AI-driven risk assessments, cloud-based data processing, and seamless app integrations that are reshaping industry competition.

Future Trends

Explore trends such as integration with connected car ecosystems, AI-powered predictive analytics, and blockchain-enabled data security. Discuss how increasing demand for real-time monitoring, automated claims processing, and behavioral coaching tools are transforming insurance delivery. Growing investments in electric vehicle insurance and mobility-as-a-service platforms are expected to further expand the UBI market.

Conclusion

Summarize the key insights regarding market drivers, restraints, opportunities, segmentation, regional outlook, and future trends. Emphasize that usage-based insurance is redefining how insurers assess risk and price premiums, providing more tailored solutions to customers. As technology advances and consumer expectations evolve, insurers that embrace data-driven approaches and transparent communication will lead the market toward greater adoption and efficiency.

Frequently Asked Questions (FAQ)

What is usage-based insurance and how does it work?

What benefits does usage-based insurance offer to customers and insurers?

What challenges are associated with implementing telematics-based insurance solutions?

How is technology shaping the future of usage-based insurance?

Which regions are expected to see the fastest adoption of usage-based insurance models?

Equip yourself with actionable insights and trends from our complete Usage-Based Insurance Market analysis. Download now:https://www.databridgemarketresearch.com/reports/global-usage-based-insurance-market

Browse More Reports:

Global Kaempferol Market

Global Karyotyping Market

Global Kegs Market

Global Kosher Food Market

Global Lab-On-A-Chip Market

Global Lambert-Eaton Myasthenic Syndrome (LEMS) Treatment Market

Global Larvicides Market

Global Laryngitis Market

Global Laryngoscopes Market

Global Laser Marking Market

Global Lateral Flow Assay Market

Global Low-Density Lipoprotein (LDL) Test Market

Global Legal Unified Communication Market

Global Leukemia Therapeutics Market

Global Level Transmitter Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 1013

Email:- corporatesales@databridgemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness