Asia-Pacific Fraud Detection Transaction Monitoring Market Demand Analysis | Insights into the Growing Industry 2025 - 2032

Executive Summary Asia-Pacific Fraud Detection Transaction Monitoring Market :

Executive Summary Asia-Pacific Fraud Detection Transaction Monitoring Market :

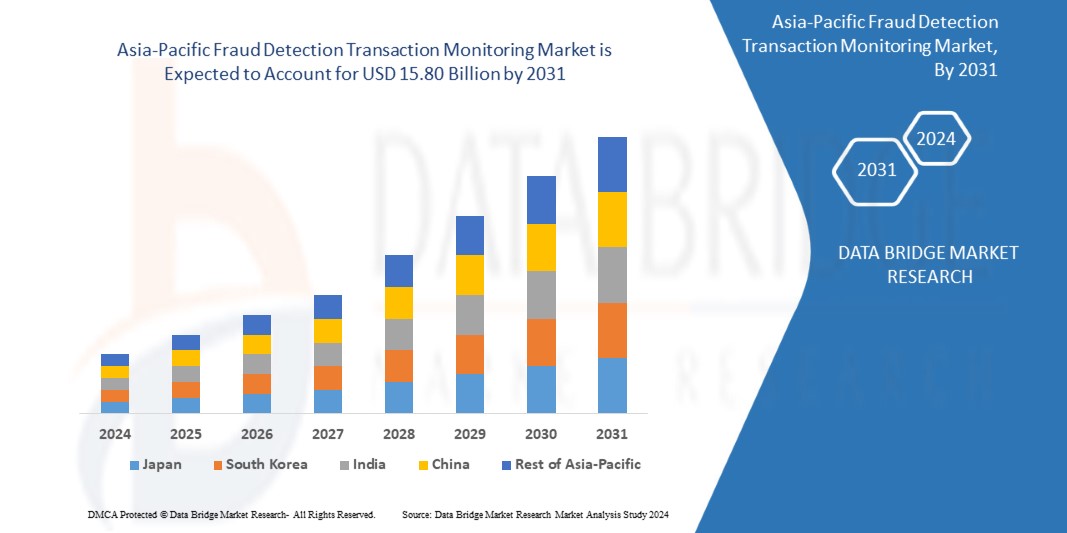

Asia-Pacific fraud detection transaction market is expected to reach a value of USD 15.80 billion by 2031 from 3.44 billion in 2023, growing at a CAGR of 21.1% during the forecast period 2024 to 2031.

This Asia-Pacific Fraud Detection Transaction Monitoring Market business report is an analytical consideration of the prime challenges that may arrive in the market in terms of sales, export, import, or revenue. This market report is a comprehensive analysis on the study of industry that gives number of market insights. This market research report describes the major moves of the top players and brands such as developments, product launches, acquisitions, mergers, joint ventures and competitive research in the market. It is a professional and in-depth analysis on the current state of the market. Asia-Pacific Fraud Detection Transaction Monitoring Market report aids to focus on the significant aspects of the market like what the recent market trends are or what buying patterns of the consumers are.

Global Asia-Pacific Fraud Detection Transaction Monitoring Market report conducts thorough competitive research to provide better market insights. This market report performs comprehensive study about industry and tells about the market status in the forecast period. The report explains the moves of top market players and brands that range from developments, products launches, acquisitions, mergers, joint ventures, trending innovation and business policies. This market analysis examines various segments which aids for the quickest development amid the estimated forecast frame. Geographical areas such as North America, South America, Europe, Asia-Pacific and Middle East & Africa are also considered for the market analysis.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Asia-Pacific Fraud Detection Transaction Monitoring Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/asia-pacific-fraud-detection-transaction-monitoring-market

Asia-Pacific Fraud Detection Transaction Monitoring Market Overview

**Segments**

- **Solution:** In this segment, fraud detection and prevention solutions are analyzed. This includes various software and tools used by organizations to detect and monitor fraudulent transactions. The key players in this segment focus on providing advanced technology to detect anomalies and suspicious activities in real-time.

- **Component:** The component segment involves analysis of different elements that make up the fraud detection and transaction monitoring systems. This includes hardware components such as servers and devices, as well as software components like algorithms and analytics tools.

- **Application Area:** This segment delves into the various industries and sectors where fraud detection and transaction monitoring are crucial. Industries such as banking, financial services, e-commerce, healthcare, and government are major players in this segment.

**Market Players**

- **IBM:** IBM is a major player in the Asia-Pacific fraud detection transaction monitoring market, offering a range of solutions and services to help organizations combat fraud and enhance security.

- **FICO:** FICO is another prominent player known for its expertise in analytics and decision management software, providing solutions for fraud detection and prevention.

- **Oracle:** Oracle offers a comprehensive suite of fraud detection and transaction monitoring solutions that cater to the needs of both large enterprises and small businesses.

- **SAS Institute:** SAS Institute is a leading provider of analytics and business intelligence solutions, with a strong focus on fraud detection and prevention in the Asia-Pacific region.

The Asia-Pacific fraud detection transaction monitoring market is witnessing significant growth due to the increasing incidents of fraud and cyber attacks in the region. Organizations are increasingly investing in advanced technologies and solutions to safeguard their operations and protect their customers' data. The market is characterized by intense competition, with key players focusing on product innovation and strategic partnerships to gain a competitive edge. The evolving regulatory landscape and growing awareness about the importance of fraud detection and prevention are driving market growth. Overall, the Asia-Pacific region presents lucrative opportunities for market players operating in the fraud detection and transaction monitoring space.

The Asia-Pacific fraud detection transaction monitoring market is poised for substantial growth in the coming years due to the increasing sophistication of fraudulent activities and cyber threats across various industries in the region. One of the key drivers propelling market expansion is the rising adoption of digital technologies across sectors such as banking, financial services, e-commerce, healthcare, and government, exposing them to higher risks of fraudulent activities. As organizations strive to safeguard their operations and protect sensitive data, the demand for advanced fraud detection and prevention solutions is on the rise.

Market players in the Asia-Pacific region are investing heavily in research and development to enhance their product offerings and stay ahead of the competition. Innovation in areas such as artificial intelligence, machine learning, behavioral analytics, and biometric authentication is becoming increasingly important to combat evolving fraud tactics effectively. Additionally, strategic partnerships and collaborations are playing a crucial role in the market landscape, enabling companies to leverage each other's strengths and capabilities to deliver comprehensive solutions to customers.

The regulatory environment in the Asia-Pacific region is also shaping the fraud detection transaction monitoring market, with stringent data protection laws and compliance requirements driving organizations to enhance their fraud prevention measures. Companies are focusing on ensuring regulatory compliance while also improving customer experience by implementing seamless and secure transaction monitoring processes. Furthermore, the growing awareness among businesses about the financial and reputational risks associated with fraud underscores the importance of investing in robust fraud detection solutions.

Looking ahead, the market is expected to witness continued growth as organizations across industries prioritize fraud prevention as a critical component of their risk management strategies. The ongoing digital transformation initiatives in the region are further fueling the demand for advanced fraud detection and transaction monitoring solutions. Market players that can offer scalable, agile, and innovative solutions tailored to the unique needs of different industries are likely to gain a competitive edge in the Asia-Pacific market.

In conclusion, the Asia-Pacific fraud detection transaction monitoring market presents lucrative opportunities for market players to capitalize on the growing demand for advanced fraud prevention solutions. With organizations increasingly prioritizing cybersecurity and risk management, the market is poised for significant expansion in the coming years, driven by technological advancements, regulatory developments, and evolving fraud landscape dynamics.The Asia-Pacific fraud detection and transaction monitoring market is a dynamic and rapidly evolving landscape with significant growth potential in the coming years. The increasing sophistication of fraudulent activities and cyber threats in industries such as banking, financial services, e-commerce, healthcare, and government is driving the demand for advanced solutions to combat fraud effectively. Market players such as IBM, FICO, Oracle, and SAS Institute are playing a pivotal role in offering innovative technologies and services to address the growing needs of organizations in the region.

One of the key drivers of market expansion is the rising adoption of digital technologies, which have exposed businesses to higher risks of fraudulent activities. As organizations strive to protect their operations and customer data, there is a growing emphasis on investing in robust fraud detection and prevention solutions. Market players are investing heavily in research and development to enhance their offerings, with a focus on areas such as artificial intelligence, machine learning, behavioral analytics, and biometric authentication to stay ahead of the competition.

Strategic partnerships and collaborations are becoming increasingly important in the Asia-Pacific market, enabling companies to leverage each other's strengths and capabilities to deliver comprehensive fraud detection solutions to customers. The regulatory environment in the region is also shaping the market landscape, with stringent data protection laws driving organizations to enhance their fraud prevention measures while ensuring regulatory compliance and improving customer experience.

As organizations across industries prioritize fraud prevention as a critical component of their risk management strategies, the demand for scalable, agile, and innovative fraud detection solutions is expected to continue to rise. The ongoing digital transformation initiatives in the Asia-Pacific region are further fueling the need for advanced technologies to monitor transactions and detect anomalies in real-time. Market players that can offer tailored solutions to meet the specific needs of different industries are likely to succeed in this competitive market environment.

In conclusion, the Asia-Pacific fraud detection transaction monitoring market offers lucrative opportunities for market players to capitalize on the increasing demand for advanced fraud prevention solutions. With a focus on technological advancements, regulatory compliance, and addressing evolving fraud tactics effectively, the market is set for significant growth in the coming years. Market players that can differentiate themselves through innovation, strategic partnerships, and a deep understanding of industry-specific challenges are well-positioned to succeed in this dynamic market.

The Asia-Pacific Fraud Detection Transaction Monitoring Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/asia-pacific-fraud-detection-transaction-monitoring-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

How Asia-Pacific Fraud Detection Transaction Monitoring Market Report Would Be Beneficial?

- Anyone who are directly or indirectly connected in value chain of Asia-Pacific Fraud Detection Transaction Monitoring Market industry and needs to have Know-How of market trends

- Marketers and agencies doing their due diligence

- Analysts and vendors looking for Asia-Pacific Fraud Detection Transaction Monitoring Market intelligence about Asia-Pacific Fraud Detection Transaction Monitoring Market Industry

- Competition who would like to correlate and benchmark themselves with market position and standings in current scenario

Browse More Reports:

U.S. Dunnage Packaging Market

Global Medical Sensors Market

Global Head-up Display Market

Global Automotive OE Tyres and Wheels Market

Global Antiaging Products and Services Market

North America Persistent Corneal Epithelial Defects Treatment Market

North America Aerospace Adhesive - Sealants Market

Asia-Pacific Obsessive-Compulsive Disorder (OCD) Drugs Market

Global Magnetite Nanoparticles Market

Global Night Vision System Market

Global Solid Phase Extraction Market

Global Arch Liner Market

Global Terrestrial Laser Scanning Market

Belgium, Netherlands and Luxembourg Karyotyping Market

Europe Agricultural Pheromones Market

Global Virtualization Security Market

Global Fluoropolymer Films Market

Global Food Texture Market

Global Airborne Satellite Communications (SATCOM) Market

Global Shoe Care Market

Global Drone Package Delivery Market

Global Silicone Oil Market

Global Robotic Surgery for Cervical Cancer Market

North America Superhydrophobic Coating Market

Global Lambert-Eaton Myasthenic Syndrome (LEMS) Treatment Market

Global All-Terrain Vehicle Market

Global Diols and Polyhydric Alcohols Market

Global Traffic Monitoring Market

Global Cashmere Clothing Market

Global Acetaminophen (Paracetamol) Market

Global Sewing Machines Market

Asia-Pacific Spunbond Market

Global Cook Processors Market

Middle East and Africa Obsessive-Compulsive Disorder (OCD) Drugs Market

Global Graphite Coatings Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness