Hotel Price Mapping Top Tourist Cities: USA, UK, UAE, India

Introduction

Understanding hotel pricing trends has become a cornerstone of modern travel planning and tourism research. Weekly hotel price analysis reveals how rates fluctuate due to peak travel seasons, promotional discounts, and blackout periods imposed by hotels. Businesses, travel aggregators, and hospitality analysts rely on data-driven insights to optimize offers and identify gaps in market pricing strategies.

The process of Hotel Price Mapping Top Tourist Cities: USA, UK, UAE, India provides essential benchmarks for both travelers and businesses seeking competitive positioning. By comparing average weekly hotel rates across destinations, stakeholders can recognize pricing patterns and tailor promotions to match demand cycles.

To ensure accuracy and comprehensive coverage, Tourist Spot Data Scraping plays a vital role. Automated scraping technologies allow real-time extraction of room rates, promotional codes, and seasonal offer data, which helps stakeholders identify trends and design market-specific strategies.

Furthermore, hotel price mapping in the USA, UK, UAE, and India reveals how regional factors, cultural events, and tourism seasonality influence weekly hotel rates. For instance, while hotel rates in New York rise sharply during Thanksgiving, London sees significant demand surges during Christmas markets. Dubai experiences premium pricing during New Year celebrations, while Goa’s hotel rates spike in December during holiday tourism.

Seasonal Promotions and Blackout Dates

Seasonal promotions are a vital component of the hotel industry. They not only help drive occupancy during off-peak times but also create unique opportunities for travelers seeking value. On the other hand, blackout dates—periods when promotional rates or loyalty redemptions cannot be applied—restrict traveler flexibility, particularly around festivals, sporting events, or local celebrations.

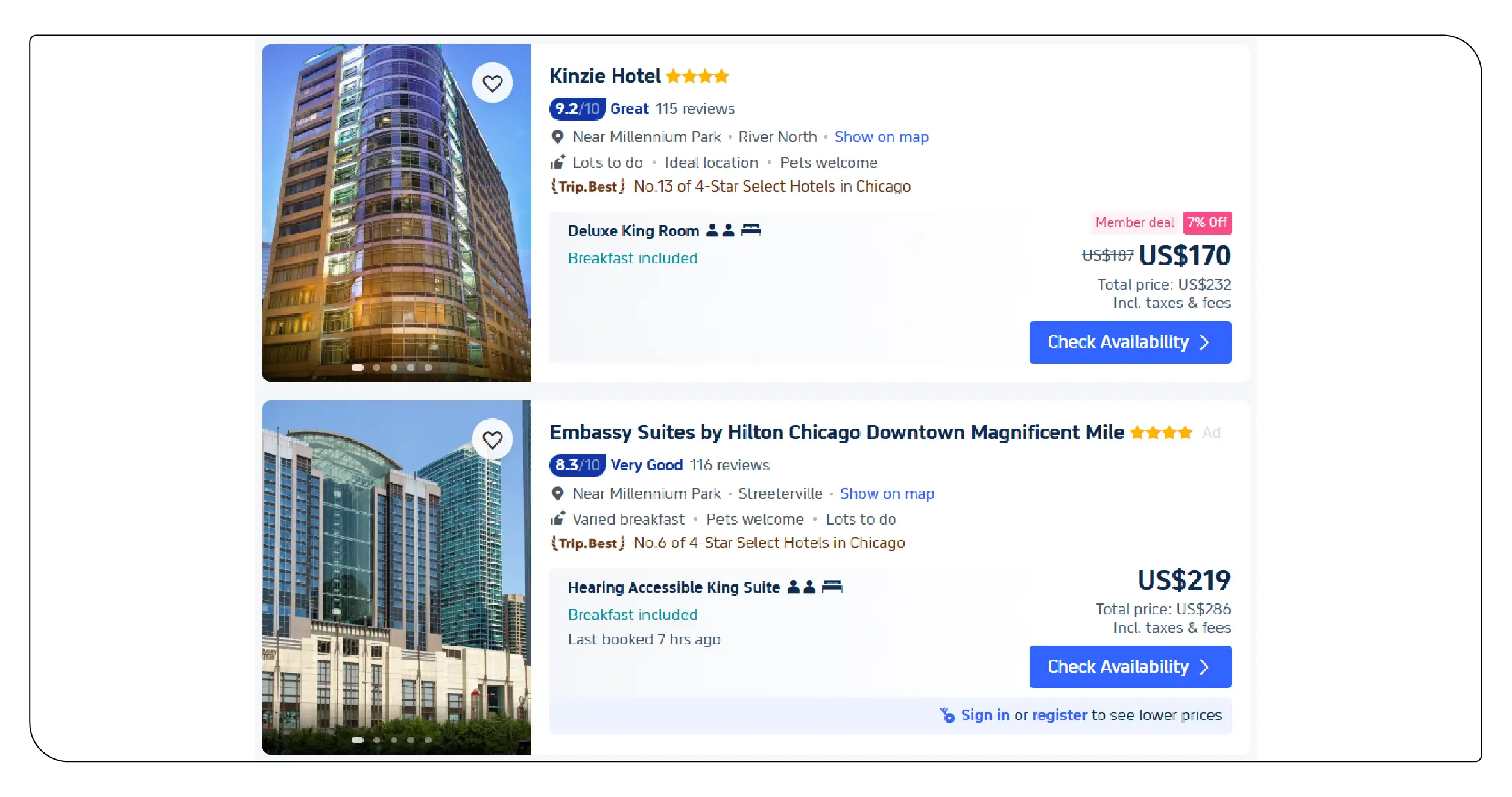

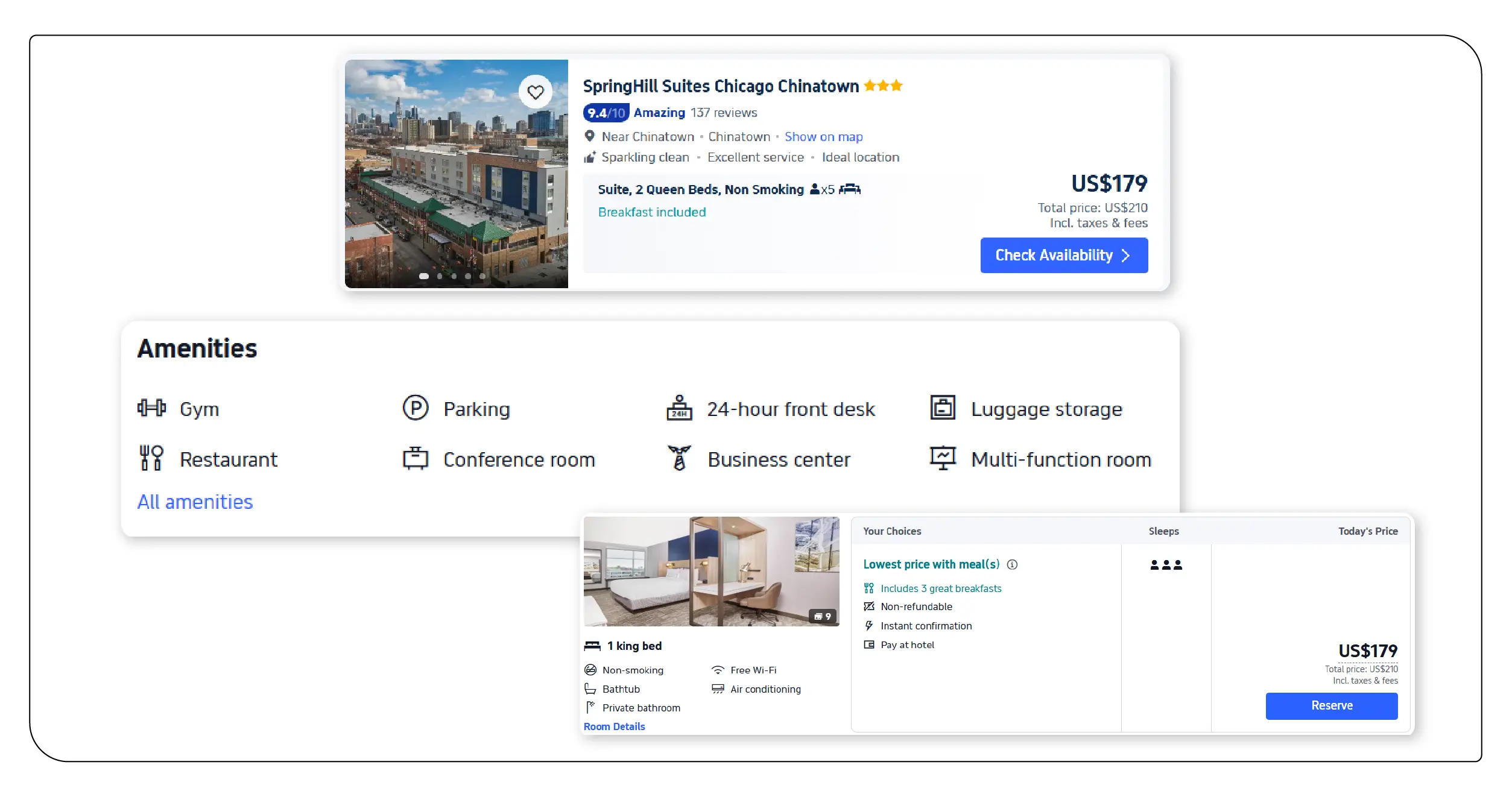

Through Hotel Data Scraping Services , travel aggregators and market analysts can monitor the timing of these promotions and blackout dates with high precision. Identifying patterns allows businesses to anticipate rate hikes and strategize for better consumer engagement.

In addition, hotel booking blackout periods analysis enables the detection of excluded dates across different cities. By comparing how blackout policies differ between regions, hotels and agencies can design loyalty and pricing strategies that are competitive and customer-friendly.

Importance of Weekly Hotel Price Mapping

Weekly hotel price tracking is not just about presenting rates—it helps in price intelligence for hotels in tourist cities. By monitoring fluctuations, travel businesses understand when hotels leverage scarcity pricing, when discounts are applied, and how loyalty rewards intersect with blackout restrictions.

Moreover, travelers benefit from data transparency. Accurate weekly price mapping provides insights into which week to book, where to redeem loyalty rewards, and how to avoid inflated rates during blackout periods.

Comparative Hotel Pricing: USA vs. UK

For the U.S., weekly hotel prices often revolve around national holidays, summer vacation schedules, and business travel seasons. USA hotel rate comparison peak vs off-season shows that cities like New York, Orlando, and Las Vegas experience steep hikes during holidays but offer deep discounts during off-peak weeks.

Meanwhile, in the UK, events such as Wimbledon, Christmas markets, and summer festivals drive hotel demand. By employing Travel Aggregators Data Scraping Services , analysts can better understand seasonal surges in rates, enabling travel firms to optimize offers.

For example, a UK hotel booking scrape for seasonal offers reveals that rates in London drop in January but rise dramatically during June’s sporting events. This knowledge helps aggregators push discounts during low-demand periods while maximizing revenue during peak times.

Hotel Pricing in UAE: Luxury and Dynamic Trends

The UAE stands as a global hub for luxury hospitality. Weekly monitoring highlights unique pricing strategies where luxury properties dominate the market. By focusing on price comparison for luxury hotels in the UAE, data shows consistent demand surges during events such as Expo seasons, Formula 1 races, and New Year celebrations.

The practice of Tracking Dynamic Hotel Prices in UAE reveals that while five-star properties see significant increases, mid-tier hotels rely heavily on promotional discounts to capture market share. Real-time monitoring enables travel companies to balance customer demands with competitive price points.

Hotel Rate Analysis in India’s Tourist Cities

India’s tourism hotspots like Goa, Jaipur, and Agra witness heavy seasonal price variation. Festivals such as Diwali and Christmas drive occupancy, while summer months often see moderate pricing in desert and heritage destinations.

Weekly mapping in India is particularly influenced by domestic tourism. By analyzing through automated systems, travel businesses can optimize offers to domestic travelers while ensuring international tourists are presented with relevant promotions.

Weekly Hotel Price Mapping Tables

Below are sample datasets showcasing predictive weekly hotel pricing in four regions. These tables reflect seasonal promotions and blackout periods, helping analysts identify when hotels employ aggressive pricing strategies.

Table 1: Weekly Hotel Prices in Top Tourist Cities (USD Equivalent)

| Week | New York (USA) | London (UK) | Dubai (UAE) | Goa (India) | Notes |

|---|---|---|---|---|---|

| Jan 1–7 | $320 | $280 | $450 | $120 | Blackout New Year’s week across all markets |

| Jan 8–14 | $210 | $190 | $320 | $95 | Post-holiday promotional rates |

| Feb 1–7 | $290 | $250 | $400 | $140 | Valentine’s week premium in urban cities |

| Mar 15–21 | $260 | $270 | $380 | $110 | Normal seasonal rates |

| Apr 1–7 | $310 | $300 | $410 | $125 | Spring break in USA |

| Jun 20–26 | $400 | $420 | $500 | $160 | Wimbledon in London; summer tourism peak |

| Aug 10–16 | $350 | $310 | $460 | $145 | UAE summer discounts, India Independence week |

| Oct 15–21 | $280 | $260 | $430 | $200 | Diwali in India, mid-season USA/UK |

| Dec 20–26 | $500 | $480 | $700 | $250 | Christmas & New Year blackout dates |

Table 2: Seasonal Promotions and Blackout Dates Across Regions C

| City | Peak Season | Off-Peak Season | Common Promotions | Blackout Dates |

|---|---|---|---|---|

| New York | Thanksgiving, Christmas, Summer | Jan–Feb, late Aug | Early booking discounts, loyalty double points | Thanksgiving week, Dec 20–Jan 2 |

| London | Wimbledon, Christmas Markets, Summer Festivals | Jan–Mar, Sep | Midweek discounts, corporate rates | Dec 24–31, Wimbledon fortnight |

| Dubai | New Year, Winter (Nov–Feb), Expo events | Jul–Sep | Stay 3 nights, pay 2; free breakfast | Dec 25–Jan 5, Expo opening weeks |

| Goa | Christmas, New Year, Carnival, Diwali | Monsoon (Jun–Sep) | Family packages, festival discounts | Dec 20–Jan 2, Diwali week |

| Jaipur | Diwali, Winter tourism | Apr–Sep | Heritage tour add-ons | Diwali week, New Year |

| Orlando | Summer holidays, Spring break | Sep, Jan | Park + hotel bundle deals | Christmas week, Easter |

Data Insights from Weekly Mapping

These tables highlight how hotel pricing in major destinations aligns with cultural and tourism calendars. Hotels maximize occupancy during festivals and holidays by restricting promotions, while in off-peak periods, discounts are offered to maintain room sales.

For example:

- New York prices double during Christmas week due to blackout policies.

- London’s promotions disappear during Wimbledon, when rates soar.

- Dubai luxury hotels leverage exclusivity during New Year’s Eve, while mid-tier hotels compete on promotions.

- Goa offers heavy discounts during monsoon but blocks loyalty redemptions during Christmas week.

Leveraging Technology for Hotel Price Mapping

Hotels and agencies can use advanced scraping tools to enhance visibility into promotions, blackout periods, and competitor pricing. By integrating these insights, businesses can align with consumer demand cycles, ensuring strong revenue management.

Through automated collection, businesses obtain data for:

- Competitive benchmarking.

- Seasonal forecast planning.

- Loyalty program alignment.

- Customer retention through tailored offers.

Conclusion

Weekly hotel pricing insights are indispensable for understanding demand cycles in global tourist hotspots. Mapping data weekly allows businesses to adapt to seasonal surges, promotions, and blackout policies effectively.

The ability to conduct scraping hotel rates in Indian tourist destinations, while integrating global datasets, gives businesses a competitive edge. By embracing Large-Scale Hotel Price Scraping , travel companies can analyze millions of data points to improve revenue management strategies.

Ultimately, weekly hotel price trends in top tourist cities USA, UK, UAE, India provide clarity for both travelers and businesses, ensuring that bookings align with customer expectations and hotel profitability goals.

Ready to elevate your travel business with cutting-edge data insights? Get in touch with Travel Scrape today to explore how our end-to-end data solutions can uncover new revenue streams, enhance your offerings, and strengthen your competitive edge in the travel market.

Source : https://www.travelscrape.com/hotel-price-mapping-top-tourist-cities.php

- #HotelPriceMappingUSAUKUAEIndia

- #hotelbookingblackoutperiodsanalysis

- #priceintelligenceforhotelsintouristcities

- #USAhotelratecomparisonpeakvsoffseason

- #UKhotelbookingscrapeforseasonaloffers

- #pricecomparisonforluxuryhotelsinUAE

- #scrapinghotelratesinIndiantourist

- #weeklyhotelpricetrendsintoptouristcitiesUSAUKUAEIndia

- #TouristSpotDataScraping

- #TrackingDynamicHotelPricesinUAE

- #LargeScaleHotelPriceScraping

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness