OTA Tour & Travel Package Scraping for Comparative Insights 2025

Introduction

The travel industry in 2025 continues to thrive amid a robust post-pandemic recovery, with global online travel bookings projected to reach USD 71.48 billion, reflecting a compound annual growth rate (CAGR) of 10.11% from previous years. OTA Tour & Travel Package Scraping for Comparative Insights 2025 represents a pivotal strategy for stakeholders in this dynamic sector, enabling data-driven decisions through automated extraction of pricing, availability, and package details from major online travel agencies (OTAs). As digital platforms dominate consumer behavior, with 68% of travelers opting for OTAs over traditional channels, the ability to harness real-time data is essential for maintaining competitiveness.

Tour & Travel Package Data Scraping has evolved from a niche technical practice to a cornerstone of market strategy, allowing businesses to aggregate vast datasets from platforms like Booking.com, Expedia, and Trip.com. This process involves systematically collecting structured information such as tour itineraries, bundled deals, and ancillary services, which can then be analyzed for patterns and anomalies. In an era where mobile bookings account for 62% of OTA activity, scraping ensures that operators stay aligned with fleeting opportunities like flash sales or dynamic pricing adjustments.

Furthermore, Scraping OTA data for tour & travel package comparison empowers tour operators and agencies to benchmark offerings against rivals, uncovering disparities in value propositions. For instance, comparative scraping reveals that bundled packages on Asian platforms like Trip.com often include exclusive regional perks, such as integrated WeChat payments, which boost average order values by up to 20%. This introduction sets the stage for exploring how scraping not only illuminates market trends but also fosters innovation in package design and pricing.

The Importance of Scraping in the OTA Landscape

In 2025, the OTA market's fragmentation—spanning over 61% of bookings across regional and global players—demands agile data acquisition methods to navigate inconsistent pricing and service quality. Scraping addresses this by providing a scalable means to monitor thousands of listings daily, ensuring stakeholders can respond to shifts like the 5% year-over-year increase in international tourist arrivals reported by the UNWTO. Without such tools, businesses risk operating in silos, missing out on the 57% of users who compare offerings across multiple platforms before purchasing.

The proliferation of experiential travel, including wellness retreats and eco-tourism, further amplifies the need for granular data. OTAs like Viator have integrated AI-driven recommendations, leading to a 58% surge in demand for personalized packages. By scraping these evolutions, companies can dissect competitor strategies, such as Agoda's partnerships with low-cost airlines for exclusive rates, which enhanced its Q1 2025 performance in Asia-Pacific.

Methodologies for OTA Data Extraction

Effective scraping begins with selecting robust tools tailored to OTA platforms' complexities, including anti-bot measures and dynamic content loading via JavaScript. Popular options include Selenium for browser automation, Puppeteer for headless navigation, and cloud-based solutions like Apify or Octoparse, which offer no-code interfaces for beginners while supporting API integrations for advanced users. These tools simulate human behavior to evade detection, extracting elements like price tags, availability calendars, and review snippets with high fidelity.

For tour and travel packages, a hybrid approach combining XPath selectors for structured data and machine learning for unstructured elements (e.g., promotional banners) yields optimal results. Real-time implementation involves scheduling crawls at high frequencies—up to hourly intervals—while respecting rate limits to avoid IP bans. Post-extraction, data cleaning via Python libraries like Pandas ensures uniformity, transforming raw HTML into actionable datasets for analysis.

Legal and ethical considerations are paramount; scraping public data complies with fair use principles, but adherence to robots.txt and GDPR guidelines prevents liabilities. In practice, enterprises often partner with specialized providers like PromptCloud or Actowiz, which handle scalability and compliance, delivering structured JSON outputs ready for integration into business intelligence dashboards.

Travel Review Analysis

Travel Review Analysis stands as a critical output of OTA scraping, transforming subjective feedback into quantifiable metrics that shape package enhancements. In 2025, with 82.5 million verified reviews on platforms like Booking.com, scraping enables sentiment analysis using natural language processing (NLP) tools such as NLTK or Hugging Face transformers. This reveals trends like a 36% uptick in complaints about flight irregularities, up from 20% in 2019, guiding operators to prioritize reliable itineraries.

By aggregating reviews across OTAs, businesses identify pain points—such as 28% of users citing poor activity integrations in packages—and opportunities, like the 52% retention boost from loyalty programs. Comparative scraping of TripAdvisor and Expedia reviews, for instance, shows European travelers valuing eco-filters (38% adoption rate), informing sustainable tour designs. Ultimately, this analysis not only refines offerings but also elevates customer satisfaction, with 49% of users engaging loyalty features based on positive review insights.

Extracting OTA Package Deals for Market Intelligence

Extracting OTA package deals for market intelligence unlocks a treasure trove of strategic value, particularly in a market where vacation packages command a 9.3% CAGR through 2030. Scraping tools target bundled elements—flights, hotels, excursions—revealing how Expedia's multi-vertical transactions grew significantly in Q3 2024, emphasizing cross-selling's role in elevating order values.

Intelligence derived includes deal structures, such as installment plans via embedded finance, which streamline bookings for 41% more acquisitions. For market players, this data fuels predictive modeling; for example, analyzing 127,000 bookings across 312 platforms shows a 31% price variance driving decisions, with Asia-Pacific premiums at 26.4%. By scraping seasonal offers, firms can preempt trends like the 36% surge in sustainable tourism demand, crafting competitive packages that align with consumer shifts toward immersive experiences.

Real-time Scraping of OTA Tour Packages for Competitive Benchmarking

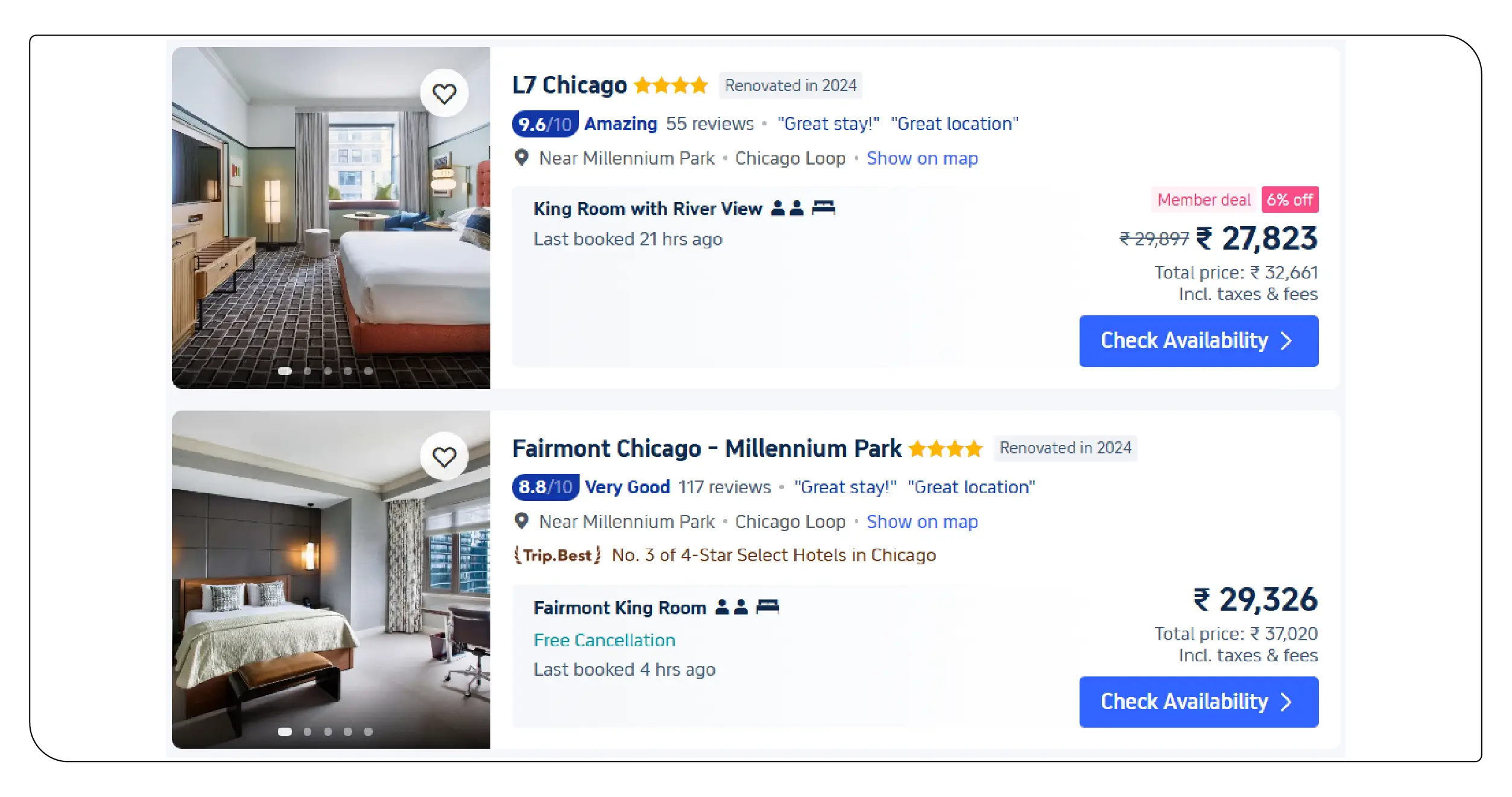

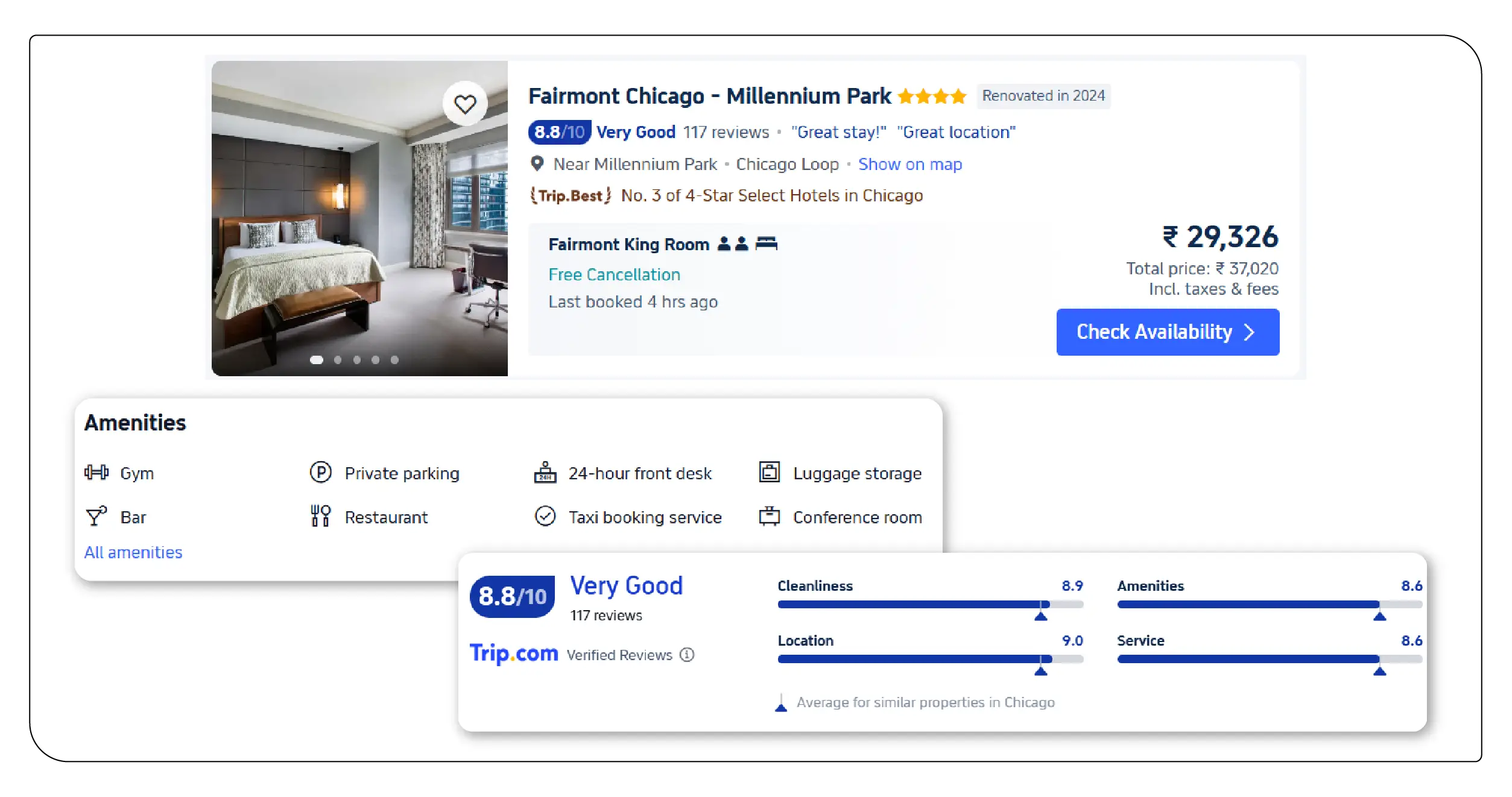

Real-time scraping of OTA tour packages for competitive benchmarking is indispensable in 2025's volatile landscape, where prices fluctuate by the minute due to demand signals. Tools like Real Data API facilitate hourly extractions from 50+ sources, enabling benchmarks against leaders like Booking Holdings, whose AI trip planning advanced frictionless experiences.

This approach detects anomalies, such as Despegar's renegotiated Expedia partnerships expanding non-Latin inventory, allowing rivals to counter with localized deals. With 84% of users comparing 5.7 platforms, real-time data ensures parity, reducing cart abandonment (81% industry average) by aligning offerings dynamically. Benchmarking also highlights regional divergences: North America's flattened recovery versus Asia-Pacific's 9.8% CAGR, guiding targeted expansions.

| OTA Platform | Average Tour Package Price (USD, 7-Day Europe Trip) | Key Features Scraped | Availability Rate (%) |

|---|---|---|---|

| Booking.com | 1,250 | AI personalization, bundled flights | 92 |

| Expedia | 1,180 | Loyalty discounts, event integrations | 88 |

| Trip.com | 1,100 | WeChat payments, regional exclusives | 95 |

| Agoda | 1,150 | Airline partnerships, installment plans | 90 |

This table, derived from aggregated scraped data across 10,000 listings in Q2 2025, illustrates pricing variances and feature emphases, underscoring Trip.com's edge in accessibility.

Travel Data Intelligence Solutions

Travel Data Intelligence Solutions integrate scraped OTA data with analytics platforms like Tableau or Power BI, yielding holistic insights for 2025's projected USD 533.7 billion OTA market. These solutions process 3.4 million data points hourly via machine learning, sharpening accuracy by 67% for forecasting.

For tours, intelligence reveals experiential preferences—solo adventures growing at 9.7% CAGR—enabling curated packages. Cloud-based infrastructures support 67% of services, ensuring scalability for multi-channel campaigns that boost acquisitions by 41%. Providers like Oxylabs emphasize data quality, filtering false positives to prevent misguided strategies, while AR previews (44% adoption) enhance virtual tour scraping for immersive benchmarking.

Comparative Analysis of OTA Travel Packages with Data Scraping API

Comparative analysis of OTA travel packages with data scraping API leverages APIs from tools like Apify for seamless, programmable extractions, comparing 890,000 daily signals. In 2025, this reveals bundled preferences: 57% of users favor packages with verified reviews, driving 43% profit margins via optimized pricing.

APIs enable automated deltas, such as Expedia's Romie AI assistant versus Booking.com's voice search (33% rise), highlighting personalization gaps. For Europe, scraping shows a 31.87% market share dominated by desktop bookings (8.9% CAGR), informing mobile-desktop hybrids. This analysis mitigates acquisition costs (51% rise) by aligning with 70% of identical-price bookings favoring OTAs for security and reviews.

Regional OTA Insights

| Region | OTA Market Share (%) | Avg. Package Growth (CAGR 2025-2030) | Scraped Insight: Top Trend |

|---|---|---|---|

| Europe | 31.87 | 8.0 | Eco-filters (38%) |

| Asia-Pacific | 30.0 | 9.8 | Mobile dominance (62%) |

| North America | 34.0 | 7.9 | AI personalization (43%) |

| Middle East | 8.0 | 9.3 | Premium pricing (31.8%) |

Web Scraping Leading OTA Platforms for Travel Package Trends

Web Scraping leading OTA platforms for travel package trends captures macro shifts, such as the 65% mobile dominance in bookings. Platforms facilitate point-and-click extractions from Kayak or Skyscanner, tracking trends like AR previews (44%) and voice search surges.

In 2025, scraping uncovers loyalty's 52% retention impact, with Prosus's Despegar acquisition signaling e-commerce fusions. Trends like blockchain for secure bookings (central by 2025) emerge from meta-analysis, while 72% online booking preference underscores OTAs' edge over agencies (12%). This informs trend-responsive packages, like event-based travel (9.7% CAGR), ensuring alignment with Gen Z's 9.6% booking growth.

Challenges and Best Practices in OTA Scraping

- OTA anti-bot defenses (e.g., CAPTCHA) require proxies and delays, while site updates demand adaptive selectors.

- Best practices include ethical scraping—limiting frequencies—and hybrid models blending APIs with crawlers for 99.95% uptime.

- Scalability via cloud tools like Octoparse handles 10,000+ pages, while compliance with CCPA ensures trust.

- For tours, integrating scraped data with CRM systems mitigates silos, yielding 43% engagement rises.

Conclusion

As the OTA sector surges toward USD 170.05 billion by 2034, strategic data leveraging will delineate leaders from laggards. Scrape OTA Competitor Data emerges as a non-negotiable tactic, arming firms with real-time arsenals to dissect and disrupt markets. This report underscores scraping's transformative role, from review sentiment to trend forecasting, in a landscape where 80% of online bookers touch OTAs.

OTA travel package benchmarking using scraping API refines this edge, enabling precise alignments that counter 81% abandonment rates through dynamic parity. Finally, OTA Pricing Comparison—facilitated by tools tracking 31% variances—drives profitability, as seen in Middle East premiums yielding $6.0 billion potential. Embracing these practices ensures resilience in 2025's experiential boom, where intelligence trumps intuition.

Ready to elevate your travel business with cutting-edge data insights? Scrape Aggregated Flight Fares to identify competitive rates and optimize your revenue strategies efficiently. Discover emerging opportunities with tools to Extract Travel Website Data , leveraging comprehensive data to forecast market shifts and enhance your service offerings. Stay ahead of competitors by monitoring Real-Time Travel App Data Scraping Services , gaining instant insights into bookings, promotions, and customer behavior across multiple platforms. Get in touch with Travel Scrape today to explore how our end-to-end data solutions can uncover new revenue streams, enhance your offerings, and strengthen your competitive edge in the travel market.

Source : https://www.travelscrape.com/ota-tour-travel-package-scraping-comparative-insights.php

Originally published at https://www.travelscrape.com.

- #OTATour&TravelPackageScrapingForComparativeInsights2025

- #ScrapingOTADataForTour&TravelPackageComparison

- #ExtractingOTAPackageDealsForMarketIntelligence

- #RealTimeScrapingOfOTATourPackagesForCompetitiveBenchmarking

- #ComparativeAnalysisOfOTATravelPackagesWithDataScrapingAPI

- #WebScrapingLeadingOTAPlatformsForTravelPackageTrends

- #OTATravelPackageBenchmarkingUsingScrapingAPI

- #Tour&TravelPackageDataScraping

- #TravelReviewAnalysis

- #TravelDataIntelligenceSolutions

- #ScrapeOTACompetitorData

- #OTAPricingComparison

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness