Digital Payment Market Size 2025 - 2032 | Challenges and Opportunities with Top Countries Data

Detailed Analysis of Executive Summary Digital Payment Market Size and Share

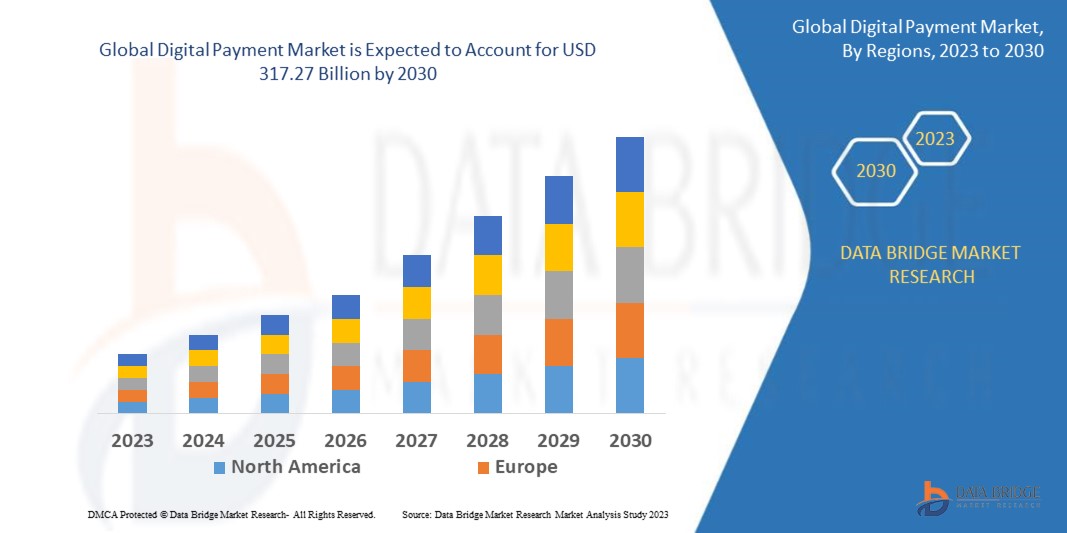

Data Bridge Market Research analyses that the digital payment market, which was USD 94.34 billion in 2022, is expected to reach USD 317.27 billion by 2030, at a CAGR of 20.60% during the forecast period 2023 to 2030.

When market research report is brilliant and precise, it proves to be a backbone for the business that helps to thrive in the competition. An all-inclusive Digital Payment Market report gives an utter background analysis of the Digital Payment Market industry along with an assessment of the parental market. It endows with a telescopic view of the competitive landscape with which planning of the strategies becomes convenient. Strategic planning supports in improving and enhancing the products with respect to customer’s preferences and inclinations. Moreover, Digital Payment Market document also describes exhaustive overview about product specification, product type, technology, and production analysis by taking into account other major factors such as revenue, cost, gross and gross margin.

The dependable Digital Payment Market report is a vital source of information which gives current and approaching technical and financial details of the industry to 2030. The report displays the systematic investigation of current scenario of the market, which covers several market dynamics. The report also recognizes and analyses the growing trends along with major drivers, restraints, challenges and opportunities in the Digital Payment Market industry. The vigilant efforts accompanied with integrated approaches and sophisticated techniques results into an excellent market research report that drives the decision making process of the business. In no doubt, businesses will increase sustainability and profitability with Digital Payment Market research report.

Take a deep dive into the current and future state of the Digital Payment Market. Access the report:

https://www.databridgemarketresearch.com/reports/global-digital-payment-market

Digital Payment Market Data Summary

**Segments**

- Based on the solution, the global digital payment market can be segmented into payment processing, payment gateway, payment wallet, POS solutions, payment security and fraud management.

- On the basis of deployment type, the market can be categorized into on-premises and cloud.

- By organization size, the market is divided into small and medium-sized enterprises (SMEs) and large enterprises.

- Depending on end-user, the market is segmented into banking, financial services, and insurance (BFSI), retail, telecommunications, government, healthcare, and others.

- Geographically, the global digital payment market is segmented into North America, Europe, Asia-Pacific, South America, and Middle East & Africa.

**Market Players**

- PayPal Holdings, Inc.

- Visa Inc.

- Mastercard

- Amazon.com, Inc.

- Alphabet Inc.

- Apple Inc.

- Samsung Electronics Co., Ltd.

- ACI Worldwide

- Fiserv, Inc.

- Square, Inc.

The global digital payment market is experiencing rapid growth due to the increasing adoption of digital payment solutions by businesses and consumers. The shift towards cashless transactions, coupled with the growing ecommerce industry, is driving the demand for digital payment services across the globe. The payment processing segment is expected to witness significant growth as businesses look to streamline their payment operations and enhance transaction efficiency. Cloud deployment is becoming popular due to its scalability and cost-effectiveness, especially among SMEs. The BFSI sector is a major end-user of digital payment solutions, as financial institutions strive to offer convenient and secure payment options to their customers.

Key players in the global digital payment market include PayPal Holdings, Inc., Visa Inc., Mastercard, Amazon.com, Inc., Alphabet Inc., Apple Inc., Samsung Electronics Co., Ltd., ACI Worldwide, Fiserv, Inc., and Square, Inc. These companies are investing in research and development to introduce innovative payment solutions that cater to the evolving needs of businesses and consumers. Partnerships and collaborations are common strategies adopted by players to expand their market presence and enhance their product offerings. With the increasing focus on digital transformation and customer experience, the competition in the digital payment market is intensifying, leading to the launch of advanced payment technologies and services.

The global digital payment market is currently driven by several key trends that are reshaping the industry landscape. One significant trend is the rise of mobile payments, fueled by the widespread adoption of smartphones and the increasing preference for convenient and contactless payment methods. Mobile wallets, such as Apple Pay and Samsung Pay, are gaining popularity among consumers for their ease of use and enhanced security features. This trend is expected to continue driving the growth of the digital payment market, especially in regions like Asia-Pacific where mobile penetration is high.

Another important trend impacting the market is the growing emphasis on data security and fraud prevention. With the increasing volume of digital transactions, cybersecurity has become a top priority for businesses and financial institutions. Payment security solutions, such as encryption technologies and biometric authentication, are being implemented to safeguard sensitive customer information and prevent fraudulent activities. This focus on security and compliance is driving investments in advanced fraud detection and prevention systems, creating opportunities for vendors offering payment security and fraud management solutions.

Furthermore, the evolving regulatory landscape is shaping the competitive dynamics of the digital payment market. Regulations such as the Revised Payment Services Directive (PSD2) in Europe and the Payment Card Industry Data Security Standard (PCI DSS) globally are driving industry players to enhance their compliance processes and strengthen data protection measures. Regulatory changes are also fostering innovation in the market, as companies seek to adapt to new requirements and capitalize on emerging opportunities in the digital payment ecosystem.

Moreover, the shift towards a cashless society is accelerating the adoption of digital payment solutions across various sectors. Retailers are increasingly offering digital payment options to cater to tech-savvy consumers, while government agencies are exploring digital platforms to streamline transactions and improve operational efficiencies. The healthcare sector is also leveraging digital payments to enhance patient experience and facilitate billing processes.

In conclusion, the global digital payment market is poised for continued growth driven by mobile payments, enhanced security measures, regulatory developments, and the broader trend towards cashless transactions. Market players will need to focus on innovation, partnerships, and compliance to stay competitive in this dynamic and rapidly evolving landscape. As digital payments become increasingly integrated into everyday transactions, businesses and consumers alike will benefit from the convenience, efficiency, and security offered by digital payment solutions.The global digital payment market is witnessing robust growth driven by the widespread adoption of digital payment solutions across various industries. Businesses and consumers are increasingly shifting towards cashless transactions, fueled by the convenience and efficiency offered by digital payment services. The demand for payment processing solutions is on the rise as companies aim to streamline their payment operations and improve transaction efficiency. Cloud deployment is gaining traction, especially among small and medium-sized enterprises, due to its scalability and cost-effectiveness. The banking, financial services, and insurance sector are key end-users of digital payment solutions, as they strive to offer secure and convenient payment options to their customers.

Key players in the global digital payment market, such as PayPal Holdings, Visa Inc., and Mastercard, are investing in innovative payment solutions to cater to the evolving needs of businesses and consumers. Partnerships and collaborations are common strategies employed by market players to expand their market presence and enhance their product offerings. The competition in the digital payment market is intensifying, leading to the introduction of advanced payment technologies and services to meet the growing demand for digital payment solutions.

Mobile payments are a significant trend shaping the digital payment market, driven by the increased adoption of smartphones and the preference for contactless payment methods. Mobile wallets like Apple Pay and Samsung Pay are gaining popularity due to their ease of use and enhanced security features, particularly in regions with high mobile penetration. Data security and fraud prevention are also key trends influencing the market, with a growing emphasis on implementing encryption technologies and biometric authentication to safeguard sensitive customer information.

Regulatory developments, such as PSD2 in Europe and PCI DSS globally, are reshaping the competitive landscape of the digital payment market. Companies are enhancing their compliance processes and data protection measures to adhere to regulatory requirements and capitalize on emerging opportunities. The shift towards a cashless society is further accelerating the adoption of digital payment solutions across sectors like retail, government, and healthcare, driving the need for secure and efficient payment platforms.

In conclusion, the global digital payment market is set for sustained growth propelled by mobile payments, enhanced security measures, regulatory changes, and the increasing acceptance of cashless transactions. Market players will need to focus on innovation, partnerships, and compliance to seize opportunities in this fast-evolving landscape. As digital payments become more integrated into everyday transactions, businesses and consumers will continue to benefit from the convenience, speed, and security offered by digital payment solutions.

Investigate the company’s industry share in depth

https://www.databridgemarketresearch.com/reports/global-digital-payment-market/companies

Digital Payment Market Overview: Strategic Questions for Analysis

- What is the reported market size of the Digital Payment Market currently?

- What rate of expansion is anticipated for the Digital Payment Market?

- What segmentations provide the framework of the Digital Payment Market?

- Who are considered the top competitors in this Digital Payment Market?

- What are the latest strategic product moves?

- Which national markets are included in the Digital Payment Market research?

- What is the fastest expanding area within the global Digital Payment Market landscape?

- Which country might outpace others in Digital Payment Market capture?

- What region has the biggest stake in the Digital Payment Market today?

- Which country is projected to lead in CAGR?

Browse More Reports:

Global Centrifugal Blood Pumps Market

Global Decorative Paint and Coatings Market

Global Depression Screening Market

Global Electrofusion Fittings Market

Global Electrostatic Chucks Market

Global Fanconi Anemia Treatment Market

Global Gene Therapy Market

Global Goat Cheese Market

Global Graphite Market

Global Ilmenite Market

Global Infant Formula Ingredients Market

Global Internal Combustion Engine (ICE) Market

Global Mastocytosis Drug Market

Global Polyetheretherketone (PEEK) Market

Global Persulfates Market

Global Environmental Test Equipment Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness