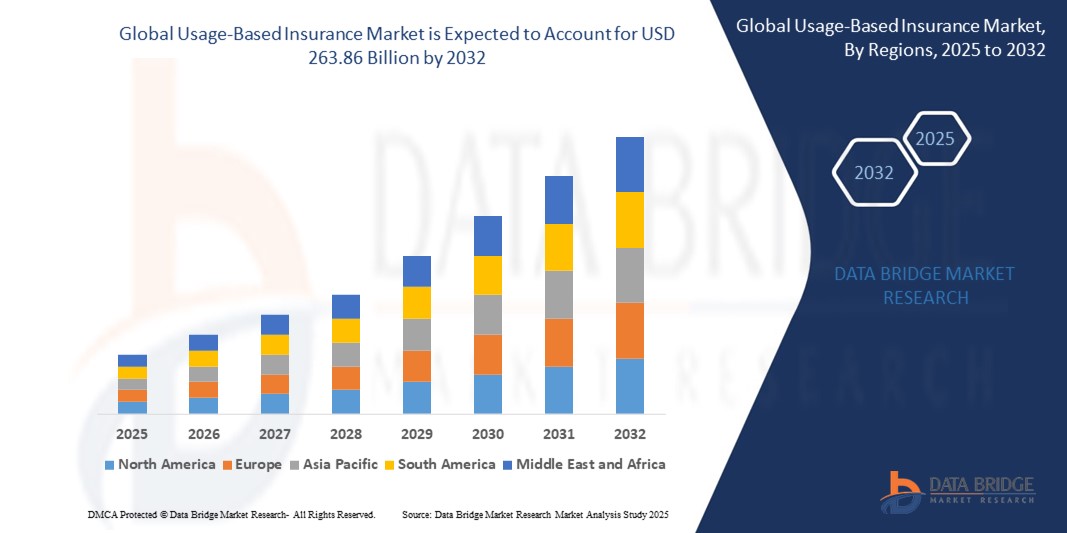

Middle East and Africa Usage Based Insurance Market Opportunities | Future Growth, Demand, and Challenges 2025 - 2032

The Middle East and Africa Usage-Based Insurance Market size was valued at USD 2.12 billion in 2024 and is expected to reach USD 6.01 billion by 2032, at a CAGR of 13.90% during the forecast period

Introduction

The Middle East and Africa Usage Based Insurance Market is experiencing steady expansion as insurance providers and technology companies collaborate to offer innovative products tailored to individual risk profiles and driving behaviors. Usage Based Insurance (UBI) leverages telematics, data analytics, and IoT devices to calculate premiums based on real-time vehicle usage, mileage, and driver behavior, making insurance pricing more personalized and potentially cost-effective. The growing adoption of connected vehicles and rising demand for flexible insurance solutions in the MEA region are key factors accelerating the UBI market's growth. This article provides a comprehensive analysis of the UBI market in Middle East and Africa, examining market size, segmentation, regional insights, drivers, challenges, and future outlook.

Market Overview

The UBI market in the Middle East and Africa is still in the nascent stage but displays strong potential driven by technological advancements, regulatory support, and shifting consumer preferences toward pay-as-you-drive insurance models. The market valued around several hundred million USD in 2024 is witnessing growing interest across urban centers, especially in countries with high vehicle penetration rates such as the UAE, Saudi Arabia, and South Africa. Introduction of telematics infrastructure, improved smartphone penetration, and increasing awareness about personalized insurance options further support market penetration.

Insurers are gradually incorporating usage data collected through embedded devices or mobile apps to assess risk more effectively, offering transparent pricing models with benefits for safe driving. The UBI model appeals to young drivers and commercial fleets, where usage patterns significantly influence insurance costs.

Market Segmentation

-

Deployment Type:

-

Embedded Telematics: Factory-installed devices in vehicles that provide continuous data.

-

Plug-in Telematics: Devices plugged into the vehicle’s OBD-II port for usage monitoring.

-

Mobile App-based Solutions: Smartphone applications tracking driving behavior without physical devices.

-

-

Insurance Type:

-

Pay-As-You-Drive (PAYD): Premiums based on the distance driven.

-

Pay-How-You-Drive (PHYD): Premiums factoring in driving behavior style, speed, acceleration, and braking.

-

-

End Users:

-

Individual Consumers: Private vehicle owners seeking personalized insurance.

-

Commercial Fleets: Businesses managing risk and costs of vehicle fleets through usage data.

-

Regional Insights

-

Gulf Cooperation Council (GCC): Saudi Arabia and the UAE lead UBI adoption due to high vehicle ownership, supportive regulations, and technological readiness. Insurance regulators in the region encourage innovations in risk-based pricing.

-

North Africa: Egypt and Morocco show growing interest in telematics insurance, driven by urban mobility challenges and insurer initiatives promoting connected car technologies.

-

Sub-Saharan Africa: South Africa is emerging as an early adopter of UBI models, supported by advanced telecommunications infrastructure and digitally savvy consumers.

Variation in infrastructure maturity and regulatory frameworks influences UBI market development across MEA countries.

Market Trends and Drivers

-

Increasing smartphone penetration and affordable connected devices facilitate UBI deployments.

-

Rising consumer demand for fair and transparent insurance pricing promotes UBI adoption.

-

Regulatory frameworks in some countries encourage innovation in insurance underwriting models.

-

Growth of ride-hailing, car-sharing, and fleet management industries drives commercial UBI uptake.

-

Advances in big data analytics and machine learning allow insurers to refine risk models and tailor premiums.

Challenges

-

Privacy concerns and data security issues surrounding telematics data collection may hinder consumer acceptance.

-

Limited awareness and trust in digital insurance models restrict market penetration in some segments.

-

High initial costs for telematics infrastructure and integration delay broad implementation.

-

Regulatory uncertainties in some MEA countries can pose barriers to UBI product approvals.

-

Diverse driving patterns and road conditions complicate standardized risk modeling.

Competitive Landscape

Key global and regional players like AXA, Allianz, Waseela Insurance (Saudi Arabia), and Hollard Insurance (South Africa) are actively investing in UBI offerings. Technology vendors providing telematics devices, data platforms, and analytics solutions collaborate with insurers to deploy scalable UBI models. The market features increasing partnerships between insurers, vehicle manufacturers, and connectivity providers aimed at creating integrated insurance ecosystems.

Future Outlook and Opportunities

The Middle East and Africa UBI market is poised for significant expansion as technology adoption, regulatory support, and consumer awareness increase. Opportunities lie in:

-

Expanding mobile app–based UBI solutions for cost-effective market entry.

-

Increasing commercial fleet telematics for operational efficiency and risk management.

-

Leveraging AI and advanced analytics to improve predictive accuracy and customer engagement.

-

Growing interest in green mobility and eco-driving programs incentivized through UBI pricing.

-

Regulatory enhancements promoting digital insurance innovation and data protection.

Conclusion

The MEA Usage Based Insurance market is on a trajectory of development fueled by evolving consumer expectations and technological progress. Despite challenges related to privacy, infrastructure, and regulation, growing vehicle connectivity and risk-based pricing demand offers promising avenues for insurers and technology players. Enhancing market education, data security, and regulatory clarity will be essential to fully unlocking UBI’s potential in the Middle East and Africa region while delivering personalized, fair, and sustainable insurance solutions.

Frequently Asked Questions (FAQs)

What is Usage Based Insurance and how does it work?

Which countries in the Middle East and Africa are leading UBI adoption?

What technologies are used to deploy Usage Based Insurance in the MEA region?

What factors are driving the growth of the UBI market in MEA?

Equip yourself with actionable insights and trends from our complete Middle East and Africa Usage Based Insurance Market analysis. Download now:https://www.databridgemarketresearch.com/reports/middle-east-and-africa-usage-based-insurance-market

Browse More Reports:

Global Tapioca Modified Starch Market

Global Textile Home Decor Market

Global Toluene Market

Global Tryptophan Market

Global Urinalysis Market

Global Vehicle Lightweighting Market

Global Vertical Lift Module Market

Global Veterinary Analgesics/Anti-Inflammatory (NSAIDS) Market

Global Viscosupplementation Market

Global Volleyball Knee Pad Market

Global Webcams Market

Global Weighing and Inspection Market

Global Wireless Display Market

Asia-Pacific Adhesive Tapes Market

Europe Adhesive Tapes Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 976

Email:- corporatesales@databridgemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness