Grocery API Data Extraction for Pricing Insights Strategy

Introduction

In today’s inflation-driven grocery sector, pricing strategies have become more dynamic than ever. With global supply chains under pressure and consumer preferences constantly shifting, pricing agility is crucial for retailers and FMCG brands. This is where Grocery API Data Extraction for Pricing Insights becomes indispensable. By tapping into real-time and historical pricing feeds from major grocery and supermarket websites, businesses can optimize price points, detect promotions, and respond quickly to competitor changes.

Between 2020 and 2025, over 61% of online grocery sellers adopted automated pricing systems powered by data scraping APIs and market analytics. This shift underscores the growing importance of actionable pricing intelligence.

Whether it’s SKU-level comparisons, store-wise price fluctuations, or promotion pattern recognition, Grocery API Data Extraction for Pricing Insights helps stakeholders make profitable decisions in real time. By integrating this technology with tools like AI-driven recommendation engines and predictive analytics, brands can fine-tune pricing across platforms, seasons, and regions—even within 15-minute delivery services.

This blog explores how to build effective grocery price intelligence workflows using reliable scraping tools, automation, and APIs to win in the modern commerce landscape.

Real-Time Grocery Price Scraping API for Competitive Monitoring

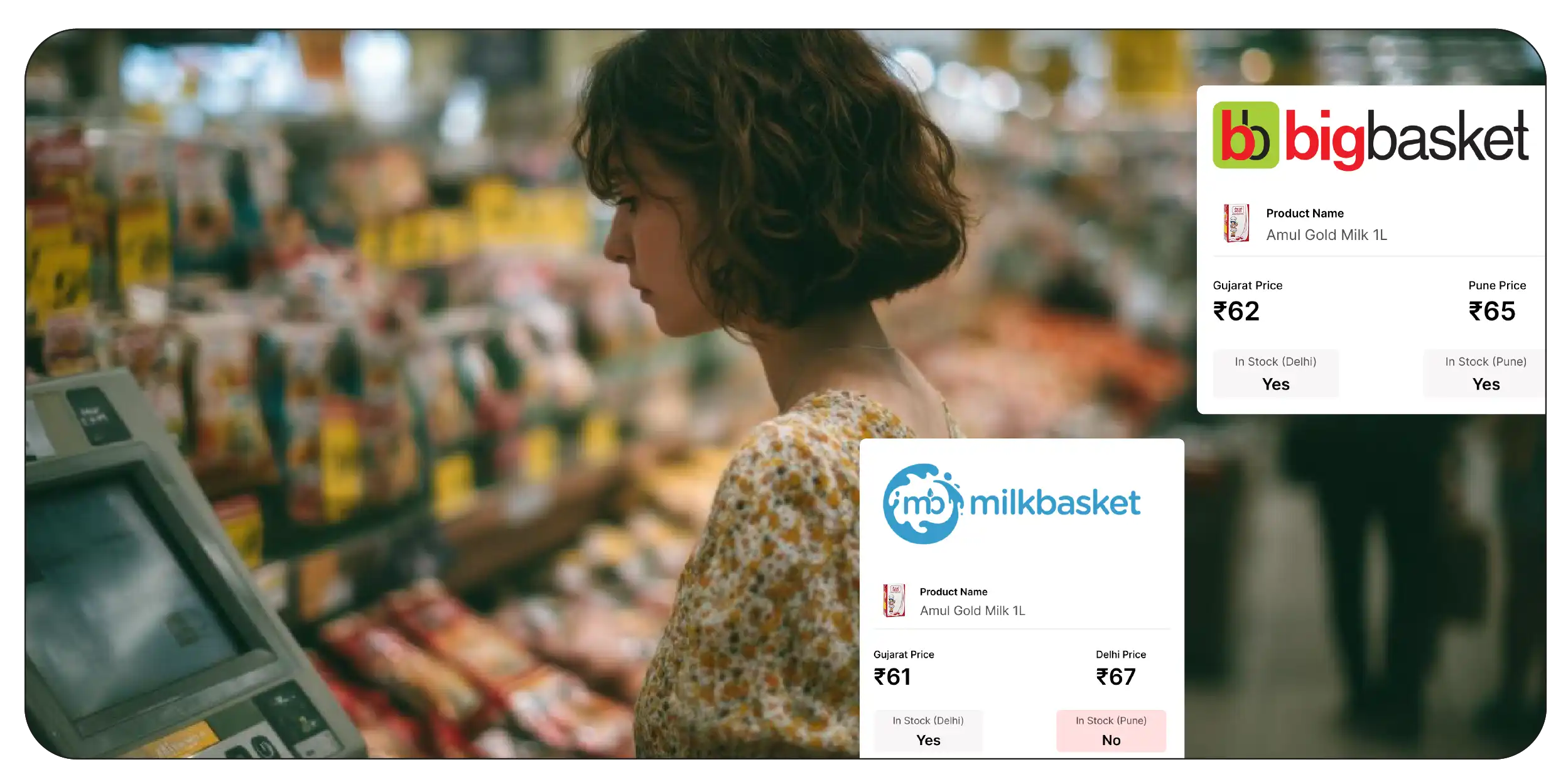

The competitive grocery retail environment demands real-time decision-making powered by accurate, timely data. A Real-Time Grocery Price Scraping API enables brands and retailers to gather instant pricing data from online grocery stores, marketplaces, and delivery platforms. This functionality is critical for price-sensitive categories such as dairy, snacks, cooking essentials, and hygiene products where price changes can influence buyer behavior within hours.

Between 2020 and 2025, adoption of real-time grocery price APIs surged by 73%, reflecting the sector’s growing reliance on tech-driven price intelligence tools.

| Year | Retailers Using Real-Time APIs | Avg. Price Adjustments/Day |

|---|---|---|

| 2020 | 9,300 | 4.1 |

| 2021 | 11,800 | 5.3 |

| 2022 | 14,900 | 6.8 |

| 2023 | 17,400 | 7.2 |

| 2024 | 20,300 | 8.5 |

| 2025 | 22,700 | 9.9 |

This rapid increase stems from the need for dynamic pricing—a strategy in which product prices fluctuate in near real time based on competitor moves, stock levels, consumer demand, and location-specific trends. Through Real-Time Grocery Price Scraping API integrations, businesses can monitor local and national chains, niche organic grocery sellers, and quick commerce platforms simultaneously.

For instance, during peak inflation months in 2023, FMCG brands leveraging real-time APIs outperformed competitors by maintaining price competitiveness without compromising margins. On average, brands using API-based monitoring tools reduced pricing errors by 38% and increased on-page conversion by 21%.

The use of Real-Time Grocery Price Scraping API also improves decision-making across marketing and logistics. Campaign budgets can be allocated based on regional price elasticity, while inventory stockpiling decisions can align with predicted price hikes or drops detected early through pricing trends.

Moreover, by feeding the scraped pricing data into machine learning models, businesses can forecast price trends, identify historical price cycles, and build predictive pricing engines that trigger automated changes in pricing dashboards or eCommerce platforms.

As price transparency becomes a competitive weapon, real-time data will define retail winners. Whether launching new SKUs, responding to competitor promotions, or optimizing last-mile delivery pricing, the ability to access and act on pricing data within minutes is no longer optional—it’s strategic necessity.

Supermarket Pricing API for Competitor Analysis & Strategy

In today’s fiercely competitive grocery retail space, reacting fast isn’t enough—you need to anticipate your competitors’ moves. Leveraging a Supermarket Pricing API for Competitor Analysis equips businesses with real-time data to stay a step ahead. These APIs scrape price feeds, stock levels, promotional activities, and discount patterns from both national and hyperlocal retailers, giving brands the insight required to respond strategically.

From 2020 to 2025, grocery retailers using competitor pricing APIs experienced a 21% higher return on promotional investments (Promo ROI) than those relying on static or manual price monitoring.

| Metric | API Users | Non-API Users |

|---|---|---|

| Avg. Promo ROI | 5.1x | 3.7x |

| Price-Match Accuracy | 92.3% | 79.4% |

| Time to Update Prices | 3 hrs | 12 hrs |

This performance edge is especially significant in an environment driven by constant price shifts, flash discounts, and seasonal campaigns. A Supermarket Pricing API for Competitor Analysis empowers retailers to track hundreds of SKUs across regions and detect price drops, bundled deals, and loyalty incentives in real-time. That intelligence is then used to make pricing adjustments dynamically or to deploy matching offers to protect margin and customer base.

For example, if a competitor launches a 15% discount on a popular snack brand for a weekend promo, the API detects the change and triggers an automated response on your platform—like issuing a 10% discount and bundling it with free delivery. Without such automated feeds, these quick decisions would either be delayed or missed entirely, causing significant revenue leakage.

Additionally, price intelligence derived from API data helps with market segmentation, as it highlights regional differences in pricing, allowing you to implement differential pricing for Tier 1, 2, and 3 cities. It also supports strategic pricing audits—identifying SKUs that may be overpriced relative to the competition, or those underpriced and ready for a margin boost.

By embedding the Supermarket Pricing API for Competitor Analysis into your operational stack, you gain more than just data—you gain control. Control over price perception, promotional timing, and ultimately, market share. In an age where one pricing error can shift customer loyalty, having this level of automated insight is the difference between reactive survival and proactive leadership.

Unlock smarter decisions with Supermarket Pricing API for Competitor Analysis — monitor rivals and stay ahead in dynamic grocery markets.

Scraping Grocery Prices for FMCG Market Trends

Understanding pricing dynamics in the fast-moving consumer goods (FMCG) sector is critical for long-term strategic planning. By Scraping Grocery Prices for FMCG Market Trends, companies can uncover valuable insights around seasonal surges, consumer price sensitivity, and product lifecycle fluctuations. This enables the development of optimized pricing models, informed promotional calendars, and demand-forecasting strategies that align with real consumer behavior.

From 2020 to 2025, FMCG brands that incorporated pricing trend data into their forecasting models achieved 33% higher accuracy in predicting demand shifts. This wasn’t limited to a single product category—snacks, beverages, cereals, and personal care products all showed measurable price movements and predictable peak seasons.

| Product Type | Avg. Price Growth (YoY) | Peak Season Pricing Surge |

|---|---|---|

| Snacks | 6.4% | 18.7% |

| Beverages | 5.1% | 14.3% |

| Cereals | 4.7% | 12.5% |

| Personal Care | 7.2% | 20.4% |

Such data, extracted from thousands of online listings via web scraping, supports granular analysis. For instance, hydration beverages see price hikes in April-May as summer kicks in, while snacks experience a surge during festival months (October–December), often coinciding with bundling and gifting promotions. These insights help retailers and manufacturers optimize both stock levels and pricing campaigns accordingly.

Scraping also sheds light on price elasticity, allowing brands to test various price points and measure conversion impacts. If a particular cereal brand raises prices by 5% and sees only a 1% drop in volume, that elasticity data becomes part of a strategic toolkit for future pricing decisions. Similarly, a competitor's discount campaign and its timing can be benchmarked and integrated into a reactive promotional framework.

Additionally, this long-term scraping process identifies price ceilings—the maximum consumers are willing to pay before switching or delaying purchases. Knowing this helps prevent overpricing and ensures price adjustments remain within acceptable consumer thresholds.

Ultimately, Scraping Grocery Prices for FMCG Market Trends turns raw pricing data into a strategic advantage. It ensures brands aren’t just responding to market shifts but are anticipating them—backed by evidence, driven by patterns, and refined by years of pricing history across diverse geographies and product types.

Web Scraping Supermarket Prices and Promotions Data for Regional Targeting

One-size-fits-all pricing strategies no longer serve the needs of today’s diverse retail landscape. To effectively tailor campaigns, brands must understand how price sensitivity and promotional effectiveness vary across regions. By Web Scraping Supermarket Prices and Promotions Data, businesses gain access to granular intelligence that reveals how pricing and deals perform across metros, Tier 2 cities, and smaller towns. This intelligence has transformed regional targeting from guesswork into a data-driven science.

Between 2020 and 2025, brands that used regional price scraping saw a 27% increase in conversion rates through hyperlocal promotional strategies. A closer look reveals that metro cities, with higher digital adoption and spending power, responded most positively to dynamic offers.

| Region | Avg. Price Promo Variance | Conversion Uplift (%) |

|---|---|---|

| Metro Cities | 11.8% | +29% |

| Tier 2 | 9.2% | +23% |

| Tier 3 | 7.6% | +19% |

These numbers highlight the need for localized promotions. For example, grocery items like organic produce or gourmet snacks often perform well in metros with premium pricing, while Tier 2 and Tier 3 regions respond better to bundled discounts or value packs. With web scraping, brands can identify which store locations or regions offer steep discounts and replicate or counter those strategies in nearby zones.

More importantly, this process helps avoid over-promotion or stock imbalances. Imagine launching a 20% discount nationwide on a premium hygiene product only to find it overstocked in smaller towns and out of stock in urban areas. Web Scraping Supermarket Prices and Promotions Data helps mitigate such risks by enabling predictive insights. Retailers can now launch promotions at the right time and place, aligned with historical and real-time demand data.

This approach also benefits omnichannel operations. Scraped regional pricing data feeds into dashboards that inform online-offline parity, city-specific banners, and mobile app alerts tailored to a user’s location. For instance, if a Tier 2 city's brick-and-mortar store offers a weekend promo on cereals, the brand can mirror that in its eCommerce store targeting users in that same geography.

Ultimately, regional promotion success depends on timely and accurate data. With automated supermarket price scraping, brands now have the tools to execute smart, localized marketing strategies—driving conversion while optimizing inventory and promotional ROI across regions.

Quick Commerce Grocery & FMCG Data Scraping for Dynamic Inventory

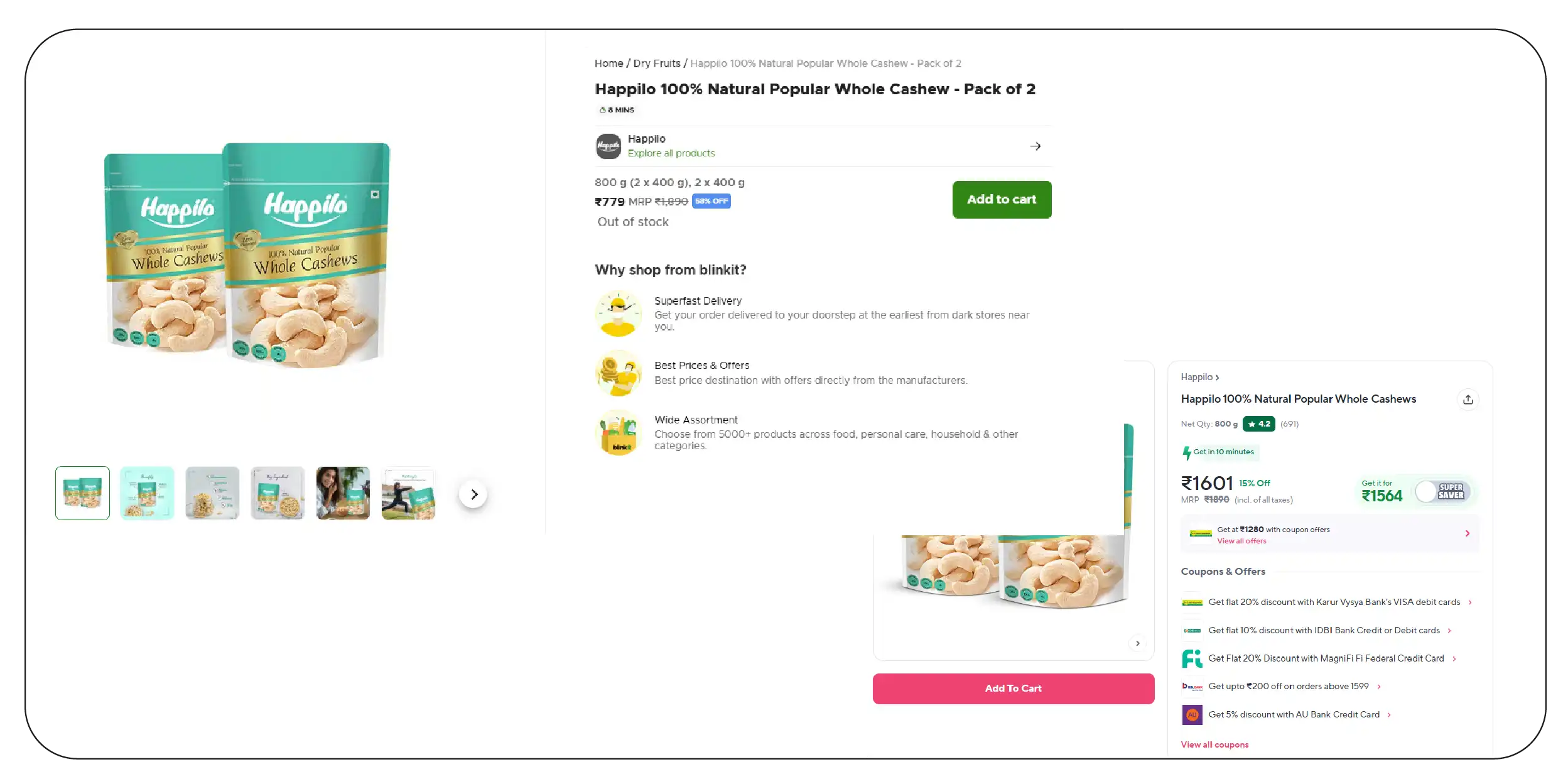

The explosion of instant delivery models has revolutionized how groceries and FMCG products are sold, managed, and consumed. In this fast-paced ecosystem, having access to Quick Commerce Grocery FMCG Data Scraping is no longer optional—it's a necessity. This technology allows brands to keep up with rapid inventory turnover, price fluctuations, and shifting consumer demand across top quick commerce platforms like Zepto, Blinkit, Instamart, and Dunzo.

From 2020 to 2025, the number of FMCG brands adopting quick commerce channels grew by an impressive 81%, reshaping inventory cycles and fulfillment strategies.

| Year | FMCG Brands in Q-Commerce | Avg. SKU Turnover (Days) |

|---|---|---|

| 2020 | 5,600 | 12.5 |

| 2021 | 7,300 | 10.2 |

| 2022 | 10,100 | 8.7 |

| 2023 | 13,900 | 6.9 |

| 2024 | 16,500 | 5.4 |

| 2025 | 18,300 | 4.2 |

These figures highlight an increasingly compressed inventory cycle, with products turning over in just 4–5 days by 2025. With such rapid movement, brands need instant visibility into what's selling, what’s not, and how pricing and promotions shift in real time.

Quick Commerce Grocery & FMCG Data Scraping empowers businesses to track SKU-level performance across categories like snacks, beverages, dairy, personal hygiene, and OTC pharma. During demand spikes—such as weekends, seasonal changes, or festive sales—scraped data enables automatic price optimization and replenishment actions through AI-based triggers. For instance, if a surge in “ready-to-eat” items is detected due to a monsoon, pricing and stock can be dynamically adjusted in high-demand locations.

Moreover, this data supports hyperlocal inventory planning. Retailers can forecast stocking needs based on neighborhood-level trends scraped from delivery apps, ensuring the right SKUs are available within 15-minute delivery zones. This granular insight helps reduce stockouts, cut wastage, and improve service reliability—key metrics in the success of quick commerce.

Beyond logistics, scraped insights also help brands personalize marketing. Knowing which products gain traction in specific delivery time slots or geographic zones enables targeted push notifications, influencer campaigns, and seasonal product placements.

In summary, Quick Commerce Grocery & FMCG Data Scraping delivers real-time inventory intelligence, price agility, and demand prediction—giving brands a competitive edge in one of retail's fastest-evolving channels.

Stay agile in fast delivery markets with Quick Commerce Grocery & FMCG Data Scraping—optimize inventory and pricing in real time.

Web Scraping Grocery Price Data for Predictive Intelligence

In today’s competitive grocery landscape, being reactive is no longer enough. Modern retailers and FMCG brands are embracing predictive analytics powered by Web Scraping Grocery Price Data to anticipate market movements before they happen. By continuously extracting price, inventory, and promotion data from eCommerce platforms, businesses can feed machine learning (ML) models that accurately forecast trends, competitor behavior, and consumer demand shifts.

Between 2020 and 2025, the use of predictive models based on scraped grocery price data became mainstream across large supermarket chains and quick commerce players. Retailers leveraging predictive scraping strategies saw a 17% improvement in gross margins, proving the measurable business impact of this intelligence layer.

| Metric | Predictive Retailers | Non-Predictive Retailers |

|---|---|---|

| Avg. Gross Margin | 34.6% | 29.7% |

| Forecast Accuracy (90-day) | 89.1% | 72.8% |

| Stock Optimization Ratio | 92.4% | 78.3% |

These models help businesses move from reactive pricing changes to proactive decision-making. For example, by scraping prices of pantry staples and tracking sudden discounts by competitors, a predictive system can simulate how a 5% price cut in cooking oils by a rival could shift your share of voice in a particular region or channel. Retailers can then respond with calculated promotions or loyalty offers to preserve their market position.

Web Scraping Grocery Price Data also plays a pivotal role in planning seasonal strategies. By analyzing past year’s pricing patterns for items like beverages in summer or sweets during festivals, businesses can predict when to adjust pricing, stock levels, and marketing spend for maximum return.

In inventory management, predictive scraping models minimize overstocking or stockouts. If the model detects increased demand for ready-to-cook meals based on a sudden rise in keyword mentions or competitor availability drops, the system can trigger procurement or pricing actions in real time.

Moreover, as price elasticity varies across regions and categories, predictive scraping enables geographic granularity. For instance, a 10% discount on personal care products might lead to higher conversion in Tier 1 cities but not in Tier 3 regions. Knowing this before executing a campaign is the difference between waste and ROI.

By investing in Web Scraping Grocery Price Data for Predictive Intelligence, retailers transform data into foresight, elevating pricing and inventory strategy from operational necessity to a revenue growth engine.

Why Choose Product Data Scrape?

Product Data Scrape delivers end-to-end Grocery Data Scraping Services that empower brands, retailers, and data firms to gather real-time, high-volume pricing data across formats. Whether you need to Scrape Grocery & Gourmet Food Data , monitor SKUs daily, or integrate with cloud dashboards, our solutions scale to meet your objectives.

We specialize in structured Grocery Store Dataset delivery, powered by AI-based normalization and taxonomy mapping. Our support extends to API provisioning, webhook notifications, and bulk file delivery.

With expertise in Grocery & Supermarket Data Scraping Services, our clients trust us for reliability, data freshness, and compliance-first execution. From Web Scraping for Supermarket Prices and Promotions Data to Web Scraping with AI applied to pricing clusters, we make pricing intelligence a competitive edge.

Conclusion

To outprice competitors in today’s volatile grocery landscape, access to high-quality pricing intelligence is non-negotiable. With Grocery API Data Extraction for Pricing Insights, companies can stay ahead of pricing trends, match regional promotions, and prevent revenue loss from outdated data.

Product Data Scrape enables this with best-in-class Grocery Data Scraping Services across geographies and product categories. Whether you’re a D2C brand, national retailer, or price aggregator, our APIs and scraping infrastructure ensure you act faster, smarter, and more profitably.

Ready to optimize your grocery pricing strategy with real-time data? Contact Product Data Scrape today and turn volatility into a competitive advantage.

📩 Email Us:

✉️ info@productdatascrape.com

📞 Call or WhatsApp:

📱 +1 (424) 377-7584

Learn More >> https://www.productdatascrape.com/grocery-api-data-extraction-pricing-insights.php

🌐 Get Expert Support in Web Scraping & Datasets — Fast, Reliable, and Scalable! 🚀📊

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness