Middle East and Africa Digital Payment Market Growth Analysis | Emerging Trends and Key Insights 2025 - 2032

In-Depth Study on Executive Summary Middle East and Africa Digital Payment Market Size and Share

In-Depth Study on Executive Summary Middle East and Africa Digital Payment Market Size and Share

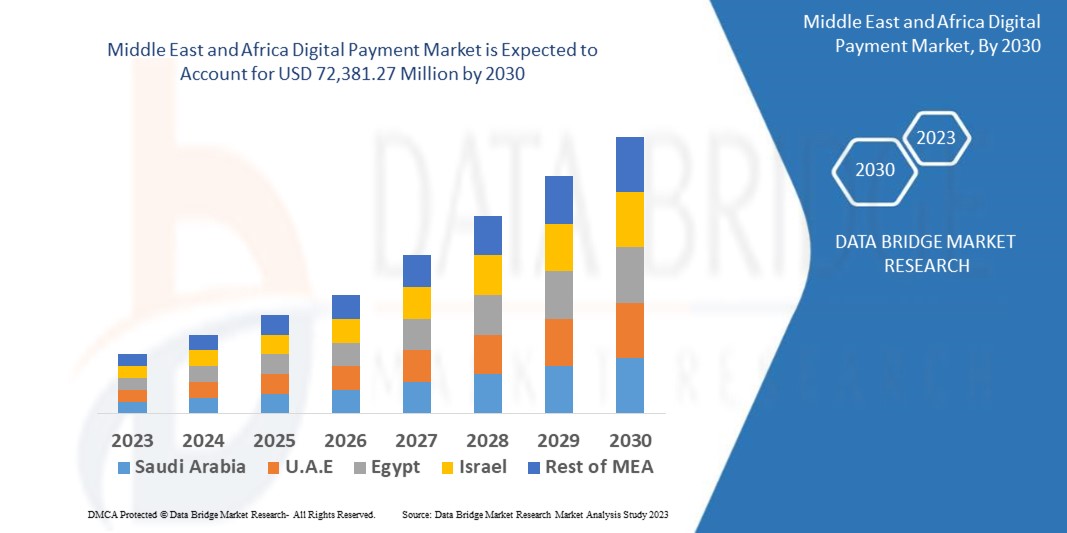

Data Bridge Market Research analyses that the digital payment market is expected to reach USD 72,381.27 million by 2030, which is USD 19,652.35 million in 2022, at a CAGR of 17.70% during the forecast period.

As the high quality Middle East and Africa Digital Payment Market survey report has precise and accurate analysis of market trends, future developments, market segments and competitive analysis which suits the needs of all sizes of businesses. This market research report is one of the best and wide-ranging market reports which provide market insights by considering number of factors. The first class Middle East and Africa Digital Payment Market business report highlights fluctuation during the forecast period of 2023-2030, historic data, current market trends, market environment, technological innovation, upcoming technologies and the technical progress in the related industry.

The data included in Middle East and Africa Digital Payment Market report is mainly plotted in the form of graphs, charts and tables which makes it easy to understand facts and figures about the market. This report makes available the pertinent information about certain niche and saves lot of time which may otherwise need for decision making. Global market research report also identifies, analyses, and estimates the up-and-coming trends along with major drivers, challenges and opportunities in the industry. Further, analysis of vendors, geographical regions, types, and applications has been carried out here. The winning Middle East and Africa Digital Payment Market report is presented with full commitment and best possible service depending upon business requirements.

Uncover strategic insights and future opportunities in the Middle East and Africa Digital Payment Market. Access the complete report: https://www.databridgemarketresearch.com/reports/middle-east-and-africa-digital-payment-market

Middle East and Africa Digital Payment Market Landscape

**Segments**

- By Component: Solutions, Services

- By Deployment: On-Premises, Cloud

- By Organization Size: Large Enterprises, Small and Medium-Sized Enterprises (SMEs)

- By Vertical: Banking, Financial Services, and Insurance (BFSI), Retail, Telecom and Information Technology (IT), Healthcare, Media and Entertainment, Transportation, Others

The Middle East and Africa digital payment market is segmented based on various factors that influence the growth and adoption of digital payment solutions in the region. The component segment is divided into solutions and services, with solutions holding a significant market share due to the increasing demand for secure and efficient digital payment platforms. Deployment options include on-premises and cloud-based solutions, with the cloud segment experiencing rapid growth as organizations look for flexibility and scalability in their payment systems. The market is further categorized by organization size, with both large enterprises and SMEs investing in digital payment technologies to streamline their operations and enhance customer experience. Vertical segmentation highlights the diverse industries leveraging digital payment solutions, including BFSI, retail, telecom, healthcare, media, entertainment, transportation, and others.

**Market Players**

- Mastercard

- Visa Inc.

- PayPal Holdings, Inc.

- Fiserv, Inc.

- ACI Worldwide, Inc.

- Fis Global, Inc.

- Fiserv, Inc.

- Apple Inc.

- Google LLC

- Samsung Electronics Co., Ltd.

Key market players in the Middle East and Africa digital payment market include globally renowned companies such as Mastercard, Visa Inc., PayPal Holdings, Inc., and Fiserv, Inc. These players dominate the market with their innovative digital payment solutions and strong customer base. Additionally, local and regional companies like ACI Worldwide, Fis Global, Apple Inc., Google LLC, and Samsung Electronics Co., Ltd. also contribute significantly to the market growth by offering tailored payment services that cater to the specific needs of the Middle East and Africa region. These market players focus on strategic partnerships, product launches, and mergers and acquisitions to expand their market presence and stay competitive in the dynamic digital payment landscape.

The Middle East and Africa digital payment market continues to witness significant growth and transformation driven by technological advancements and changing consumer preferences. One key trend shaping the market is the increasing adoption of mobile payment solutions, facilitated by the widespread use of smartphones and internet connectivity in the region. Mobile wallets and contactless payment methods are gaining popularity as consumers seek convenience and security in their transactions. Moreover, the growing e-commerce sector and the rise of digital banking services are fueling the demand for secure and efficient payment solutions across various industries.

Another factor driving market growth is the emphasis on financial inclusion and digital transformation initiatives by governments and regulatory bodies in the Middle East and Africa. These initiatives aim to promote digital payments, reduce reliance on cash transactions, and enhance financial literacy among the population. As a result, there is a growing awareness and acceptance of digital payment solutions by both businesses and consumers, leading to increased transaction volumes and revenue opportunities for market players.

Furthermore, the evolving regulatory landscape and data privacy concerns are shaping the digital payment market in the region. With the implementation of stringent data protection regulations and cybersecurity measures, organizations are investing in secure payment technologies to safeguard customer information and prevent fraud. Compliance with regulatory requirements and adherence to international standards are becoming crucial considerations for market players to gain trust and credibility in the digital payment ecosystem.

In terms of market dynamics, competition among key players such as Mastercard, Visa Inc., and PayPal Holdings, Inc. intensifies as they strive to differentiate their offerings and enhance customer engagement. Innovations in payment technology, such as biometric authentication, tokenization, and blockchain integration, are driving the development of more secure and seamless payment experiences for users. Additionally, strategic partnerships between fintech companies, traditional financial institutions, and technology providers are reshaping the payment landscape by enabling interoperability and interoperable solutions that cater to diverse customer needs.

Looking ahead, the Middle East and Africa digital payment market is poised for continued growth and innovation as digital transformation accelerates across industries. Market players will need to focus on user experience, security, and scalability to stay competitive and capture new opportunities in this dynamic and rapidly evolving ecosystem. By aligning with market trends, regulatory requirements, and customer preferences, companies can capitalize on the potential of digital payments to drive financial inclusion, economic growth, and seamless transaction experiences for businesses and consumers in the region.The Middle East and Africa digital payment market is undergoing significant transformation driven by technological advancements, changing consumer preferences, and regulatory initiatives. One of the key trends impacting the market is the increasing adoption of mobile payment solutions, facilitated by the widespread availability of smartphones and internet connectivity in the region. Mobile wallets and contactless payment methods are gaining traction as consumers prioritize convenience and security in their transactions. This shift towards mobile payments is reshaping the payment landscape and creating new opportunities for market players to innovate and cater to evolving consumer demands.

Moreover, the growth of the e-commerce sector and the expansion of digital banking services are driving the demand for secure and efficient payment solutions across various industries in the Middle East and Africa. Businesses are increasingly integrating digital payment options into their operations to enhance customer experience and stay competitive in the evolving market landscape. This trend is expected to continue as more businesses and consumers embrace digital payment solutions for their transactions, leading to increased transaction volumes and revenue potential for market players.

Government efforts towards financial inclusion and digital transformation are also influencing the digital payment market in the region. Initiatives aimed at promoting digital payments, reducing cash reliance, and improving financial literacy are creating a conducive environment for the adoption of digital payment technologies. As a result, there is a growing awareness and acceptance of digital payment solutions among businesses and consumers, driving market growth and opportunities for market players to expand their offerings and services.

Furthermore, the evolving regulatory framework and focus on data privacy and security are shaping the digital payment landscape in the Middle East and Africa. With the implementation of stringent data protection regulations and cybersecurity measures, organizations are investing in secure payment technologies to safeguard customer information and prevent fraud. Compliance with regulatory requirements and adherence to international standards are becoming crucial factors for market players to build trust and credibility in the digital payment ecosystem, thereby fostering a secure environment for digital transactions.

In conclusion, the Middle East and Africa digital payment market is poised for continued growth and innovation as digital transformation advances across industries. Market players need to navigate evolving consumer preferences, technological advancements, and regulatory developments to capitalize on the opportunities presented by the growing digital payment landscape. By focusing on enhancing user experience, ensuring security, and adapting to market trends, companies can position themselves for success in the dynamic and rapidly evolving digital payment market in the region.

View comprehensive company market share data

https://www.databridgemarketresearch.com/reports/middle-east-and-africa-digital-payment-market/companies

Global Middle East and Africa Digital Payment Market: Strategic Question Framework

- What is the size of the Middle East and Africa Digital Payment Market as per the latest findings?

- What is the anticipated CAGR over the forecast period?

- Which main sectors are included in the market segmentation?

- Who are the influential names in the Middle East and Africa Digital Payment Market industry?

- Have any recent products or technologies been introduced?

- What country-wise data is presented in the Middle East and Africa Digital Payment Market study?

- Which region has the highest momentum in growth?

- Which country is likely to lead the Middle East and Africa Digital Payment Market by 2032?

- What part of the globe accounts for the biggest Middle East and Africa Digital Payment Market value?

- Which country will see the strongest CAGR trajectory?

Browse More Reports:

Global Pallet Market

Global Web Performance Market

Middle East and Africa Refractories Market

Global Water Bath Market

Europe Orthopedic Surgical Robots Market

Global Fusion Protein Market

North America Orthobiologics Market

Global Bubble Tea Ingredients Market

Europe Adhesive Tapes Market

Europe Polyethylene Glycol Market

Global Orthopaedic Braces and Supports Market

Global Refractories Market

Europe Ear and Nasal Packing Market

Europe Craniomaxillofacial Implants Market

Global Larvicides Market

Global High Performance Polyamides Market

Global Electrofusion Fittings Market

Global Endoscope Reprocessing Market

Global Produced Water Treatment Market

Global Orthobiologics Market

North America Craniomaxillofacial Implants Market

Global Airborne Surveillance Market

Global Spectroscopy Equipment and Accessories Market

Middle East and Africa Paper Bags Market

Global Dehydrated Alfalfa Market

Asia-Pacific Fraud Detection Transaction Monitoring Market

Global Steel Metal Powder Market

Global Dry Whole Milk Powder Market

North America Baking Oven Market

Global Automated Optical Inspection Market

Global Automotive Sensors Market

Global Nanomechanical Testing Market

Global Nanomagents Market

Global Intelligent Apps Market

Europe Tank Insulation Market

Global Flame Resistant (FR) Coveralls Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness