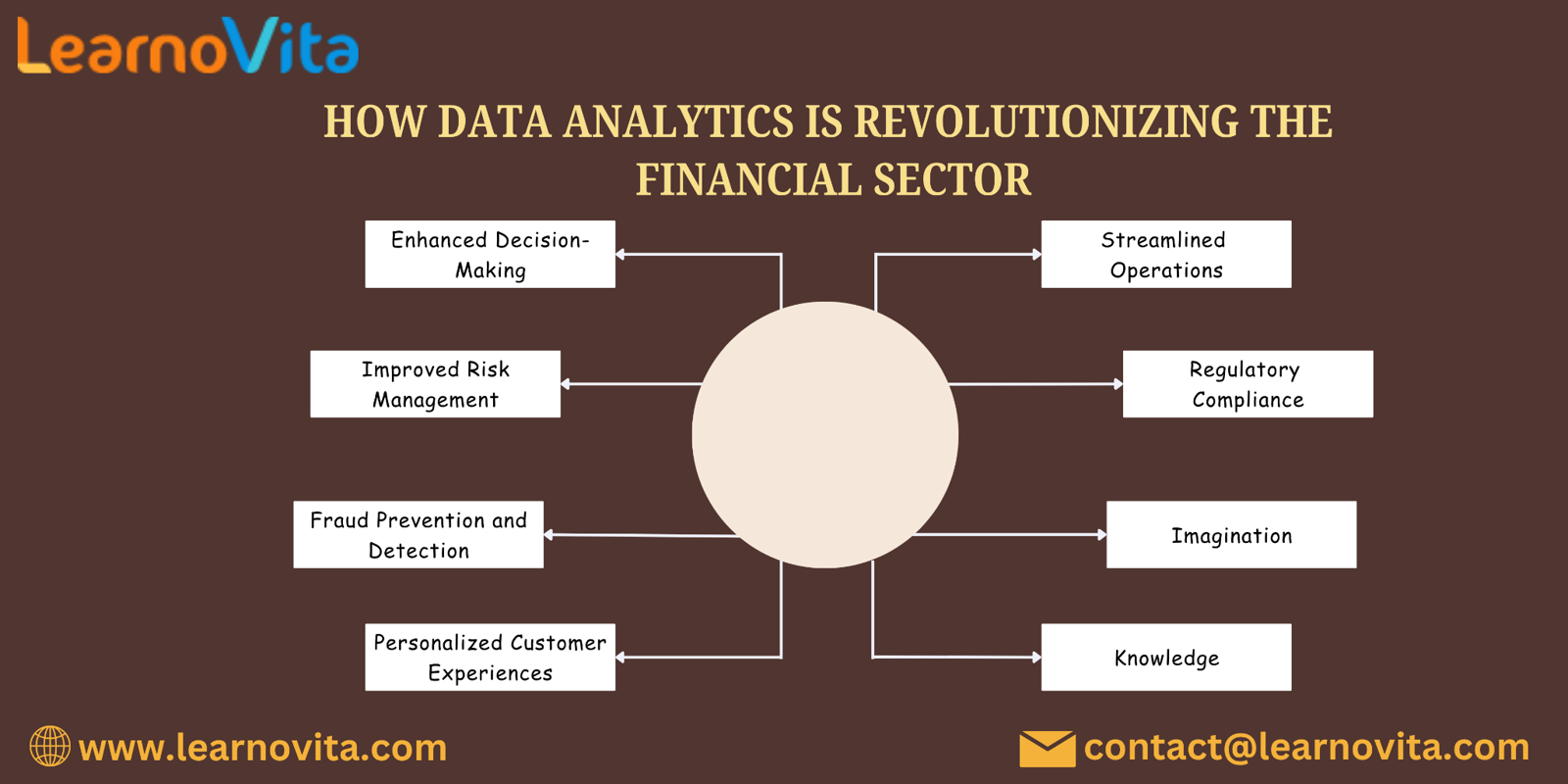

How Data Analytics is Revolutionizing the Financial Sector

In today's fast-paced financial landscape, data analytics has emerged as a transformative force, reshaping how institutions operate, make decisions, and serve their customers. With the exponential growth of data, financial organizations are leveraging advanced analytics to gain insights that drive innovation and efficiency. Here's a closer look at how data analytics is revolutionizing the financial sector.

For those looking to enhance their skills, Data Analytics Course in Bangalore programs offer comprehensive education and job placement assistance, making it easier to master this tool and advance your career.

1. Enhanced Decision-Making

Data analytics empowers financial professionals to make informed decisions based on real-time data insights. By analyzing historical trends and current market conditions, institutions can formulate strategies that are not only reactive but also proactive. This data-driven approach minimizes guesswork, leading to more accurate forecasts and better investment choices.

2. Improved Risk Management

Risk is an inherent part of finance, but data analytics helps mitigate potential threats. Financial institutions use predictive analytics to assess risks associated with investments, lending, and market volatility. By identifying patterns and anomalies, organizations can anticipate adverse events and implement measures to protect their assets.

3. Fraud Prevention and Detection

Fraud remains a significant concern in the financial sector. Data analytics plays a critical role in combating fraud by identifying suspicious activities and transaction anomalies. Advanced algorithms can analyze vast datasets to flag potential fraud in real time, allowing institutions to act swiftly and reduce financial losses.

4. Personalized Customer Experiences

Understanding customer behavior is essential for delivering tailored financial products and services. Data analytics enables organizations to gather insights into customer preferences, spending habits, and financial needs. By leveraging this information, financial institutions can offer personalized solutions, enhancing customer satisfaction and loyalty.

5. Streamlined Operations

Operational efficiency is vital for success in finance. Data analytics helps organizations streamline processes by identifying inefficiencies and bottlenecks. By automating routine tasks and improving workflow management, institutions can reduce costs and enhance productivity, ultimately benefiting both the organization and its clients.

With the aid of Data Analytics Certification Course programs, which offer comprehensive training and job placement support to anyone looking to develop their talents, it’s easier to learn this tool and advance your career.

6. Regulatory Compliance

Compliance with regulatory requirements is a top priority for financial institutions. Data analytics facilitates efficient tracking and reporting of compliance-related data. By automating compliance processes and ensuring data accuracy, organizations can minimize the risk of penalties and maintain regulatory standards.

7. Competitive Advantage

In a highly competitive financial environment, staying ahead requires innovation. Data analytics provides insights into market trends, competitor strategies, and customer sentiment. Financial institutions that leverage these insights can develop strategies that position them favorably in the marketplace, allowing them to capitalize on emerging opportunities.

8. Portfolio Optimization

Data analytics is pivotal in portfolio management. Financial analysts utilize various analytical tools to evaluate asset performance, market conditions, and economic indicators. By applying data-driven strategies, institutions can optimize their portfolios, maximizing returns while managing risks effectively.

Conclusion

The integration of data analytics in the financial sector is not merely a trend; it is a fundamental shift that is reshaping the industry. As financial institutions continue to harness the power of data, they are better equipped to navigate challenges, seize opportunities, and deliver exceptional value to their customers. In this data-driven era, those who embrace analytics will undoubtedly lead the way in financial innovation and success.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness