Cloud Computing Insuretech Market Demand: Growth, Share, Value, Size, and Insights By 2034

Executive Summary Cloud Computing Insuretech Market :

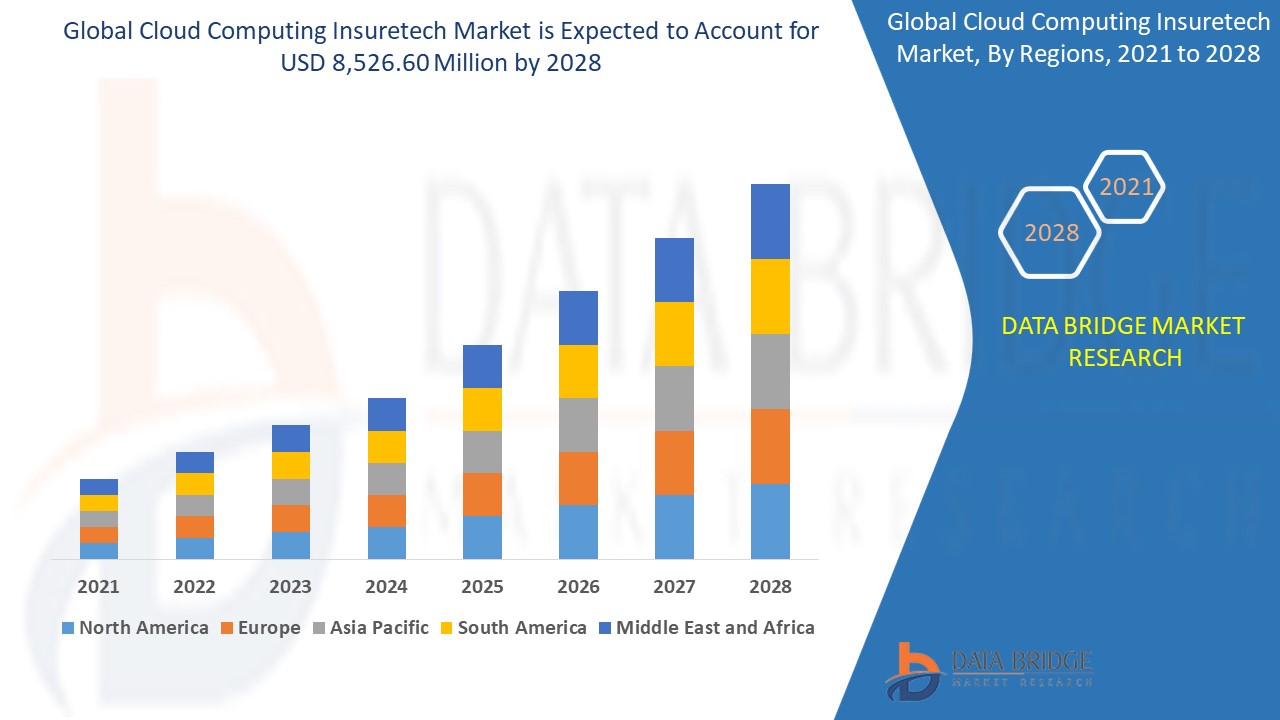

CAGR Value: Cloud computing insuretech market is expected to reach USD 8,526.60 million by 2028 witnessing market growth at a rate of 10.50% in the forecast period of 2021 to 2028.

Myriad of scopes are carefully evaluated through this Cloud Computing Insuretech Market report which range from estimation of potential market for new product, identifying consumer’s reaction for particular product, figuring out general market tendencies, knowing the types of customers, recognizing dimension of marketing problem and more. The report encompasses key players along with their share (by volume) in key regions such as APAC, EMEA, and Americas and the challenges faced by them. The use of established statistical tools and coherent models for analysis and forecasting of market data makes this Cloud Computing Insuretech Market report outshining.

Market drivers and market restraints estimated in this Cloud Computing Insuretech Market business report gives understanding about how the product is getting utilized in the recent period and also gives estimations about the future usage. This report has a lot of features to offer about industry such as general market conditions, trends, inclinations, key players, opportunities, and geographical analysis. This market research report has been framed with the most excellent and superior tools of collecting, recording, estimating and analysing market data. The forecast, analysis and estimations that are carried out in this Cloud Computing Insuretech Market report are all based upon the finest and well established tools and techniques such as SWOT analysis and Porter’s Five Forces analysis.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Cloud Computing Insuretech Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-cloud-computing-insuretech-market

Cloud Computing Insuretech Market Overview

**Segments**

- **By Component**: The global cloud computing insuretech market can be segmented by component into solutions and services. Cloud insuretech solutions include platforms for policy management, claims management, billing, and others. Cloud insuretech services consist of consulting, implementation, and support services.

- **By End-User**: The market can also be segmented by end-user into insurance companies, third-party administrators, brokers, and agents. Each of these segments has unique requirements and challenges that can be addressed using cloud computing technologies in the insuretech sector.

- **By Deployment Model**: Another crucial segmentation is based on the deployment model, including public cloud, private cloud, and hybrid cloud. Different insurance organizations may opt for different deployment models based on their data security, scalability, and compliance needs.

**Market Players**

- **IBM Corporation**: IBM offers cloud technologies tailored for the insurance industry, providing solutions such as IBM Cloud for Financial Services and IBM Insurance Platform.

- **Microsoft Corporation**: Microsoft Azure is a popular choice for cloud computing in the insuretech sector, offering a wide range of secure and compliant services for insurance companies.

- **Google LLC**: Google Cloud Platform caters to insurance-specific requirements, enabling companies to leverage AI and machine learning capabilities for better risk assessment and customer engagement.

- **Oracle Corporation**: Oracle provides cloud solutions for insurers to streamline operations, enhance customer experience, and enable predictive analytics for better decision-making.

- **Amazon Web Services, Inc.**: AWS offers a comprehensive suite of cloud services for insuretech applications, including data storage, processing, and security features.

The global cloud computing insuretech market is witnessing significant growth due to the increasing adoption of digital technologies in the insurance sector. Insurers are leveraging cloud computing to improve operational efficiency, enhance customer experience, and drive innovation in product development and distribution. With the rise of Insuretech startups disrupting the traditional insurance industry, established players are turning to cloud solutions to stay competitive and meet evolving customer demands. The market is expected to continue expanding as insurance companies invest in cloud technologies to stay ahead in a rapidly changing landscape.

The global cloud computing Insuretech market is experiencing a paradigm shift as traditional insurance practices are being revolutionized by technology. One emerging trend is the integration of blockchain technology in Insuretech solutions to enhance security and transparency in insurance transactions. Blockchain offers immutable and decentralized ledger capabilities that can streamline claims processing, policy management, and reduce fraudulent activities in the insurance industry. As insurers strive to enhance trust and data integrity, blockchain-based solutions are gaining traction in the market, offering a novel approach to modernizing insurance operations.

Moreover, the convergence of cloud computing and Internet of Things (IoT) is reshaping the Insuretech landscape. IoT devices such as connected cars, smart homes, and wearables are generating vast amounts of data that can be leveraged by insurers for personalized risk assessment, dynamic pricing, and proactive risk prevention. By harnessing the power of cloud computing to analyze and derive insights from IoT data, insurance companies can offer tailored policies, optimize underwriting processes, and create new revenue streams through value-added services. This trend signifies the transformative potential of IoT-enabled cloud solutions in driving innovation and competitiveness in the Insuretech market.

Another key development in the market is the growing emphasis on data analytics and artificial intelligence (AI) to drive business intelligence and predictive modeling in the insurance sector. Cloud computing platforms equipped with advanced analytics tools enable insurers to gain deep insights into customer behavior, market trends, and risk profiles, empowering them to make data-driven decisions and optimize operational performance. By harnessing AI algorithms for fraud detection, claims processing, and customer segmentation, insurance companies can enhance operational efficiency, mitigate risks, and deliver superior customer experiences. The integration of AI-powered analytics in cloud-based Insuretech solutions is poised to revolutionize how insurers assess risks, price policies, and personalize services in the digital age.

Furthermore, the proliferation of digital channels and omnichannel distribution strategies is reshaping the way insurers engage with customers and distribute insurance products. Cloud computing enables seamless integration of multiple channels, such as mobile apps, websites, and social media platforms, to provide convenient access to insurance services and enhance customer interactions. Insurers leveraging cloud-based Insuretech solutions can deliver personalized offers, real-time assistance, and automated claims processing through diverse digital touchpoints, enhancing customer satisfaction and loyalty. The shift towards omnichannel experiences supported by cloud technologies reflects the industry's commitment to enhancing customer engagement, fostering long-term relationships, and streamlining insurance operations in a connected world.

In conclusion, the global cloud computing Insuretech market is undergoing rapid transformation driven by technological advancements, shifting consumer preferences, and regulatory changes. As insurers embrace cloud solutions to optimize processes, mitigate risks, and deliver innovative products and services, the market is poised for sustained growth and innovation. By capitalizing on emerging trends such as blockchain integration, IoT connectivity, AI-powered analytics, and omnichannel distribution, insurance companies can unlock new opportunities for growth, differentiation, and value creation in the increasingly competitive Insuretech landscape. The convergence of cloud computing and Insuretech is reshaping the future of insurance, ushering in a new era of digital transformation, agility, and customer-centricity.The global cloud computing Insuretech market is currently experiencing a significant evolution, driven by the convergence of advanced technologies and changing market dynamics. One notable trend shaping the market is the increasing integration of blockchain technology in Insuretech solutions. Blockchain's ability to enhance security, transparency, and efficiency in insurance transactions is attracting a growing number of insurers looking to streamline processes and combat fraud. By leveraging blockchain capabilities, such as immutable and decentralized ledgers, insurance companies can revolutionize their operations, particularly in claims processing and policy management.

Furthermore, the intersection of cloud computing with the Internet of Things (IoT) is playing a crucial role in reshaping the Insuretech landscape. IoT devices like connected cars, smart homes, and wearables are generating vast amounts of data that can be harnessed by insurers for personalized risk assessment, dynamic pricing, and proactive risk prevention. The utilization of cloud computing to analyze and derive valuable insights from IoT data enables insurance companies to offer tailored policies, optimize underwriting processes, and introduce new revenue streams through value-added services. This trend underscores the transformative potential of IoT-enabled cloud solutions in driving innovation and competitiveness in the Insuretech sector.

Additionally, the increasing emphasis on data analytics and artificial intelligence (AI) is revolutionizing business intelligence and predictive modeling in the insurance industry. Cloud computing platforms integrated with advanced analytics tools empower insurers to gain deep insights into customer behavior, market trends, and risk profiles, enabling data-driven decision-making and operational optimization. By incorporating AI algorithms for fraud detection, claims processing, and customer segmentation, insurance providers can enhance operational efficiency, mitigate risks, and deliver superior customer experiences. The fusion of AI-powered analytics with cloud-based Insuretech solutions holds the promise of reshaping how insurers evaluate risks, price policies, and personalize services in the digital era.

Moreover, the proliferation of digital channels and omnichannel distribution strategies is redefining customer engagement and insurance product distribution. Cloud computing facilitates seamless integration of multiple channels, such as mobile apps, websites, and social media platforms, to offer convenient access to insurance services and enhance customer interactions. Insurers leveraging cloud-based Insuretech solutions can deliver personalized offers, real-time support, and streamlined claims processing through diverse digital touchpoints, enhancing customer satisfaction and loyalty. The shift towards omnichannel experiences supported by cloud technologies reflects the industry's commitment to elevating customer engagement, fostering enduring relationships, and streamlining insurance operations in an interconnected world.

In conclusion, the global cloud computing Insuretech market is undergoing a profound transformation fueled by technological innovation, evolving consumer preferences, and regulatory shifts. As insurance companies embrace cloud solutions to optimize processes, manage risks, and introduce innovative products and services, the market is poised for continuous growth and advancement. By capitalizing on emerging trends such as blockchain integration, IoT connectivity, AI-driven analytics, and omnichannel distribution, insurers can unlock new avenues for expansion, differentiation, and value creation in the increasingly competitive Insuretech landscape. The fusion of cloud computing and Insuretech is reshaping the future of insurance, ushering in a new era of digital transformation, agility, and customer-centricity.

The Cloud Computing Insuretech Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-cloud-computing-insuretech-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Core Objective of Cloud Computing Insuretech Market:

Every firm in the Cloud Computing Insuretech Market has objectives but this market research report focus on the crucial objectives, so you can analysis about competition, future market, new products, and informative data that can raise your sales volume exponentially.Size of the Cloud Computing Insuretech Market and growth rate factors.

- Important changes in the future Cloud Computing Insuretech Market.

- Top worldwide competitors of the Cloud Computing Insuretech Market.

- Scope and product outlook of Cloud Computing Insuretech Market.

- Developing regions with potential growth in the future.

- Tough Challenges and risk faced in Cloud Computing Insuretech Market.

Global Cloud Computing Insuretech Market top manufacturers profile and sales statistics.

Browse More Reports:

Global Dental Implants and Prosthetics Market

China Surgical Visualization Products Market

Asia-Pacific Hyper-Converged Infrastructure Market

Global Beau's Lines Treatment Market

Global Inflammatory Disease Drug Delivery Market

Chile Menopause Drugs Market

Global Terahertz and Infrared Spectroscopy Market

Asia-Pacific Photogrammetry Software Market

Global Lice Treatment Market

North America Vanilla (B4C) Market

Global Bladder Cancer Therapeutics Market

Global Soybean Oil-Based Lubricant Market

Asia-Pacific Organo Mineral Fertilizers Market

Global Solid State Drive (SSD) Controller Market

Global Thiram Pesticides Market

Global DevOps Market

Global Human African Trypanosomiasis (Sleeping Sickness) Market

Global Marine Incinerators Market

Global Safety Switch Market

Global Managed Security Services Market

Global Perlite Market

Global Pet Sitting Market

North America Protein Hydrolysates for Animal Feed Application Market

Global miRNA Sequencing and Assay Market

Europe Gift Card Market

Asia-Pacific Urology Laser Market

Global Livestock Grow Lights Market

Global Blepharospasm Treatment Market

Global Cheese Processing Equipment Market

Global Ingestible Sensor Market

Global Signaling Devices Market

Global Corn Meal Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness