Europe Usage-Based Insurance Market Opportunities | Future Growth, Demand, and Challenges 2025 - 2032

Key Drivers Impacting Executive Summary Europe Usage-Based Insurance Market Size and Share

Key Drivers Impacting Executive Summary Europe Usage-Based Insurance Market Size and Share

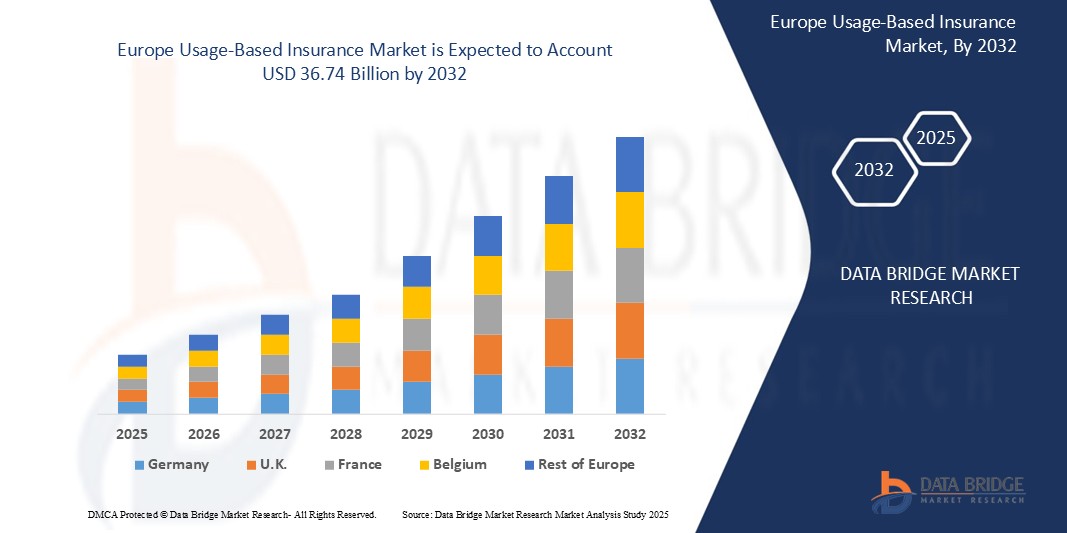

The Europe Usage-Based Insurance Market size was valued at USD 10.01 billion in 2024 and is expected to reach USD 36.74 billion by 2032, at a CAGR of 17.65% during the forecast period

Business intelligence has been employed here to create Europe Usage-Based Insurance Market report which is a vital aspect when it comes to accomplish thorough and wide-ranging market insights. Many businesses have started adopting a market research report solution. This market research report endows clients with the supreme level of market data which exactly suits to the niche and business requirements. The business report has been prepared specifically by keeping in mind business needs of all sizes. An excellent Europe Usage-Based Insurance Market report is a definitive solution for sound decision making and superior management of goods and services.

The company profiles of all the top market players and brands are listed in Europe Usage-Based Insurance Market report which puts light on their moves like product launches, product enhancements, joint ventures, mergers and acquisitions and their effect on the sales, import, export, revenue and s. This credible report includes key information about the industry, market segmentation, important facts and figures, expert opinions, and the latest developments across the globe. According to this market report, the global market is anticipated to witness a moderately higher growth rate during the forecast period. Moreover, businesses can accomplish insights for profitable growth and sustainability programme with Europe Usage-Based Insurance Market report.

Understand market developments, risks, and growth potential in our Europe Usage-Based Insurance Market study. Get the full report:

https://www.databridgemarketresearch.com/reports/europe-usage-based-insurance-market

Europe Usage-Based Insurance Industry Trends

**Segments**

- **By Package Type**

- **Pay-As-You-Drive (PAYD)**

- **Pay-How-You-Drive (PHYD)**

- **Manage-How-You-Drive (MHYD)**

- **By Device**

- **On-Board Diagnostics (OBD)**

- **Smartphones**

- **Hybrid**

- **Black-Box**

- **Embedded**

- **By Vehicle Age**

- **New Vehicles**

- **On-Road Vehicles**

- **By Vehicle Type**

- **Passenger Vehicle**

- **Commercial Vehicle**

Usage-based insurance (UBI) in Europe is segmented based on various factors which include Package Type, Device, Vehicle Age, and Vehicle Type. The Package Type segmentation comprises Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), and Manage-How-You-Drive (MHYD). Further, the Device segment includes On-Board Diagnostics (OBD), Smartphones, Hybrid, Black-Box, and Embedded. The Vehicle Age segment differentiates between New Vehicles and On-Road Vehicles. Lastly, the Vehicle Type category is divided into Passenger Vehicle and Commercial Vehicle, showcasing the diverse nature of the UBI market in Europe.

**Market Players**

- **Allianz**

- **AXA**

- **Progressive Casualty Insurance Company**

- **Aviva**

- **Generali Group**

- **Insure The Box Limited**

- **Allstate Insurance Company**

- **Desjardins**

- **Oxbotica**

- **Metromile**

- **Track24**

- **Liberty Mutual Insurance**

Prominent market players are actively participating in the , with companies like Allianz, AXA, Progressive Casualty Insurance Company, Aviva, Generali Group, Insure The Box Limited, Allstate Insurance Company, Desjardins, Oxbotica, Metromile, Track24, and Liberty Mutual Insurance leading the way. These companies are leveraging advanced technologies and strategic partnerships to enhance their UBI offerings and gain a competitive edge in the dynamic European market landscape.

The Europe Usage-Based Insurance market is witnessing significant growth driven by technological advancements, changing consumer behaviors, and the increasing focus on personalized insurance solutions. One of the key trends shaping the market is the growing adoption of telematics devices for tracking and monitoring driver behavior. Telematics devices, such as OBD systems, smartphones, and embedded solutions, enable insurers to collect real-time data on driving habits, mileage, and other relevant parameters to offer personalized insurance plans. This data-driven approach allows insurers to assess risks more accurately, customize premiums based on individual driving patterns, and promote safer driving practices among policyholders.

Moreover, the market is experiencing a shift towards more data-centric insurance models, fueled by the rising availability of connected vehicles and IoT technologies. By utilizing advanced analytics and AI, insurance companies can extract valuable insights from the vast amounts of data generated by telematics devices. This enables them to offer proactive risk management solutions, optimize claims processing, and develop innovative pricing strategies tailored to individual policyholders. As a result, insurers can enhance customer engagement, improve retention rates, and drive operational efficiencies in the UBI sector.

Furthermore, the segmentation of the Europe Usage-Based Insurance market based on Package Type, Device, Vehicle Age, and Vehicle Type offers a comprehensive understanding of the diverse needs and preferences of both individual and commercial customers. For instance, the PAYD, PHYD, and MHYD packages cater to different driving behaviors and usage patterns, allowing insurers to offer flexible coverage options that align with the specific requirements of policyholders. Similarly, the availability of various device options, such as OBD, smartphones, and black-box solutions, provides customers with a range of choices for monitoring their driving performance and receiving feedback on their behavior.

In addition, the market players in the Europe Usage-Based Insurance sector are actively investing in research and development initiatives to innovate their product offerings and enhance customer experiences. Companies like Allianz, AXA, and Progressive Casualty Insurance Company are collaborating with technology providers and automotive manufacturers to integrate telematics solutions into their insurance products, creating seamless and value-added services for policyholders. This strategic approach not only differentiates these market players from their competitors but also fosters long-term relationships with customers based on trust, transparency, and innovation.

Overall, the Europe Usage-Based Insurance market presents a promising landscape for insurers to capitalize on the growing demand for personalized insurance solutions and digital transformation. By leveraging emerging technologies, fostering strategic partnerships, and tailoring their offerings to meet evolving customer needs, insurance companies can position themselves as market leaders and drive sustainable growth in the dynamic UBI market.The Europe Usage-Based Insurance market is witnessing a significant transformation driven by technological advancements and changing consumer behaviors. As technological innovations continue to reshape the insurance industry, market players are increasingly focusing on offering personalized insurance solutions to meet the diverse needs of individual and commercial customers. The growing adoption of telematics devices, such as OBD systems, smartphones, and embedded solutions, is enabling insurers to collect real-time data on driving habits and mileage to provide customized insurance plans tailored to specific customer profiles. This trend is not only enhancing risk assessment accuracy but also promoting safer driving practices among policyholders, thereby leading to a reduction in accidents and claims payouts.

Furthermore, the market is experiencing a shift towards data-centric insurance models, propelled by the increasing prevalence of connected vehicles and IoT technologies. Advanced analytics and AI capabilities are being leveraged by insurance companies to derive actionable insights from the vast data streams generated by telematics devices. By utilizing these insights, insurers can proactively manage risks, streamline claims processing, and devise innovative pricing strategies that resonate with individual policyholders. This data-driven approach is empowering insurers to enhance customer engagement, boost customer retention rates, and drive operational efficiencies in the UBI sector, ultimately leading to improved profitability and sustainable growth.

Moreover, the segmentation of the Europe Usage-Based Insurance market based on Package Type, Device, Vehicle Age, and Vehicle Type is enabling insurers to address the unique requirements of different customer segments effectively. The diverse package offerings, such as PAYD, PHYD, and MHYD, cater to varying driving behaviors and usage patterns, allowing insurers to provide flexible coverage options that align with the specific needs of policyholders. Similarly, the availability of multiple device options, including OBD, smartphones, and black-box solutions, empowers customers to choose monitoring solutions that best suit their preferences and driving habits, fostering a higher level of engagement and satisfaction.

In conclusion, the Europe Usage-Based Insurance market presents lucrative opportunities for insurers to innovate, collaborate, and differentiate their offerings in the rapidly evolving insurance landscape. By embracing technological advancements, nurturing strategic partnerships, and embracing a customer-centric approach, market players can establish themselves as industry leaders and drive sustained growth in the dynamic UBI market. The focus on personalized insurance solutions, data-driven decision-making, and customer engagement will be pivotal in positioning insurers for success in a competitive and evolving market environment.

Break down the firm’s market footprint

https://www.databridgemarketresearch.com/reports/europe-usage-based-insurance-market/companies

Europe Usage-Based Insurance Market Reporting Toolkit: Custom Question Bunches

- What is the latest valuation of the Europe Usage-Based Insurance Market?

- What is the CAGR across different segments?

- What are the most lucrative applications in the Europe Usage-Based Insurance Market?

- Who are the key stakeholders across the supply chain?

- What recent developments have changed the Europe Usage-Based Insurance Market structure?

- What countries are critical from a Europe Usage-Based Insurance Market share perspective?

- What is the most rapidly evolving geographic segment?

- Which countries are introducing Europe Usage-Based Insurance Market friendly regulations?

- What regions are currently undervalued?

- What market limitations are being addressed through innovation?

Browse More Reports:

Europe Tunable Laser Market

Global Automated Nucleic Acid Extraction Devices Market

North America Agricultural Pheromones Market

Global Gynecological Drugs Market

Global Elastic Adhesive Market

North America Optical Films Market

Global Social Mapping Management Market

Global Compressor Control System Market

Europe Passenger Information System Market

Global Molybdenum Market

North America Ostomy Drainage Bags Market

Europe Residential Energy Management (REM) Market

Global Optical Measurement Market

Global Automatic Faucets Market

Global Low Voltage Energy Distribution Market

Global Postmenopausal Vaginal Atrophy Treatment Market

Global Freezers Market

North America Low Density Lipoprotein (LDL) Test Market

North America Orthopedic Braces and Supports Market

Global Automotive Ozone Generator Market

Global First Aid Monitoring Kits Market

Global Operating Room Equipment and Supplies Market

Asia-Pacific Fitness Equipment Market

North America Usage Based Insurance Market

Global AC-DC Cable Assembly Market

Global Chemical Detection Technology Market

Asia-Pacific Superhydrophobic Coating Market

Europe Non-Hodgkin Lymphoma Diagnostics Market

Global Urinary Retention Drugs Market

Europe Magnetic Resonance Imaging Devices Market

Global Greenhouse Irrigation System Market

Global Paint Additives Market

Global Intravenous (IV) Infusion Bottle Seals and Caps Market

Global Asbestosis Treatment Market

Global Smart Connected Assets and Operations Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness