Middle East and Africa Digital Payment Market Key Drivers | Challenges, Opportunities, and Forecast 2025 - 2032

Executive Summary Middle East and Africa Digital Payment Market :

Executive Summary Middle East and Africa Digital Payment Market :

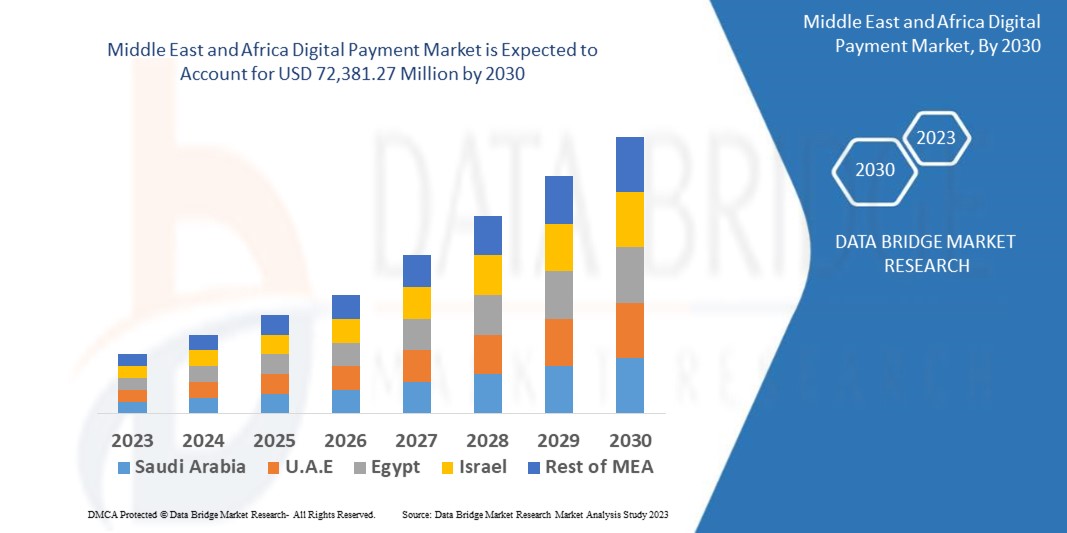

Data Bridge Market Research analyses that the digital payment market is expected to reach USD 72,381.27 million by 2030, which is USD 19,652.35 million in 2022, at a CAGR of 17.70% during the forecast period

The data within the Middle East and Africa Digital Payment Market report is showcased in a statistical format to offer a better understanding upon the dynamics. The market report also computes the market size and revenue generated from the sales. What is more, this market report analyses and provides the historic data along with the current performance of the market. Middle East and Africa Digital Payment Market report is a comprehensive background analysis of the industry, which includes an assessment of the parental market. The Middle East and Africa Digital Payment Market is supposed to demonstrate a considerable growth during the forecast period.

The emerging trends along with major drivers, challenges and opportunities in the market are also identified and analysed in this report. Middle East and Africa Digital Payment Market report is a systematic synopsis on the study for market and how it is affecting the industry. This report studies the potential and prospects of the market in the present and the future from various points of views. SWOT analysis and Porter's Five Forces Analysis are the two consistently and promisingly used tools for generating this report. Middle East and Africa Digital Payment Market report is prepared using data sourced from in-house databases, secondary and primary research performed by a team of industry experts.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Middle East and Africa Digital Payment Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/middle-east-and-africa-digital-payment-market

Middle East and Africa Digital Payment Market Overview

**Segments**

- By Component: The Middle East and Africa digital payment market can be segmented based on components such as solutions and services. The solutions segment includes payment processing, payment gateway, payment wallet, and others. Services segment includes professional services and managed services.

- By Deployment Type: The market for digital payments in the Middle East and Africa can be categorized on the basis of deployment type into on-premises and cloud. The cloud segment is further expected to witness significant growth due to its scalability and cost-efficiency.

- By Organization Size: Based on the organization size, the market can be divided into small and medium-sized enterprises (SMEs) and large enterprises. SMEs are likely to adopt digital payment solutions to streamline their financial operations and improve customer experience.

- By End-User: The digital payment market in the Middle East and Africa can also be segmented by end-user, which includes retail, banking, financial services, and insurance (BFSI), healthcare, IT and telecommunications, and others. The retail sector is expected to dominate the market share due to the rapid adoption of e-commerce and mobile payment solutions in the region.

**Market Players**

- Mastercard

- Visa Inc.

- PayU

- PayPal

- Fiserv, Inc.

- ACI Worldwide

- PayFort International

- Network International

- Ingenico Group

- Interswitch Group

These aforementioned market players are leading the digital payment market in the Middle East and Africa region. They are actively involved in strategic partnerships, mergers, acquisitions, and product innovations to strengthen their market presence and expand their customer base.

The Middle East and Africa digital payment market is poised for significant growth driven by various factors such as increasing smartphone penetration, expanding internet connectivity, and shifting consumer preferences towards cashless transactions. Emerging economies in the region are witnessing a surge in digital payment adoption, fueled by government initiatives to promote financial inclusion and digitalization. As a result, market players are focusing on offering innovative solutions tailored to the unique needs of the Middle East and Africa markets.

One of the key trends shaping the digital payment landscape in the Middle East and Africa is the rising demand for contactless payment solutions. With the ongoing COVID-19 pandemic driving the need for hygienic and convenient payment methods, contactless payments have gained traction among consumers and businesses alike. Market players are investing in contactless technology to meet this growing demand and enhance the overall payment experience for users.

Moreover, the increasing popularity of e-commerce platforms and online shopping behaviors are driving the adoption of digital payment solutions in the Middle East and Africa region. Consumers are becoming more comfortable with making online purchases, prompting retailers to provide secure and seamless payment options. As a result, market players are focusing on developing robust e-commerce payment gateways and wallet solutions to cater to the evolving needs of retailers and consumers.

In addition, the regulatory environment in the Middle East and Africa region is evolving to support the growth of digital payments. Governments and regulatory bodies are introducing measures to enhance cybersecurity, data protection, and consumer rights in digital transactions. Market players are collaborating with regulators to ensure compliance with local regulations and standards, thereby building trust among users and fostering the adoption of digital payment solutions.

Furthermore, partnerships and collaborations among market players are driving innovation and competitiveness in the Middle East and Africa digital payment market. Companies are joining forces to leverage each other's strengths, expand their service offerings, and reach a wider customer base. These strategic alliances are expected to accelerate the development of cutting-edge payment solutions and enhance the overall user experience in the region.

Overall, the Middle East and Africa digital payment market presents lucrative opportunities for players across the payment ecosystem. With the continued digitization of economies and the growing preference for convenient and secure payment methods, the market is set to experience sustained growth in the coming years. Market players that can adapt to the evolving market dynamics, capitalize on emerging trends, and meet the needs of diverse end-users are likely to succeed in this rapidly expanding market landscape.The Middle East and Africa digital payment market is witnessing significant growth driven by various factors like increasing smartphone penetration, expanding internet connectivity, and changing consumer preferences towards cashless transactions. The market segmentation based on components, deployment type, organization size, and end-users provides a comprehensive understanding of the diverse factors influencing the market landscape. Solutions such as payment processing, gateway, and wallet, along with services like professional and managed services, cater to different needs of organizations in the region. Additionally, the deployment types of on-premises and cloud offer scalability and cost-efficiency, further promoting the adoption of digital payment solutions in the Middle East and Africa.

In terms of market players, top companies like Mastercard, Visa Inc., and PayPal are driving innovation and competitiveness in the region by focusing on strategic partnerships, acquisitions, and product innovations. These market leaders are actively involved in expanding their customer base and strengthening their market presence to capitalize on the growing demand for digital payment solutions in the Middle East and Africa. The presence of key players like Fiserv, Inc., PayU, and ACI Worldwide also contributes to the competitive landscape of the digital payment market in the region, fostering a dynamic environment for advancements and collaborations.

Key trends such as the rising demand for contactless payment solutions, driven by the COVID-19 pandemic, are shaping the digital payment landscape in the Middle East and Africa. The increasing popularity of e-commerce platforms and online shopping behaviors are driving the adoption of digital payment solutions, prompting market players to focus on secure and seamless payment options for retailers and consumers. Moreover, the evolving regulatory environment in the region is supporting the growth of digital payments by enhancing cybersecurity, data protection, and consumer rights in digital transactions, building trust among users and driving the adoption of digital payment solutions further.

Partnerships and collaborations among market players are fostering innovation and competitiveness in the Middle East and Africa digital payment market. By leveraging each other's strengths and expanding service offerings, companies are accelerating the development of cutting-edge payment solutions and enhancing the overall user experience in the region. Overall, the market presents lucrative opportunities for players across the payment ecosystem to succeed by adapting to evolving market dynamics, capitalizing on emerging trends, and meeting the diverse needs of end-users in the rapidly expanding digital payment landscape of the Middle East and Africa.

The Middle East and Africa Digital Payment Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/middle-east-and-africa-digital-payment-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

The report can answer the following questions:

- Global major manufacturers' operating situation (sales, revenue, growth rate and gross margin) of Middle East and Africa Digital Payment Market

- Global major countries (United States, Canada, Germany, France, UK, Italy, Russia, Spain, China, Japan, Korea, India, Australia, New Zealand, Southeast Asia, Middle East, Africa, Mexico, Brazil, C. America, Chile, Peru, Colombia) market size (sales, revenue and growth rate) of Middle East and Africa Digital Payment Market

- Different types and applications of Middle East and Africa Digital Payment Market share of each type and application by revenue.

- Global of Middle East and Africa Digital Payment Market size (sales, revenue) forecast by regions and countries from 2022 to 2028 of Middle East and Africa Digital Payment Market

- Upstream raw materials and manufacturing equipment, industry chain analysis of Middle East and Africa Digital Payment Market

- SWOT analysis of Middle East and Africa Digital Payment Market

- New Project Investment Feasibility Analysis of Middle East and Africa Digital Payment Market

Browse More Reports:

Global Weighing and Inspection Market

Global Cardiac Ablation System Market

Middle East and Africa Smart Lighting Market

North America Health Screening Market

Global Quad Flat Package (QFP) Microcontroller Socket Market

Global Hot Flashes Treatment Market

Global DIP Microcontroller Socket Market

Global Process Oil Market

Europe Gene Therapy Market

Global Thermoelectric Materials Market

Global Underactive Bladder Market

Global Contact and Convective Dryers Market

Europe Healthcare 3D Printing Market

Middle East and Africa Butyric Acid Market

Global Bio Surgical Agents Market

Global Alcohol Free Spirits Market

Europe Food Pathogen Testing Market

Middle East and Africa Automated Material Handling Market

Global Electro-Medical Devices in Alzheimer’s Treatment Market

Asia-Pacific Medical Device Testing Market

North America Passenger Information System Market

Asia-Pacific Call Center Platforms Market

North America Commercial Seaweed Market

Global Lateral Flow Assay Market

Global Ear and Nasal Packing Market

Global Meat Snacks Market

Asia-Pacific Orthobiologics Market

Global Spunbond Market

Europe Orthobiologics Market

Global Polyethylene Glycol Market

Global Anti-Viral Coatings Market

Global Laryngitis Market

Global Surface Vision and Inspection Market

Global Automotive Throttle Cables Market

ASEAN Video Measuring System Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness