Usage-Based Insurance Market Insights 2025 - 2032 | Challenges and Opportunities with Top Countries Data

Executive Summary Usage-Based Insurance Market :

Executive Summary Usage-Based Insurance Market :

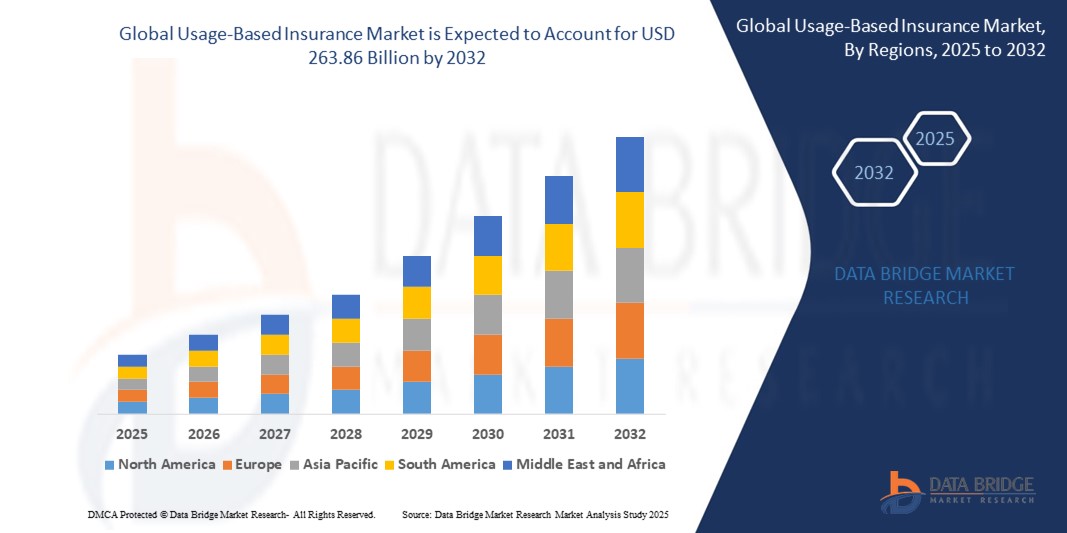

The global usage-based insurance market size was valued at USD 39.83 billion in 2024 and is expected to reach USD 263.86 billion by 2032, at a CAGR of 26.66% during the forecast period

The whole Usage-Based Insurance Market document can be divided into four major areas which include market definition, market segmentation, competitive analysis and research methodology. Important industry trends, market size, market share estimates are analysed and mentioned in the report. This Market report helps the firm in exploring new uses and new markets for its existing products and thereby, increasing the demand for its products. The market report offers an in-depth overview of product specification, technology, product type and production analysis considering major factors such as revenue, cost, and gross margin. The winning Usage-Based Insurance Market report is comprehensive and opens a door of international market for the products.

An all-inclusive Usage-Based Insurance Market study consists of a market attractiveness analysis, wherein each segment is benchmarked based on its market size, growth rate, and general attractiveness. The report is based on the market type, organization size, availability on-premises and the end-users’ organization type, and the availability in areas such as North America, South America, Europe, Asia-Pacific and Middle East & Africa. The info covered helps businesses know how patents, licensing agreements and other legal restrictions affect the manufacture and sale of the firm’s products. An influential Usage-Based Insurance Market report reveals the nature of demand for the firm’s product to know if the demand for the product is constant or seasonal.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Usage-Based Insurance Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-usage-based-insurance-market

Usage-Based Insurance Market Overview

**Segments**

- **By Package Type**: Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), Manage-How-You-Drive (MHYD)

- **By Device**: On-Board Diagnostics (OBD-II), Smartphone, Embedded System, Black-Box

- **By Vehicle Type**: Passenger Vehicle, Commercial Vehicle

- **By Region**: North America, Europe, Asia-Pacific, South America, Middle East and Africa

The global usage-based insurance market is segmented based on package type, device, vehicle type, and region. The package type segment includes Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), and Manage-How-You-Drive (MHYD). Based on the device, the market is categorized into On-Board Diagnostics (OBD-II), Smartphone, Embedded System, and Black-Box. Furthermore, the segmentation by vehicle type covers passenger vehicles and commercial vehicles. Geographically, the market is divided into regions such as North America, Europe, Asia-Pacific, South America, and the Middle East and Africa.

**Market Players**

- **Progressive Casualty Insurance Company**

- **Allstate Insurance Company**

- **Vodafone**

- **Allianz**

- **AXA**

- **Liberty Mutual Insurance Company**

- **Desjardins Insurance**

- **Metromile**

- **Nationwide**

- **Safer, Simpler, Secure (S3)**

- **TomTom Telematics**

- **UnipolSai Assicurazioni S.p.A.**

- **Zurich**

- **Mapfre**

- **Generali Group**

Key market players in the global usage-based insurance market include Progressive Casualty Insurance Company, Allstate Insurance Company, Vodafone, Allianz, AXA, Liberty Mutual Insurance Company, Desjardins Insurance, Metromile, Nationwide, Safer, Simpler, Secure (S3), TomTom Telematics, UnipolSai Assicurazioni S.p.A., Zurich, Mapfre, and Generali Group. These companies are actively participating in the market, offering innovative products and services to cater to the growing demand for usage-based insurance solutions.

The global usage-based insurance market is witnessing significant growth due to several factors driving the adoption of usage-based insurance solutions. One key trend shaping the market is the increasing demand for personalized insurance offerings. Consumers are looking for insurance policies that are tailored to their individual driving behavior, leading to the rise in popularity of usage-based insurance packages such as Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), and Manage-How-You-Drive (MHYD). These packages allow insurers to offer more customized coverage options based on real-time data collected from devices like On-Board Diagnostics (OBD-II), smartphones, embedded systems, and black boxes installed in vehicles.

Moreover, the market is also benefiting from the growing focus on road safety and risk management. Usage-based insurance not only incentivizes safer driving practices but also helps reduce insurance premiums for policyholders with good driving behavior. This incentivization model encourages drivers to adopt safer habits, leading to a decrease in road accidents and associated costs for insurance companies. As a result, insurance providers are increasingly leveraging telematics technology and big data analytics to assess driving patterns, detect potential risks, and price policies more accurately based on individual behavior.

In terms of geographical segmentation, North America and Europe are currently the leading markets for usage-based insurance due to the high penetration of advanced telematics systems and regulatory support for usage-based insurance programs. However, the Asia-Pacific region is expected to witness rapid growth in the coming years, driven by increasing awareness about the benefits of usage-based insurance, rising disposable incomes, and the expanding automotive industry. South America and the Middle East and Africa regions are also presenting lucrative opportunities for market players as they strive to address the evolving insurance needs of consumers in these regions.

Furthermore, market players in the global usage-based insurance market are focusing on strategic collaborations, partnerships, and product innovations to gain a competitive edge. Companies like Progressive Casualty Insurance Company, Allstate Insurance Company, Vodafone, and Allianz are investing heavily in technology and data analytics to enhance their UBI offerings and provide better value to customers. With the increasing adoption of connected cars and IoT devices, the market is poised for further growth, offering opportunities for insurers to differentiate themselves through personalized and data-driven insurance solutions.The global usage-based insurance market has been experiencing significant growth, primarily driven by various factors that are shaping the industry landscape. One of the key trends influencing the market is the rising demand for personalized insurance offerings. Consumers are increasingly seeking insurance policies that are tailored to their specific driving behaviors, leading to the surge in popularity of usage-based insurance packages such as PAYD, PHYD, and MHYD. These packages enable insurers to provide more customized coverage options based on real-time data collected from devices like OBD-II, smartphones, embedded systems, and black boxes installed in vehicles. This shift towards personalized insurance solutions is reshaping the traditional insurance model and providing more value to customers through tailored coverage options.

Additionally, the increasing focus on road safety and risk management is playing a crucial role in driving the adoption of usage-based insurance solutions. By incentivizing safer driving practices and offering lower insurance premiums for policyholders with good driving behavior, usage-based insurance fosters a culture of safe driving habits among consumers. This approach not only benefits policyholders by reducing their insurance costs but also helps insurance companies mitigate risks associated with road accidents. The utilization of telematics technology and big data analytics allows insurers to assess driving patterns, identify potential risks, and price policies more accurately based on individual behavior, thereby promoting safer roads and reducing overall insurance costs.

Geographically, while North America and Europe currently dominate the global usage-based insurance market, the Asia-Pacific region is poised for substantial growth in the upcoming years. Factors such as increasing awareness about the advantages of usage-based insurance, rising disposable incomes, and the expanding automotive industry are driving the growth of this market in the Asia-Pacific region. Furthermore, South America and the Middle East and Africa regions present significant opportunities for market players to tap into as they address the evolving insurance needs of consumers in these regions. The market players are focusing on strategic collaborations, partnerships, and continuous product innovations to stay competitive in the evolving landscape of usage-based insurance. Investments in technology and data analytics by companies like Progressive Casualty Insurance Company, Allstate Insurance Company, Vodafone, and Allianz are instrumental in enhancing UBI offerings and delivering enhanced value to customers. With the advent of connected cars and IoT devices, the market is poised for further expansion, offering insurers the chance to differentiate themselves through personalized and data-driven insurance solutions tailored to individual driving behaviors.

The Usage-Based Insurance Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-usage-based-insurance-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Key Questions Answered in This Report: –

- How has this Usage-Based Insurance Marketperformed so far and how will it perform in the coming years?

- Which are the key product types available in this Usage-Based Insurance Market?

- Which are the major application areas in theUsage-Based Insurance Market?

- What are the key distribution channels in the global Usage-Based Insurance Market?

- What are the key regions in this Usage-Based Insurance Market?

- What are the price trends?

- What are the various stages in the value chain of this industry?

- What are the key driving factors and challenges in the market?

Browse More Reports:

Europe Emollient Esters Market

Global Diesel Engine Catalyst Market

Global Continuously Variable Transmission Market

Global Digital Audio Workstation (DAWs) Market

North America Tank Insulation Market

Global Cosmetovigilance Market

Europe Laboratory Information Systems (LIS) Market

Global Abrasive Waterjet Cutting Machine Market

Global Prebiotic Ingredients Market

Global Business Travel Market

Global Baking Oven Market

Global Gastrointestinal Stromal Tumor Market

Global Blow Molding Resins Market

North America Orthopedic Surgical Robots Market

Middle East and Africa Polyethylene Glycol Market

Global Cellulose Esters and Ethers Market

Middle East and Africa Automotive Sensors Market

Global Female Sterilization Devices Market

Global Volleyball Knee Pad Market

Global Paget’s Disease Treatment Market

Global Radar Transmitter Market

Global Modified Starch Market

Middle East and Africa Reed Sensors Market

Global Razor Market

Global Laboratory Information Systems (LIS) Market

Global Inter-Integrated Circuit (I2C) Bus Market

Canada Refrigerated Warehousing Market

Global Food Pathogen Testing Market

North America Medical Display Market

Global Heart Valve Disease Treatment Market

Global Anesthesia Monitoring Market

Global Arthroscopic Shavers Market

Middle East and Africa Tunable Laser Market

Global Antivirus Gateways Security Market

Europe Isopropyl Alcohol Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness