Critical Illness Insurance Market Expands with Rising Awareness of Health Risks

Executive Summary Critical Illness Insurance Market: Growth Trends and Share Breakdown

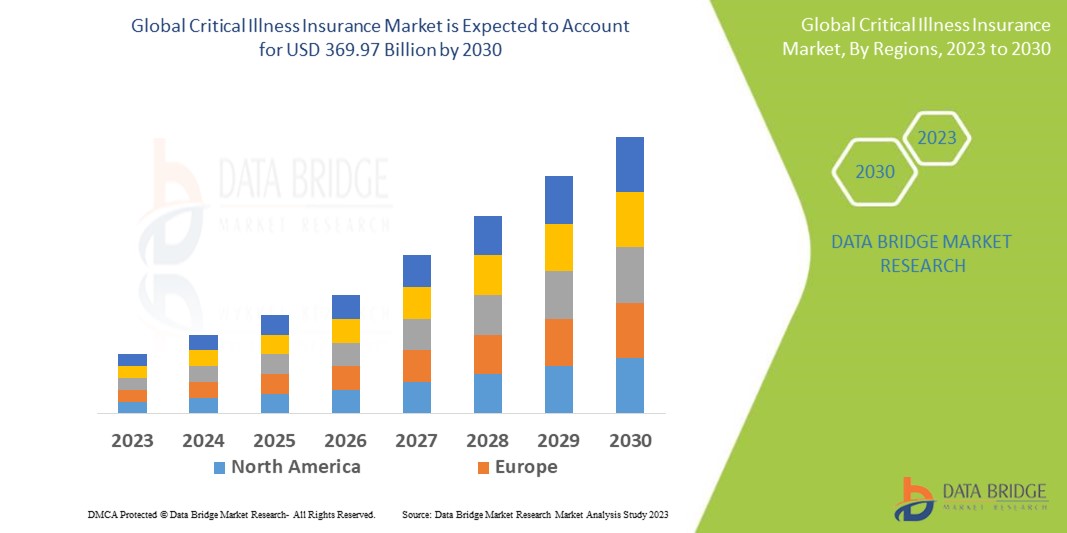

Data Bridge Market Research analyses that the critical illness insurance market, which was USD 216.5 Billion in 2022, would rocket up to USD 369.97 Billion by 2030 and is expected to undergo a CAGR of 10.40% during the forecast period.

Critical Illness Insurance Market research report is a verified source of data and information that provides a telescopic view of the current market trends, situations, opportunities and status. These market research data analyses prime challenges faced by the Critical Illness Insurance Market industry presently and in the coming years. The report gives CAGR (compound annual growth rate) value fluctuations for the specific forecasted period which is useful in deciding costing and investment strategies. It gives idea to other market participants about the problems that they might face while operating in this market over a longer period of time. Critical Illness Insurance Market document is an explicit study of the Critical Illness Insurance Market industry which explains what the market definition, classifications, applications, engagements, and global industry trends are.

The large scale Critical Illness Insurance Market report makes available major statistics on the market status of global and regional manufacturers and is a supportive source for companies and individuals interested in the Critical Illness Insurance Market industry. The company profiles of all the dominating market players and brands that are making moves such as product launches, joint ventures, mergers and acquisitions are described in the report. It also becomes easy to analyse the actions of key players and respective effect on the sales, import, export, revenue and CAGR values. Critical Illness Insurance Marketing report is most suitable for business requirements in many ways.

Get a full overview of market dynamics, forecasts, and trends. Download the complete Critical Illness Insurance Market report: https://www.databridgemarketresearch.com/reports/global-critical-illness-insurance-market

Critical Illness Insurance Market Summary

Segments:

- Based on the type, the critical illness insurance market can be segmented into individual and group.

- By end-user, the market can be divided into adults, children, and senior citizens.

- On the basis of distribution channel, the market is categorized into direct sales and agency.

These segments highlight the diverse nature of the critical illness insurance market, catering to individuals of different age groups through various distribution channels. The individual segment is expected to dominate the market due to the rising awareness about the benefits of having personal coverage against critical illnesses. Additionally, the increasing number of insurance providers offering group policies to organizations for their employees is driving the growth of the group segment. Moreover, the end-user segmentation reflects the importance of providing coverage to individuals across all age groups.

Market Players:

- Allianz

- AXA

- Aviva

- AIA Group Limited

- Dai-ichi Life Holdings, Inc.

- Prudential plc

- China Life Insurance Company Limited

- Ping An Insurance (Group) Company of China, Ltd.

- MetLife Services and Solutions, LLC

- Zurich Insurance Group

These market players are key contributors to the global critical illness insurance market, with each company offering a diverse range of products and services to meet the varied needs of consumers. Companies like Allianz, AXA, and Aviva have established a strong presence in the market, leveraging their expertise to provide comprehensive critical illness insurance solutions. Emerging players such as AIA Group Limited and Dai-ichi Life Holdings, Inc. are also making significant strides in the market by introducing innovative products tailored to specific customer segments. Overall, the market players play a crucial role in driving competition, innovation, and growth within the critical illness insurance industry.

The global critical illness insurance market is witnessing a significant shift towards customization and accessibility, with insurance providers focusing on tailoring products to meet the specific needs of different consumer segments. One emerging trend in the market is the emphasis on innovative coverage options that go beyond traditional critical illness policies. Insurers are now offering add-on benefits such as wellness programs, virtual healthcare services, and mental health support to enhance the overall value proposition for policyholders. This trend reflects a broader industry-wide effort to provide comprehensive and holistic protection against critical illnesses, addressing not only the financial aspect but also the overall well-being of individuals.

Another key trend shaping the critical illness insurance market is the increasing integration of technology in product development and distribution. Insurers are leveraging data analytics, artificial intelligence, and machine learning to improve underwriting accuracy, streamline claims processing, and enhance customer engagement. For instance, the use of wearable devices and health monitoring apps allows insurers to collect real-time data on policyholders' health status, enabling personalized risk assessments and proactive health management strategies. This digital transformation is not only enhancing operational efficiency for insurance companies but also empowering consumers to take a more proactive approach to their health and well-being.

Furthermore, the COVID-19 pandemic has underscored the importance of adequate insurance coverage against unforeseen health crises, driving demand for critical illness insurance across geographies. The pandemic has heightened awareness around the financial vulnerabilities associated with critical illnesses and has prompted individuals to reassess their protection needs. As a result, insurance providers are seeing an increased uptake of critical illness policies as individuals seek to safeguard themselves and their families against the financial impact of serious illnesses.

In terms of market dynamics, the competitive landscape of the critical illness insurance market is expected to intensify as companies strive to differentiate themselves through product innovation, customer experience, and distribution strategies. Insurers that can effectively leverage data and technology to offer personalized solutions and seamless digital experiences are likely to gain a competitive edge in the market. Additionally, partnerships and collaborations between insurance companies and healthcare providers are expected to drive product innovation and expand market reach, allowing insurers to offer comprehensive health and wellness solutions to their customers.

Overall, the global critical illness insurance market is poised for continued growth and evolution as insurers adapt to changing consumer needs, technological advancements, and emerging risks. By embracing innovation, customization, and collaboration, insurance providers can not only meet the evolving demands of the market but also play a vital role in promoting financial security and well-being for individuals facing critical illnesses.The critical illness insurance market is experiencing a paradigm shift towards personalization and accessibility as insurance providers aim to cater to the diverse needs of consumers. This trend is being driven by a growing awareness of the benefits of having tailored coverage against critical illnesses across different age groups. The emphasis on customization is leading to the development of innovative coverage options that extend beyond traditional policies, such as wellness programs and mental health support, to provide a comprehensive protection package for policyholders. This shift towards holistic coverage underscores the industry's commitment to addressing not only the financial implications but also the overall well-being of individuals.

Moreover, the integration of technology is playing a pivotal role in reshaping the critical illness insurance market. Insurers are increasingly leveraging data analytics, artificial intelligence, and wearable devices to enhance underwriting accuracy, streamline claims processing, and improve customer engagement. The use of technology enables insurers to offer personalized risk assessments and proactive health management strategies based on real-time health data, empowering consumers to take a more active role in safeguarding their health and financial well-being. This digital transformation is not only enhancing operational efficiencies for insurance companies but also elevating the overall customer experience by providing seamless and personalized services.

The ongoing COVID-19 pandemic has further accelerated the demand for critical illness insurance globally, as individuals seek comprehensive protection against unforeseen health crises. The pandemic has highlighted the financial vulnerabilities associated with critical illnesses, prompting a surge in the uptake of insurance policies as people reevaluate their coverage needs. This shift in consumer behavior is expected to drive market growth as insurers continue to innovate and adapt to meet the evolving demands of the market. Additionally, collaborations between insurance companies and healthcare providers are anticipated to spur product innovation and extend the reach of critical illness insurance offerings, enabling insurers to provide a more comprehensive suite of health and wellness solutions to their customers.

As the competitive landscape of the critical illness insurance market intensifies, companies will need to differentiate themselves through product innovation, customer-centric strategies, and digital capabilities to stay ahead in the market. Those insurers that can effectively harness technology, data analytics, and collaboration opportunities are poised to gain a competitive edge by offering personalized solutions and enhancing the overall customer experience. By embracing innovation and collaboration, insurance providers can not only meet the changing needs of consumers but also play a pivotal role in promoting financial security and well-being for individuals facing critical illnesses.

Examine the market share held by the company

https://www.databridgemarketresearch.com/reports/global-critical-illness-insurance-market/companies

Critical Illness Insurance Market Research Questionnaire – 25 Sets of Analyst Questions

- How large is the addressable market in the Critical Illness Insurance Market sector?

- What is the estimated revenue forecast for the next 5 years?

- What are the key distribution channels in the Critical Illness Insurance Market?

- Which demographics contribute most to demand?

- How does product innovation influence Critical Illness Insurance Market competitiveness?

- What is the level of brand loyalty in the Critical Illness Insurance Market?

- What barriers are hindering Critical Illness Insurance Market growth?

- How are key players differentiating their offerings?

- What geographic trends are shaping the Critical Illness Insurance Market?

- How do raw material prices affect profit margins?

- What is the impact of social media Critical Illness Insurance Market?

- Which export markets are growing for this Critical Illness Insurance Market industry?

- What are the sustainability concerns in the sector?

- Are local brands outperforming global Critical Illness Insurance Market ones?

Browse More Reports:

Global Hospital Gown Market

North America Dental Implants Market

Europe Breast Biopsy Devices Market

Europe Infusion Pump System, Accessories and Software Market

Asia-Pacific Low Emissivity (Low-E) Glass Market

Middle East and Africa Low-E (Low Emissivity) Glass Market

Europe Deep Brain Stimulation Systems Market

North America Food Storage Container Market

Middle East and Africa Recovered Carbon Black (rCB) Market

North America Medical Devices Market

Europe Airless Dispenser Market

Asia-Pacific Microalgae Market

Asia-Pacific Cosmetics Market

Asia-Pacific Amniotic Products Market

Europe Food Diagnostics Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness